LAS VEGAS (USA) – At this year’s Consumer Electronics Show (CES) in Las Vegas, the spotlight is heavily focused on artificial intelligence (AI), marking a shift in the mission for technology journalists. The world’s largest consumer electronics event has transformed into a showcase for AI-enhanced products, with nearly every device boasting some form of AI capability. However, experts warn that many of these claims may be more about marketing than substantial innovation.

The challenge for attendees will be to discern genuine advancements in AI technology from mere advertising gimmicks aimed at enticing consumers to purchase new gadgets. Last year, many AI-first devices, touted as the future of technology, did not meet expectations, leading to skepticism about the industry’s promises.

Looking forward to 2026, the industry is bracing for a period characterized as “innovation under pressure.” While consumer electronics spending shows signs of a rebound, the sector faces substantial macroeconomic challenges, particularly regarding rising component costs. A significant driver of this escalation is the increasing demand for RAM due to its extensive use in AI applications.

Data centers that train generative models are consuming an ever-larger share of dynamic random-access memory (DRAM) and high-bandwidth memory (HBM). According to research firm TrendForce, over half of memory investments are now allocated to AI servers, reflecting the industry’s shift towards AI-enhanced capabilities. With manufacturers keen to follow profit margins, the value of AI-specific memory can reach up to five times that of standard PC RAM, creating a supply crunch for consumer electronics.

The limited number of factories capable of producing these high-demand chips means that the overall capacity for consumer-grade components will remain constrained. Building new fabrication plants (fabs) is a time-consuming and costly endeavor, often taking years and requiring billions in investment. As a result, the market is facing a scarcity of chips, leading to opaque pricing structures and anticipated price increases of between 15% to 20% in 2025.

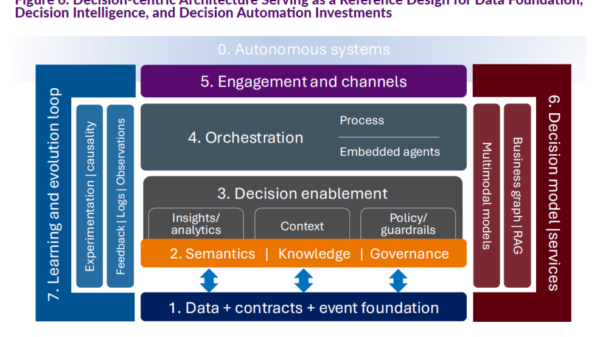

This situation is not merely a fleeting market trend; it represents a significant shift in how AI is reshaping the hardware supply chain. The ramifications for consumers could include higher costs for a range of electronic devices as manufacturers adjust to the evolving landscape dominated by AI technologies.

In this context, CES serves as a vital barometer for the direction of consumer electronics and the broader implications of AI adoption. As companies unveil their latest innovations, the focus will be on balancing genuine technological advancement with the realities of cost and supply constraints. The industry’s future may depend on its ability to navigate these challenges while making meaningful contributions to the integration of AI into everyday life.

See also 2025 Sees AI Surge: DeepSeek and Grok Models Redefine Performance Metrics

2025 Sees AI Surge: DeepSeek and Grok Models Redefine Performance Metrics India Orders X Corp to Curb Obscene Content from Grok AI Chatbot Within 72 Hours

India Orders X Corp to Curb Obscene Content from Grok AI Chatbot Within 72 Hours AI Investment Surge Remains Strong in 2026, Analysts Cite Caution Amid Market Risks

AI Investment Surge Remains Strong in 2026, Analysts Cite Caution Amid Market Risks Ireland’s Data Centers Surge: AI’s Energy Demand Fuels $70B Investment Race

Ireland’s Data Centers Surge: AI’s Energy Demand Fuels $70B Investment Race Meta Acquires AI Startup Manus for $2B Amid Capital Pressure on Tech Sector

Meta Acquires AI Startup Manus for $2B Amid Capital Pressure on Tech Sector