Investor enthusiasm for artificial intelligence (AI) has significantly shaped market dynamics, especially throughout 2025. In a recent discussion, Tom, an industry expert, articulated his thoughts on how this trend might evolve into 2026. According to Tom, while AI has acted as a “rising tide” lifting various tech stocks over the past three and a half years, a shift is anticipated as the AI market matures.

As 2026 approaches, Tom posits that the landscape will become more selective, with certain companies emerging as clear winners while others may falter. He emphasized that the fervor surrounding AI will not dissipate entirely but will resemble the more fractured environment seen in the fourth quarter of 2025, rather than the collective surge experienced earlier in the year. This anticipated segmentation raises questions for investors about how to identify the next successful enterprises in the AI sector.

“For me, I look at AI as sort of a cycle that’s maturing,” Tom explained. He delineated the evolution of AI into distinct stages, starting with an “epiphany stage,” where the potential of the technology became apparent. The subsequent demand for semiconductors fueled a rush to acquire these critical components, benefitting players like **Nvidia**, **Broadcom**, and **Taiwan Semiconductor Manufacturing Company** (TSMC).

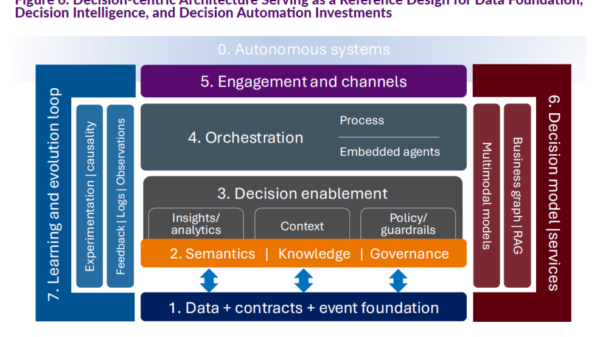

Looking forward, Tom suggests that the focus will shift from merely securing semiconductors to identifying companies at the forefront of AI innovation. He named **Google** as his top AI pick for 2026, citing the advantages of its **Gemini 3** model and its stronghold in search capabilities, which position it favorably against competitors like **OpenAI**. Tom believes that Google’s infrastructure, particularly in data centers, will be pivotal as companies expand their memory needs to accommodate increasing computational demands.

In this evolving landscape, Tom sees opportunities for memory infrastructure to play a crucial role. As organizations ramp up their digital capabilities and leverage AI technologies, the need for robust memory solutions is expected to escalate. This aligns with the broader infrastructure requirements essential for supporting AI applications, he noted.

Tom’s insights reflect a growing sentiment that the AI market will continue to mature, encouraging a more discerning approach to investment. While companies like **Micron** may emerge as standout performers, others, such as **Oracle** and **Qualcomm**, could face challenges as the sector becomes more nuanced and competitive.

As investors prepare for 2026, understanding the intricacies of the AI market will be vital. Tom’s observations suggest that successful navigation will rely on recognizing which companies are best positioned to leverage AI’s transformative capabilities. The landscape may no longer favor all players equally, making it imperative for investors to conduct thorough research and stay informed on emerging trends.

The implications of this shift extend beyond just individual company performance; they hint at broader structural changes within the tech industry as AI continues to evolve. As firms adapt to this new reality, investment strategies will need to pivot accordingly, with an emphasis on identifying those poised to thrive amidst the complexities of the AI ecosystem. This selective approach will not only shape the fortunes of individual stocks but could also redefine the competitive landscape as companies vie for leadership in the AI arena.

See also Enterprise AI Data Analyst: Boost Accuracy, Security, and Explainability in Finance Teams

Enterprise AI Data Analyst: Boost Accuracy, Security, and Explainability in Finance Teams AI Financial Advisors: Experts Debate Benefits and Risks for Consumers in 2026

AI Financial Advisors: Experts Debate Benefits and Risks for Consumers in 2026 Hong Kong’s Paul Chan Promotes Tech-Finance Integration Amid AI Stock Surge

Hong Kong’s Paul Chan Promotes Tech-Finance Integration Amid AI Stock Surge Investors Shift Focus to Undervalued Assets as AI Market Matures in 2026

Investors Shift Focus to Undervalued Assets as AI Market Matures in 2026 Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed