As artificial intelligence (AI) continues to integrate into various sectors, its role in personal finance is emerging as a significant topic of discussion. Holiday shoppers increasingly leaned on AI tools to inform their purchasing decisions this year, prompting experts to examine whether these technologies can effectively serve as financial planners. While some advocate for AI’s potential in providing tailored financial advice, others caution against over-reliance on such systems.

Jonathan Vance, owner of Missouri-based Vance Financial Planning, highlighted the advantages of utilizing platforms like ChatGPT or Claude for crafting financial plans. “AI’s primary edge is greater speed and personalization,” Vance explained. He noted that traditional search engines often fail to deliver in-depth, state-specific insights, such as tax implications for residents of Missouri. This rapid response capability positions AI as a valuable tool for users seeking customized financial guidance.

Samyr Laine, managing partner at venture capital firm Freedom Trail Capital, echoed this sentiment by emphasizing AI’s ability to democratize financial education. “AI can give you insights in seconds that would take hours to research,” he stated. This accessibility is particularly crucial for individuals unable to afford traditional financial advisors or those unsure of how to begin their financial journeys. Laine considered this capability a major leap towards enhancing financial literacy among the general public.

Dr. Erika Rasure, chief financial wellness advisor at debt consolidation firm Beyond Finances, pointed out that AI tools can provide critical support to underserved and marginalized communities. “AI can expand access to financial literacy tools,” she said, underscoring how technology can meet people at their various levels of financial knowledge and emotional readiness. This is particularly important for communities facing systemic barriers in finance, such as geographic isolation or a lack of trust in financial institutions.

Despite its advantages, experts expressed reservations about using AI as the sole advisor for financial planning. Vance raised concerns about the limitations of AI in generating comprehensive and nuanced financial strategies. He cautioned that AI is only as reliable as the prompts it receives and often prioritizes immediate responses over necessary follow-up questions. “I think we can all become more informed decision-makers with AI, but I wouldn’t let it replace your entire critical thinking and verification process,” he added.

Laine shared similar apprehensions, emphasizing that AI lacks the nuanced understanding of individual circumstances that can significantly influence financial outcomes. “AI lacks context and accountability,” he warned, stressing that it cannot adapt to personal life situations like family dynamics or career trajectories. He cautioned against the risk of becoming overly dependent on AI for financial decisions, advising users to treat AI-generated advice as one of many data sources rather than infallible truth.

Iliya Rybchin, principal at AI consulting firm Vorpal Hedge, also noted the perils of over-dependence on AI. He emphasized the importance of cross-referencing AI-generated advice with real-world changes, such as regulatory updates, to avoid outdated guidance. Privacy concerns also loom large, particularly if users input sensitive financial information into unvetted platforms. Rybchin mentioned that while reputable tools can mitigate these risks, AI still falls short in providing the emotional support needed during financial crises.

When asked if consumers should rely solely on AI for financial advice, Laine firmly advised against it. “AI should be a tool in your financial decision-making process, not your sole advisor,” he reiterated. He recognized AI’s speed and pattern recognition capabilities, noting that it excels at analyzing vast datasets more efficiently than humans. However, he maintained that financial decisions encompass aspects like context, risk tolerance, and personal goals that algorithms do not adequately comprehend.

Conversely, Rybchin expressed a more optimistic outlook on AI’s future in personal finance. He believes that by 2026, AI could effectively serve as a financial advisor for many consumers. “AI is not a replacement for humans or a total solution,” he said, “but is an exceptional starting point for everyone.” He argued that for individuals with straightforward investment goals—such as maintaining low fees, diversifying portfolios, and practicing disciplined strategies—AI can efficiently enforce essential financial rules.

ChatGPT, when asked about its potential role as a financial advisor, responded cautiously, stating, “Short answer: not by itself – yet. Long answer: AI can be a great co-pilot in 2026, but a risky captain.” As AI technologies continue to evolve, the debate over their place in financial planning remains pertinent, with many experts urging caution while others envision a future where AI plays a significant role in guiding financial decisions.

See also Hong Kong’s Paul Chan Promotes Tech-Finance Integration Amid AI Stock Surge

Hong Kong’s Paul Chan Promotes Tech-Finance Integration Amid AI Stock Surge Investors Shift Focus to Undervalued Assets as AI Market Matures in 2026

Investors Shift Focus to Undervalued Assets as AI Market Matures in 2026 Generative AI to Boost Financial Efficiency by 20% Amid Compliance Challenges

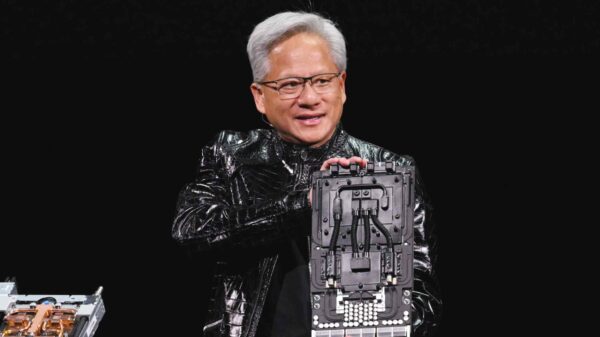

Generative AI to Boost Financial Efficiency by 20% Amid Compliance Challenges Nvidia Launches Vera Rubin Superchip at CES 2026, Promises 4x GPU Efficiency Boost

Nvidia Launches Vera Rubin Superchip at CES 2026, Promises 4x GPU Efficiency Boost Palantir Stock Drops 8.9% Amid AI Contract Growth and Insider Selling Concerns

Palantir Stock Drops 8.9% Amid AI Contract Growth and Insider Selling Concerns