The digital advertising landscape concluded 2025 amid significant upheaval driven by algorithm changes, advancements in artificial intelligence (AI), and a wave of platform consolidation that redefined competitive dynamics. This turmoil reached a peak in December, particularly during the holiday advertising season, as Google completed a substantial core algorithm update that resulted in dramatic fluctuations in search rankings and website traffic.

On December 29, Google confirmed the conclusion of its December 2025 core update, following an 18-day implementation that began on December 11. The rollout led to considerable volatility in search results, with many website operators reporting traffic declines of up to 85%, and some experiencing a staggering 98% drop in Google Discover impressions during a critical period for advertising. Research from August 2025 indicated that Google Discover was responsible for two-thirds of referrals to news and media websites, making this disruption particularly damaging for publishers reliant on platform traffic.

The impact of the algorithm update was compounded by broader industry trends. On December 22, Alphabet announced its acquisition of Intersect for $4.75 billion, aimed at tackling the escalating energy demands associated with AI and data center operations. This move highlights a growing recognition within the tech sector that AI infrastructure necessitates innovative power solutions. CEO Sundar Pichai emphasized that the acquisition would enhance capacity and agility in developing new energy generation strategies alongside data center needs.

This acquisition followed other significant infrastructure investments by Google, including a nuclear partnership with Kairos Power in August 2025. The tech giant, along with other major companies such as Meta and Microsoft, reported combined capital expenditures of A$627 billion for the year, showcasing an escalating competition for resources and technical talent. Pay packages for AI engineers and researchers reached as high as $300 million over four years at leading firms.

Despite facing regulatory pressures, Big Tech companies maintained their dominance in advertising markets. Google’s decision to retract its commitment to deprecating third-party cookies in Chrome marked a notable shift, indicating that the anticipated Privacy Sandbox initiative would not materialize as originally planned. This decision allowed Google to retain its stronghold in the digital advertising ecosystem.

Amid these developments, Amazon’s demand-side platform (DSP) witnessed significant growth, capturing second place among marketers’ preferred DSPs by Q3 2025, with 50% usage. This shift illustrated Amazon’s increasing prominence in programmatic advertising, while The Trade Desk slipped to third place at 39%. On December 18, Amazon introduced new content exclusion categories within its DSP, enabling advertisers to manage brand safety across various channels.

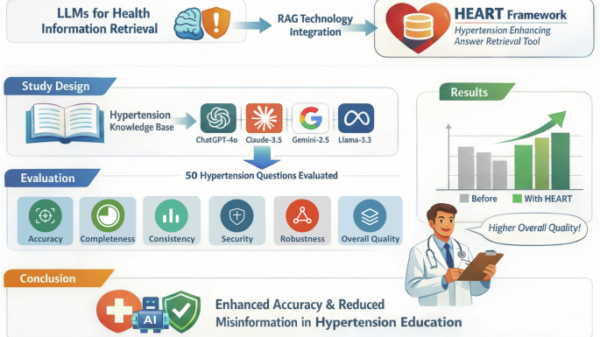

Google also advanced its AI capabilities in search products by deploying Gemini 3 on December 18, marking the introduction of real-time simulations for complex queries. This launch represented a leap in technical sophistication, utilizing a frontier model that could dynamically generate search interfaces tailored to individual user queries. Such advancements are likely to raise competitive challenges for smaller search engines lacking similar capabilities.

The integration of Gemini with Google Maps, introduced on December 13, enabled users to interact with the platform using images and voice commands, further enhancing the user experience. However, monetization strategies for Gemini remained elusive, with mixed signals from Google regarding the introduction of advertisements in 2026.

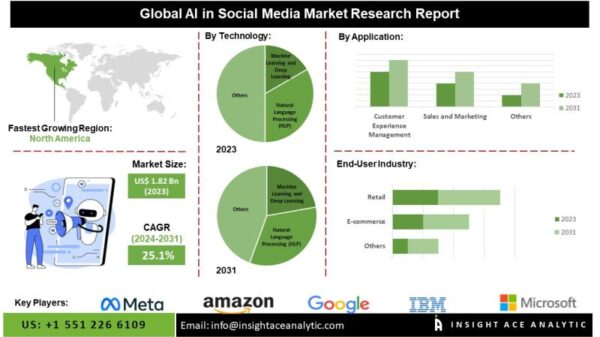

The advertising sector faced intensifying regulatory scrutiny, particularly concerning AI systems. The Australian Competition and Consumer Commission raised concerns about the rapid advancements in AI technologies and the potential risks they pose, including data misuse and misleading advertising practices. The report highlighted the emergence of agentic systems capable of autonomous decision-making, raising complex questions about accountability and liability.

As 2025 drew to a close, the advertising industry began to rebound from earlier challenges, with several publicly traded publishers reporting increased digital advertising revenue. However, reliance on tech platforms remained a critical concern, as publishers struggled with transparency and traffic volatility driven by algorithm changes. The December core update exemplified the concentration of power within a few dominant platforms, as many smaller websites experienced significant ranking losses.

Looking ahead, the advertising industry is poised for further transformations as it grapples with the implications of AI integration and platform dominance. The December core update not only marked the end of a tumultuous year but also set the stage for ongoing changes that will continue to shape the future of digital marketing and publishing. As the landscape evolves, the survival of independent publishers will increasingly depend on their ability to adapt to these shifting dynamics.

See also New York Enacts AI Disclosure Law Requiring Transparency on Synthetic Performers

New York Enacts AI Disclosure Law Requiring Transparency on Synthetic Performers Dot Ai Appoints Dr. Ansgar Thiede as Chief Strategy Officer to Enhance Product Strategy

Dot Ai Appoints Dr. Ansgar Thiede as Chief Strategy Officer to Enhance Product Strategy VoAgents Launches Voice AI Platform, Boosts Customer Engagement and Conversion Rates by 23%

VoAgents Launches Voice AI Platform, Boosts Customer Engagement and Conversion Rates by 23% Google Reveals 2026 SEO Strategies: Prioritize User Experience and Quality Content

Google Reveals 2026 SEO Strategies: Prioritize User Experience and Quality Content Capgemini Reveals 2026 Consumer Report: 71% Prioritize Transparency in Brand Loyalty

Capgemini Reveals 2026 Consumer Report: 71% Prioritize Transparency in Brand Loyalty