Hong Kong’s Financial Secretary, Paul Chan Mo-po, announced on Sunday the city’s commitment to further integrate financial services with technological innovation, aiming to cultivate a vibrant economic ecosystem. This pledge comes on the heels of a significant surge in investor interest in artificial intelligence-related stocks, which propelled the Hang Seng Index to its strongest opening since 2013, climbing over 700 points, or 2.8 percent, at the start of the year.

Chan emphasized Hong Kong’s pivotal role as an international capital market, particularly in supporting the growth of mainland China’s frontier tech firms. He encouraged these enterprises to consider listing and raising capital in the city, stating, “We welcome these enterprises to list and raise capital in Hong Kong and also encourage them to settle in the city to establish research and development [R&D] centres, transform their research outcomes, and set up advanced manufacturing facilities.”

In addition to attracting R&D centres, Chan highlighted the importance of establishing regional or international headquarters in Hong Kong. He noted that these moves would enable companies to reach global markets and strategically expand across Southeast Asia and beyond. “We support them in establishing regional or international headquarters in Hong Kong to reach international markets and strategically expand across Southeast Asia and the globe,” he added.

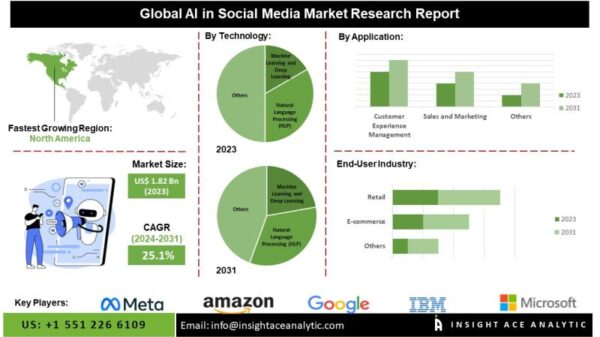

The surge in the Hang Seng Index has been largely attributed to innovation and technology giants, with the Hang Seng Tech Index experiencing a remarkable 4 percent rise. This reflects a burgeoning appetite among investors for AI-related stocks, which have become increasingly prominent in the financial landscape. The enthusiasm for artificial intelligence technologies is not only reshaping investment patterns but also signaling a potential shift in how financial markets operate in the coming years.

As Hong Kong continues to bolster its technological capabilities, its strategic position as a financial hub is underscored by these developments. The city’s unique blend of financial resources and technological advancements presents a compelling proposition for companies looking to innovate and grow. This integration of finance and technology could potentially attract more international investors and tech firms seeking to capitalize on Hong Kong’s offerings.

Looking ahead, the interplay between financial services and technological advancements appears set to play a crucial role in shaping the future of Hong Kong’s economy. As the city positions itself as a key player in the global tech landscape, the implications for innovation, investment, and economic growth are significant. With ongoing advancements in AI and related technologies, Hong Kong is poised to leverage its strengths to foster an environment conducive to technological and financial integration.

See also Investors Shift Focus to Undervalued Assets as AI Market Matures in 2026

Investors Shift Focus to Undervalued Assets as AI Market Matures in 2026 Generative AI to Boost Financial Efficiency by 20% Amid Compliance Challenges

Generative AI to Boost Financial Efficiency by 20% Amid Compliance Challenges Nvidia Launches Vera Rubin Superchip at CES 2026, Promises 4x GPU Efficiency Boost

Nvidia Launches Vera Rubin Superchip at CES 2026, Promises 4x GPU Efficiency Boost Palantir Stock Drops 8.9% Amid AI Contract Growth and Insider Selling Concerns

Palantir Stock Drops 8.9% Amid AI Contract Growth and Insider Selling Concerns xAI Raises $20 Billion to Enhance AI Infrastructure and Deploy Grok to 600 Million Users

xAI Raises $20 Billion to Enhance AI Infrastructure and Deploy Grok to 600 Million Users