Meta Platforms is facing scrutiny as discussions around its stock performance unfold, particularly in light of a potential AI acquisition that is currently under review by Chinese authorities. Concerns expressed on social media reflect investor anxiety regarding the geopolitical risks that may affect the company’s market standing. This scrutiny has led to debates among investors about whether the current dip in Meta’s stock price represents a strategic buying opportunity.

Despite these challenges, there is a growing optimism among analysts about Meta’s future. Recent upgrades have seen several institutions raising their price targets, buoyed by expectations of strong advertising momentum and advancements in AI leadership throughout 2026. The sentiment appears more hopeful, as some analysts believe that long-term monetization prospects could outweigh any short-term capital expenditure concerns.

In the past six months, Meta insiders have executed 232 trades, all of which were sales, raising questions about the confidence levels of the company’s leadership in its stock. Notably, CEO Mark Zuckerberg has sold 143,660 shares valued at approximately $110.6 million, while other executives have followed suit with significant sales as well. This trend raises eyebrows among investors who may interpret the lack of stock purchases from insiders as a sign of caution.

In terms of financial performance, Meta reported revenues of $51.2 billion in the third quarter of 2025, reflecting a substantial increase of 26.25% compared to the same period in the prior year. This growth indicates that the company’s core advertising business remains strong, despite the external pressures it faces.

Congressional stock trades related to Meta also paint an interesting picture. In the last six months, members of Congress executed a total of 24 trades, including 18 purchases and 6 sales. Noteworthy trades include Senator Shelley Moore Capito’s two purchases totaling up to $30,000 and Representative Cleo Fields’ ten purchases worth up to $1.4 million. Such activity suggests varying levels of confidence among lawmakers about Meta’s future prospects.

Institutional investors reflect a mixed sentiment towards Meta, with 2,572 adding shares to their portfolios while 1,771 have reduced their positions. Notable moves include Kingstone Capital Partners completely divesting from Meta by removing over 59 million shares, while UBS Asset Management increased its stake by acquiring over 9 million shares. This divergence in institutional activity underscores the uncertainty surrounding Meta’s market trajectory.

Analysts remain predominantly bullish on the stock, with 26 firms issuing buy ratings and none recommending a sell. Recent price targets set by analysts vary significantly, with a median target of $825. This range highlights a spectrum of optimism, with individual targets as low as $750 and as high as $1,117. Notable analysts such as Deepak Mathivanan from Cantor Fitzgerald and Michael Morris from Guggenheim have set targets of $750 and $800, respectively.

As Meta continues to navigate a complex landscape marked by regulatory scrutiny and evolving market conditions, investor sentiment will likely remain polarized. The company’s ability to leverage its AI advancements and advertising momentum will be critical in shaping its future performance. How Meta addresses the current challenges and capitalizes on its strengths will be essential not only for its stock valuation but also for maintaining investor confidence.

See also Ex-Grok Executive Secures Rare Waiver to Retain xAI Stake Amid Deepfake Controversy

Ex-Grok Executive Secures Rare Waiver to Retain xAI Stake Amid Deepfake Controversy Louisville Partners with Govstream.ai, Appoints First Chief AI Officer to Streamline Permitting

Louisville Partners with Govstream.ai, Appoints First Chief AI Officer to Streamline Permitting Grok’s AI Sparks Global Investigations Over Sexualized Deepfake Images of Women

Grok’s AI Sparks Global Investigations Over Sexualized Deepfake Images of Women Elon Musk’s Grok Bot Limits Deepfake Sexual Images Amid Global Outrage and Regulatory Scrutiny

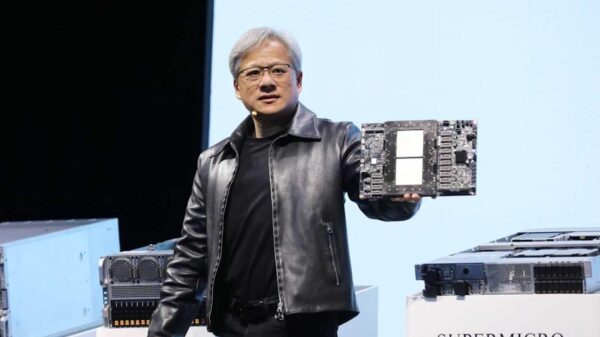

Elon Musk’s Grok Bot Limits Deepfake Sexual Images Amid Global Outrage and Regulatory Scrutiny Investors Should Buy Nvidia, Broadcom, and Amazon to Capitalize on AI Market Surge

Investors Should Buy Nvidia, Broadcom, and Amazon to Capitalize on AI Market Surge