Investors are increasingly focusing on the building blocks of artificial intelligence (AI) technology, particularly semiconductors and data-center equipment, as a multi-year capital expenditure cycle begins to unfold. This shift was underscored by recent market movements, including a 2.3% drop in Meta’s stock following reports of its discussions with EssilorLuxottica to potentially double its AI smart-glasses production by the end of 2026. Despite these efforts, investors are seeking tangible evidence that new product categories can generate sustainable profits.

Market reactions indicate a heightened sensitivity to any signs of demand fluctuations. For instance, Nvidia’s stock price remained largely unchanged after the company countered a Reuters report regarding strict payment terms for its H200 chips with Chinese customers. Such maneuvers highlight the precarious balance companies must strike amid evolving export regulations and increasing scrutiny over China exposure.

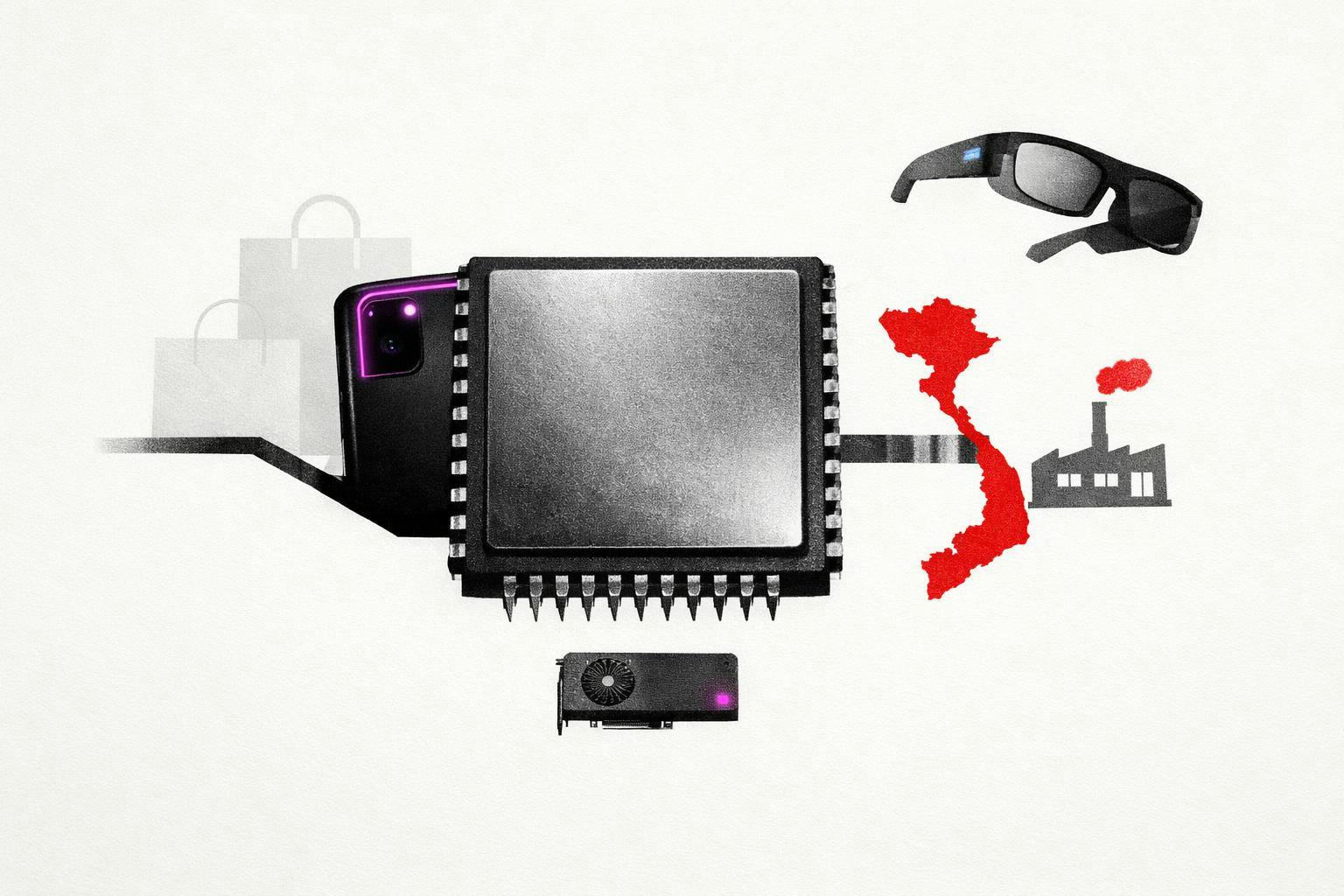

The ongoing demand for AI hardware has created a noticeable gap between semiconductor stocks and broader technology shares. This divergence suggests that investors view chips and data-center gear as the most reliable avenues for capitalizing on the AI boom. While consumer devices and emerging product categories hold potential for unexpected growth, the complexity surrounding their adoption and profit margins makes them harder to evaluate.

As the race for AI supremacy intensifies, it appears to be evolving into a race for supply-chain dominance. Recent distribution agreements related to Google’s Gemini initiative, coupled with reports of the company’s plans to manufacture phones in Vietnam, illustrate how critical partnerships and manufacturing capabilities are becoming. Winning in AI no longer solely depends on the sophistication of algorithms but also on the ability to scale hardware production.

Meta’s efforts in the smart-glasses sector reflect this broader trend. The company is striving to bring AI into tangible applications, necessitating robust supply chains and reliable access to components. As these dynamics unfold, a significant portion of AI’s economic benefits may accrue to manufacturers and suppliers rather than solely benefiting software developers.

The market’s reaction to these developments signals that investors are becoming more discerning about where to place their bets in the evolving tech landscape. While the long-term demand for AI technologies appears robust, immediate concerns regarding supply chains and geopolitical factors are beginning to shape market sentiment. Companies must navigate this complex environment carefully to reassure investors and prove their ability to deliver on the promises of AI innovation.

Looking ahead, the interplay between hardware capabilities and software advancements will likely be pivotal in determining winners and losers in the AI race. As companies ramp up production and seek new partnerships, understanding the intricate balance of supply chain management will be essential for sustaining growth in this rapidly evolving sector.

See also 2026: AI and Quantum Computing Set to Revolutionize Business Strategies and Drug Discovery

2026: AI and Quantum Computing Set to Revolutionize Business Strategies and Drug Discovery France Signs $14B Deal with Mistral AI to Enhance Military Defense Capabilities

France Signs $14B Deal with Mistral AI to Enhance Military Defense Capabilities Global AI Regulations Surge in 2026: Over 50 Countries Implement Accountability Standards

Global AI Regulations Surge in 2026: Over 50 Countries Implement Accountability Standards AI Revolutionizes Science: Accelerating Discoveries in Medicine, Chemistry, and Climate Models

AI Revolutionizes Science: Accelerating Discoveries in Medicine, Chemistry, and Climate Models Google DeepMind Launches Veo 3.1 with Reference Image Feature for Enhanced Video Creation

Google DeepMind Launches Veo 3.1 with Reference Image Feature for Enhanced Video Creation