Microsoft Corp. (NASDAQ: MSFT) is navigating a turbulent start to 2026, as the global financial markets face a sharp valuation reset in the technology sector. Once a leader during the 2023–2025 generative AI bull run, Microsoft has found itself under intense scrutiny amid a broader market downturn. The company’s challenge now lies in transitioning from the “AI experimentation” phase to “industrial-scale deployment,” with the market increasingly demanding profitability to justify the substantial capital expenditures currently underway.

Founded in 1975 by Bill Gates and Paul Allen, Microsoft has undergone a transformation over the decades, marked by its evolution from a software vendor to a cloud infrastructure titan under CEO Satya Nadella. The company shifted its focus toward a “Mobile-First, Cloud-First” strategy in 2014, which propelled its growth in cloud services through Azure and significant acquisitions, such as LinkedIn, GitHub, and Activision Blizzard. As of early 2026, Microsoft is positioned as not just a cloud provider but the primary interface for the global workforce interacting with machine intelligence.

Microsoft’s diverse business model includes three main segments: Intelligent Cloud, which encompasses Azure, SQL Server, and Enterprise Services; Productivity and Business Processes, featuring Microsoft 365, LinkedIn, and Dynamics 365; and More Personal Computing, which includes Windows, Xbox, and Surface. The recent integration of Activision titles into Game Pass has transformed its gaming segment into a recurring revenue powerhouse, a necessary shift in an economically challenging climate.

Over the past decade, Microsoft’s stock has been a key indicator of the tech sector’s health, yielding over 800% in returns. However, a more nuanced one-year performance reveals a 15% decline from its record high of $555.45 in July 2025 to its current level of $470.67. This retracement underscores a broader tech-led downturn as investors shift away from high-multiple growth stocks amidst stabilizing interest rates and apprehensions regarding the “AI payback period.” Despite this, Microsoft remains one of the few companies in the “Magnificent Seven” with a market capitalization above $3.5 trillion.

Financially, Microsoft reported $281.7 billion in revenue and over $101 billion in net income for fiscal year 2025, with Q1 FY2026 revenues reaching $77.7 billion, an 18% year-over-year increase. The earnings per share of $4.13 exceeded analyst estimates, but the estimated $121 billion in annual capital expenditure for 2026, aimed at expanding data center infrastructure and GPU clusters, remains a contentious issue. Trading at a trailing P/E of approximately 33.5x, Microsoft’s valuation is high compared to its historical average but has moderated from levels seen during the height of the AI hype in 2025.

Market Context

Under Nadella’s leadership, Microsoft is focusing on advancing “Agentic AI,” enabling AI systems to autonomously perform various tasks. Recent management changes, including the promotion of Judson Althoff to oversee commercial operations, allow Nadella to concentrate on research and development for the AI-first product roadmap. While the board is praised for its governance, it faces increasing scrutiny regarding the long-term return on investment for its partnership with OpenAI.

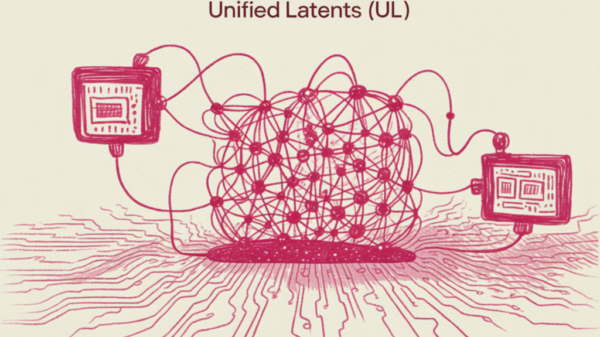

Innovation efforts are centered around Microsoft’s “AI Stack,” which includes the Copilot ecosystem, Azure AI services, and the development of custom silicon to reduce reliance on NVIDIA. This strategic pivot enables Microsoft to provide essential infrastructure for AI applications while enhancing its gaming segment through subscription services. Microsoft’s competitive landscape remains fierce, particularly in cloud infrastructure, where Azure is closing in on Amazon’s AWS market share, and in AI models, where competitors like Google and Anthropic are ramping up their capabilities.

Despite its strengths, Microsoft faces significant challenges. High capital expenditure may compress margins, and any downtime in Azure’s service could push enterprise clients toward competitors. The ongoing competition for AI talent poses an additional risk, as does the looming power grid constraints that may limit new data center growth.

Looking forward, several opportunities could catalyze Microsoft’s growth. The company’s AI revenue run-rate has already surpassed $13 billion, and any accelerated growth in this segment could prompt a stock recovery. Moreover, the increasing demand for localized AI infrastructure presents a multi-billion dollar market, particularly for “Sovereign AI Clouds.” With nearly $80 billion in cash reserves, Microsoft holds the potential for strategic acquisitions in the AI landscape.

Investor sentiment remains largely bullish, with 55 of 57 major analysts maintaining a “Strong Buy” rating and a median price target of $630.00, indicating significant upside potential. While institutional investors emphasize the company’s strong balance sheet, retail sentiment has cooled as the novelty of AI wanes, leading users to seek more practical applications from tools like Copilot.

Regulatory scrutiny continues to loom over Microsoft, with investigations into its bundling practices and the implications of the upcoming EU AI Act, which will impose stringent compliance requirements. Additionally, the restructuring of OpenAI has raised questions about Microsoft’s influence over its strategic direction, despite its substantial stake in the organization.

As Microsoft navigates the complexities of 2026, it stands at a pivotal juncture. While its foundational role in the digital economy positions it well for future growth, the current market dynamics serve as a reminder that even industry giants must adapt to shifting investor expectations and economic realities. The forthcoming quarterly earnings report will be critical in assessing whether its substantial capital investments are translating into accelerated growth for Azure and overall profitability.

See also Liverpool Seeks AI Innovators for Taskforce to Drive Ethical AI Adoption by Jan 2026

Liverpool Seeks AI Innovators for Taskforce to Drive Ethical AI Adoption by Jan 2026 Inflection AI Explores IPO Potential Amid $4 Billion Valuation and $1.3 Billion Funding

Inflection AI Explores IPO Potential Amid $4 Billion Valuation and $1.3 Billion Funding Microsoft’s $500 Million Annual Commitment to Anthropic AI Signals Major Shift in Cloud Strategy

Microsoft’s $500 Million Annual Commitment to Anthropic AI Signals Major Shift in Cloud Strategy AI-Driven ERP Integration Transforms Business Planning, Boosting Efficiency by 20% by 2026

AI-Driven ERP Integration Transforms Business Planning, Boosting Efficiency by 20% by 2026