Austin, Jan. 16, 2026 (GLOBE NEWSWIRE) — The global AI Video Analytics Market was valued at USD 8.30 billion in 2025 and is projected to surge to USD 64.48 billion by 2035, reflecting a compound annual growth rate (CAGR) of 22.85% from 2026 to 2035. This dramatic expansion is driven by increasing demands for automated monitoring, real-time danger detection, and intelligent surveillance across both public and private sectors.

The integration of artificial intelligence (AI), Internet of Things (IoT), and cloud technologies contributes significantly to this growth, enhancing operational efficiency and decision-making in various applications such as smart cities, transportation, retail, and industrial environments. This convergence not only boosts safety but also fosters rapid advancements within the global market.

In the U.S. alone, the AI Video Analytics Market was valued at USD 2.23 billion in 2025, with expectations to reach USD 16.79 billion by 2035, growing at a CAGR of 22.39%. Factors driving this U.S. growth include the widespread adoption of smart surveillance systems, sophisticated security frameworks, and government initiatives aimed at improving traffic monitoring, public safety, and infrastructure efficiency.

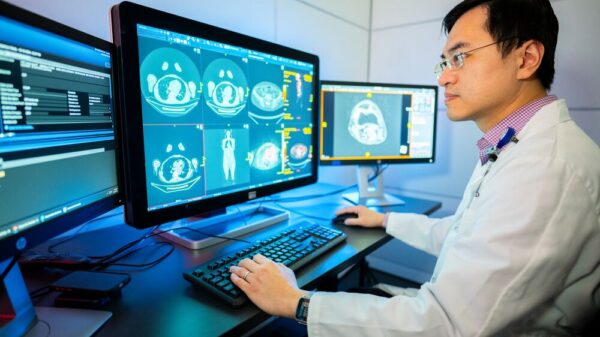

The market segmentation reveals that the Security and Surveillance application dominated with a 35% share in 2025, primarily due to heightened demand for real-time monitoring and automated incident responses. The Traffic and Transportation Management segment is anticipated to grow at the fastest CAGR from 2026 to 2035 as more governments implement AI-driven traffic management solutions.

In terms of analytics type, Video Content Analytics held a 31% market share in 2025, owing to its capability to extract actionable insights from video data. The Crowd and Behavior Detection segment is expected to witness the fastest growth during the forecast period, driven by the increasing need for monitoring crowd density and detecting unusual behavior in public spaces and transport hubs.

By end-user, the Government and Public Safety sectors led with a 29% share in 2025, as various agencies harness AI for crime prevention and emergency response. Notably, the Retail and E-commerce segment is projected to experience rapid growth, leveraging AI video analytics to enhance customer experience and optimize store layouts.

From a component perspective, software accounted for 51% of the market share in 2025, reflecting a demand for advanced analytics platforms and real-time video processing solutions. The services segment is set to grow at the fastest CAGR from 2026 to 2035, as organizations increasingly seek consulting, integration, training, and maintenance in AI video analytics.

The deployment mode analysis indicates that cloud-based solutions dominated with a 59% market share in 2025, attributed to their scalability and cost-effectiveness for video storage and processing. This segment is also expected to grow rapidly, driven by the increasing adoption of AI analytics and smart city initiatives.

Regionally, North America led the AI video analytics market with a revenue share of approximately 38% in 2025, spurred by advanced digital infrastructures and significant investments in smart surveillance technologies. Conversely, the Asia Pacific region is projected to witness the fastest growth rate of about 24.20% from 2026 to 2035, as countries ramp up investments in smart city projects and urban surveillance systems.

The rising demand for intelligent surveillance and security solutions is a major factor propelling market expansion globally. Sectors such as government, transportation, and business increasingly adopt AI video analytics to enhance real-time monitoring and threat detection capabilities. Advanced machine learning algorithms enable automated object detection and behavioral analysis, thereby elevating security effectiveness.

Key players in the AI video analytics landscape include IBM Corporation, Honeywell International Inc., Cisco Systems, Inc., Axis Communications AB, and Avigilon Corp., among others. Recent developments include Cisco’s unveiling of an AI-powered Webex Contact Center, improving video quality through various integrations, and Genetec’s introduction of AI-driven features in its Security Center SaaS, accelerating video evidence analysis.

As the landscape evolves, players will need to navigate regulatory changes and the increasing need for compliance with data privacy laws. The ongoing shift toward AI video analytics reflects broader trends in urbanization and the demand for enhanced safety measures, making it a critical area for future investment and technological advancement.

See also Ransomware Attacks Surge 60% in December, Driven by Unmanaged GenAI Risks

Ransomware Attacks Surge 60% in December, Driven by Unmanaged GenAI Risks Automotive IDPS Market Expected to Reach $7.82B by 2036, Driven by AI Threat Detection

Automotive IDPS Market Expected to Reach $7.82B by 2036, Driven by AI Threat Detection IBM and Palo Alto Networks Launch Unified AI Security to Cut Costs by 19.4%

IBM and Palo Alto Networks Launch Unified AI Security to Cut Costs by 19.4% Free AI Tools Compromise Data Security: 95% of Businesses Lack NHI Management Strategies

Free AI Tools Compromise Data Security: 95% of Businesses Lack NHI Management Strategies AI Cybersecurity Solutions Reduce Threat Detection Time by 95% for Modern Businesses

AI Cybersecurity Solutions Reduce Threat Detection Time by 95% for Modern Businesses