SAP SE’s stock, traded under the symbol SAP.DE, closed at €202.15 on XETRA in Germany on 16 January 2026, declining by €3.45 or -1.68% for the day. The trading volume was notably high at 2,129,163 shares, exceeding the average volume of 1,263,366. Investor sentiment was influenced by significant put activity and the announcement of new AI partnerships aimed at integrating SAP’s cloud ERP with industry-specific applications. This report reviews various aspects of SAP.DE’s valuation, AI catalysts, technical indicators, and price forecasts from the Meyka AI model.

The downward movement in SAP.DE’s stock was largely attributed to a surge in bearish options flows and profit-taking among investors. The stock reached an intraday high of €204.20 and dipped to a low of €199.50. Market reports highlighted substantial put buying and a long-term AI partnership with Syngenta, which is expected to enhance SAP’s positioning within the AI landscape. Notably, the options activity was seen as a primary source of immediate pressure on the stock.

In terms of valuation, SAP.DE trades at a price-to-earnings (PE) ratio of 33.58, with earnings per share (EPS) at €6.02 and a market capitalization of €235.42 billion. The stock’s 50-day moving average stands at €208.88, while the 200-day average is significantly higher at €235.64. Furthermore, key financial ratios reveal a price-to-sales ratio of 6.56 and a price-to-book ratio of 4.77, indicating that the stock is trading at premium multiples common among leading software firms. SAP reported revenue growth of approximately 9.51% for fiscal year 2024, although net income experienced a decline, leading to mixed near-term fundamentals.

SAP’s strategy emphasizes AI integration through its S/4HANA platform and the Business Technology Platform. The collaboration with Syngenta not only embeds AI into the agricultural sector but also validates the broader enterprise adoption of AI technologies. The technology sector in Germany has shown a year-to-date performance of 4.44%, maintaining a focus on AI leaders. While SAP.DE stands to benefit from increasing demand for enterprise AI solutions, it faces stiff competition from larger cloud platforms affecting its margins and growth potential.

Technical indicators for SAP.DE reveal a neutral momentum, with a relative strength index (RSI) of 45.31 and a small positive reading on the MACD histogram. The Bollinger Bands suggest a limited intraday range, set between €203.43 and €212.74. The observed trading volume of 2,129,163 shares reflects a relative volume of 1.69, indicating above-normal selling pressure. Immediate support is positioned near €199.50, while resistance is found at €208.08, aligned with the 50-day moving average.

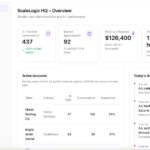

The Meyka AI model assigns SAP.DE a rating of 73.35 out of 100, reflecting a grade of B+ and suggesting a BUY recommendation. This assessment incorporates comparisons to the S&P 500, sector and industry metrics, financial growth, vital ratios, forecasts, and analyst consensus. Projections from the Meyka AI model anticipate monthly, quarterly, and yearly price targets of €233.39, €254.29, and €237.98, respectively. Compared to the current price of €202.15, this indicates a potential upside of 15.46% (monthly), 25.79% (quarterly), and 17.73% (yearly).

Short-term risks for SAP.DE include heightened put activity in options trading and potential pressure on software margins. The stock could face valuation challenges if growth in the cloud segment falters. Conversely, catalysts like a strong earnings performance in January, broader enterprise adoption of AI solutions, or improved margin outcomes could bolster investor confidence. The company offers a dividend yield of approximately 1.14%, providing some cushion for income-sensitive investors.

In summary, SAP.DE closed at €202.15 on XETRA on 16 January 2026, experiencing a day marked by heavier trading volume and negative options flow. The company’s fundamentals remain mixed, with positive revenue growth juxtaposed against declines in EPS and certain cash metrics for fiscal year 2024. Despite its premium valuation, with a PE of 33.58 and a price-to-sales ratio of 6.56, SAP’s capabilities in AI integration and the alliance with Syngenta could broaden its market opportunities. The Meyka AI model’s one-year price forecast of €237.98 suggests a 17.73% potential upside. Investors may wish to monitor the €199.50 support level as well as the 50-day average around €208.88. SAP.DE represents an appealing option for those looking to gain exposure to AI within enterprise software, although valuation and earnings clarity should guide investment decisions.

See also ScaleLogix AI Launches Investor-Grade Platform to Democratize Access to High-Performance AI

ScaleLogix AI Launches Investor-Grade Platform to Democratize Access to High-Performance AI Czech Credo Ventures Invests $3.4M in Modeinspect to Disrupt $6B Design Software Market

Czech Credo Ventures Invests $3.4M in Modeinspect to Disrupt $6B Design Software Market Vertical AI Startups Face 99.5% Failure Rate in 2026—Market Shaping Offers Solution

Vertical AI Startups Face 99.5% Failure Rate in 2026—Market Shaping Offers Solution LG CNS Invests 10 Billion Won in Cha Biotech to Launch AI-Driven Connected Healthcare Services

LG CNS Invests 10 Billion Won in Cha Biotech to Launch AI-Driven Connected Healthcare Services Woori Financial Group Advances AI Transformation with 344 Use Cases by 2024

Woori Financial Group Advances AI Transformation with 344 Use Cases by 2024