Fundrise, the Washington, D.C.-based online investment platform, has launched RealAI, an advanced AI-driven analysis tool aimed at making institutional-grade real estate market intelligence accessible to everyday investors. This innovative platform taps into an extensive database of 3.5 trillion data points on every U.S. property, aiming to disrupt the current data monopoly held by major asset managers like Blackstone and TPG Angelo Gordon. The announcement was made by CEO Ben Miller, who described RealAI as a significant step in democratizing access to critical real estate data.

RealAI is priced at $69 per month following an initial complimentary trial period of 12 uses. The tool is designed to provide users with insights that were historically available only to institutional investors, including neighborhood trends, property comparisons, and income data. By doing so, Fundrise seeks to empower individual investors and challenge the traditional dominance of big players in the real estate sector.

Fundrise currently manages $3 billion in assets for over 2 million investors, with a minimum investment requirement of just $10. This democratization strategy has been central to the company’s mission, and the launch of RealAI marks a new chapter in its efforts to make real estate investment more accessible. “We went out and built a database of, now, 3.5 trillion data points of all the real estate knowledge you want. That’s every property in America,” Miller stated in an interview with CNBC’s Property Play.

The platform will initially focus on residential real estate, covering both single-family and multifamily properties. However, Miller announced plans to expand RealAI’s capabilities to encompass all commercial real estate sectors within six months. This rapid rollout reflects a broader trend in the real estate industry, which has long been criticized for its slow adoption of technology but is now under pressure to integrate AI solutions before they disrupt traditional roles within the sector.

RealAI differentiates itself by combining public records with private databases, integrating property data with demographic intelligence sourced from social media and other avenues. Users can perform market comparisons, evaluate specific properties, and model potential returns—a level of analysis that previously required a team of analysts and expensive Bloomberg terminals.

The launch of RealAI underscores the increasing urgency for real estate firms to embrace technological advancements. As the pressure mounts for traditional analysts to adapt, platforms like Fundrise are positioning themselves at the forefront of the PropTech revolution. By making sophisticated analysis tools available to a wider audience, RealAI not only enhances investment opportunities but also signifies a shift in how data is perceived and utilized in the real estate market.

Looking ahead, the introduction of RealAI may catalyze a broader transformation in the real estate sector, prompting more companies to invest in innovative technologies. As competition heats up among firms striving to leverage AI’s capabilities, the landscape of real estate investment is likely to continue evolving dramatically. Fundrise’s initiative could serve as a blueprint for future ventures seeking to democratize access to market intelligence and reshape the industry’s competitive dynamics.

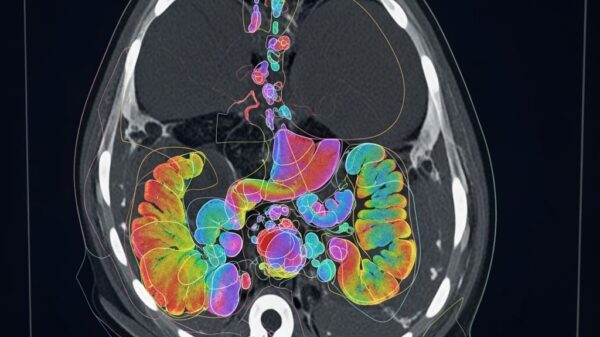

See also AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes

AI Transforms Health Care Workflows, Elevating Patient Care and Outcomes Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements

Tamil Nadu’s Anbil Mahesh Seeks Exemption for In-Service Teachers from TET Requirements Top AI Note-Taking Apps of 2026: Boost Productivity with 95% Accurate Transcriptions

Top AI Note-Taking Apps of 2026: Boost Productivity with 95% Accurate Transcriptions