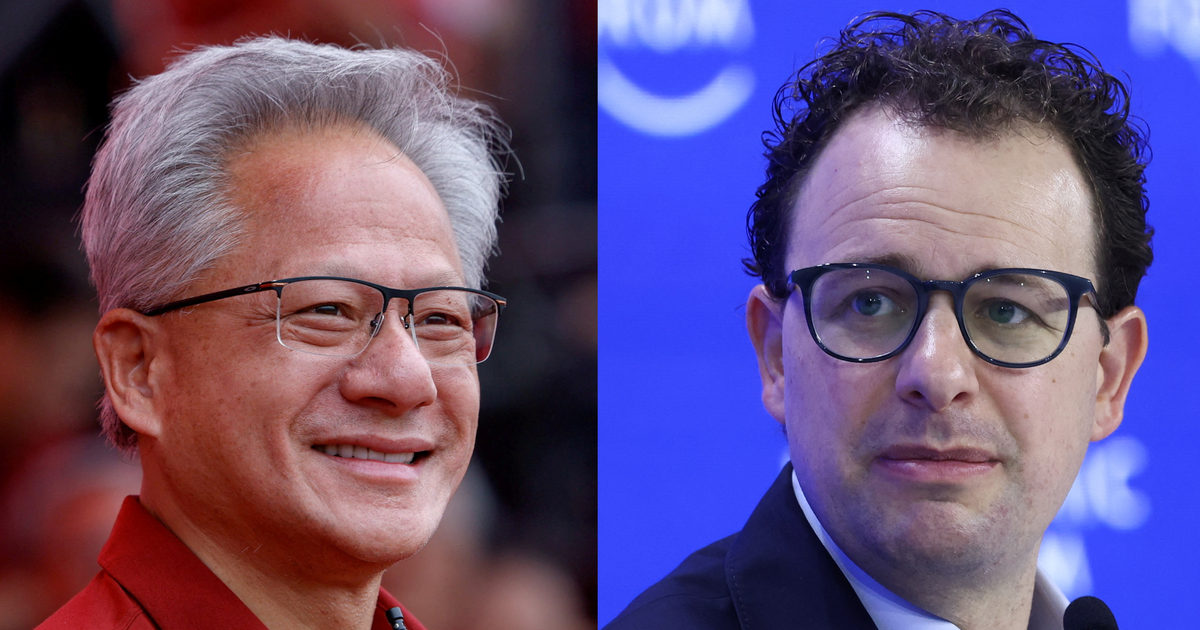

On Tuesday, Anthropic, the AI startup known for its popular chatbot Claude, saw its valuation soar to $350 billion. This significant increase follows recent investments from tech giants Microsoft and Nvidia, marking the latest collaboration among leading American technology companies.

In a reciprocal move, Anthropic has committed to a $30 billion deal to utilize Microsoft’s cloud services. This partnership aligns with Microsoft’s strategy to decrease its reliance on OpenAI, the creator of the ChatGPT model. The backdrop of these eight-figure agreements indicates a growing trend in the tech industry, where companies are increasingly funding their own customers, which has raised concerns about potential market bubbles. As Bloomberg’s Joe Weisenthal pointed out, such announcements are becoming less impactful, suggesting a shift in market dynamics.

Amid the optimism, some industry analysts are sounding alarms. A strategist from Goldman Sachs recently raised eyebrows during a podcast discussion, questioning whether this interconnected web of investments and partnerships might ultimately resemble “a house of cards, with everyone propping each other up.” This skepticism reflects broader anxieties about the sustainability of such massive valuations and interdependencies in the rapidly evolving AI landscape.

The Circular Investment Trend

The recent activities of Anthropic, Microsoft, and Nvidia underscore a circular investment phenomenon increasingly evident within the AI sector. Companies that invest heavily in AI startups are often benefiting from their own services, creating a tightly knit web of dependencies. This “self-funding” model, while beneficial in the short term, raises questions about long-term viability. If one company falters, it could send shockwaves through its partners, as their success is intricately linked.

As the industry grapples with these realities, the implications extend beyond individual companies. The investments signify a competitive race among tech giants to secure the best AI capabilities, which can lead to significant advancements in technology and applications. However, the challenge remains in ensuring the stability of these investments and the health of the market overall.

Implications for the AI Ecosystem

The intertwining of these major players suggests a possible shift in the AI ecosystem, where collaboration may supersede competition. The trajectory of these relationships will be pivotal in shaping the future landscape of AI technology. Companies like Anthropic, with their innovative products like Claude, are now at the forefront of a critical battle for market share and technological dominance.

Yet, as the industry evolves, stakeholders must remain vigilant. The concerns raised by experts about potential overvaluation and market bubbles should not be overlooked. As investments continue to flow into AI, understanding the sustainability of these partnerships will be crucial for future growth and innovation.

In conclusion, Anthropic’s recent valuation surge and significant commitments to Microsoft highlight the dynamic and often precarious nature of the current AI market. As the sector continues to grow, the interplay between investment and reliance among major technology firms will be a key factor in determining the future of AI development.

See also AI Detective Work: The Growing Challenge of Spotting AI-Generated Content

AI Detective Work: The Growing Challenge of Spotting AI-Generated Content Intuit Partners with OpenAI to Integrate ChatGPT into TurboTax, QuickBooks, and More

Intuit Partners with OpenAI to Integrate ChatGPT into TurboTax, QuickBooks, and More AI-Generated Campaign Ad Sparks Ethical Debate in U.S. Senate Race

AI-Generated Campaign Ad Sparks Ethical Debate in U.S. Senate Race IBM Integrates AI Platform into Microsoft 365, Saving Consultants 250,000 Hours Annually

IBM Integrates AI Platform into Microsoft 365, Saving Consultants 250,000 Hours Annually Yang Hongxia’s InfiX.ai Aims for Decentralized Generative AI with $250M Valuation

Yang Hongxia’s InfiX.ai Aims for Decentralized Generative AI with $250M Valuation