Meta Platforms Inc.’s stock performance has become a focal point for investors contemplating the company’s value amid evolving market conditions. The shares closed at US$706.41, reflecting a return of 5.1% over the past week, 8.6% over the past month, and a modest 1.6% increase year-to-date. In comparison to its peers, this return appears to be lagging, raising questions about the underlying business’s worth.

Recent narratives surrounding Meta have centered on its substantial investments in artificial intelligence tools across its platforms, including Facebook, Instagram, and WhatsApp. This is complemented by the company’s ongoing development within Reality Labs and its overarching vision for the metaverse. These themes seem to influence investor sentiment, shaping perceptions of both potential upside and associated risks.

According to Simply Wall St’s valuation assessments, Meta currently holds a score of 5 out of 6, indicating that it is perceived as undervalued across most valuation metrics. A closer examination of specific valuation approaches reveals insight into this view, particularly focusing on the company’s discounted cash flow and price-to-earnings ratios.

The Discounted Cash Flow (DCF) model estimates a company’s value by evaluating projected future cash flows, which are discounted back to their present value. For Meta, analysts have provided forecasts extending to 2030, with the latest annual free cash flow reported at approximately US$61.98 billion and projected to rise to US$115.29 billion by that year. This model arrives at an intrinsic value of about US$1,039.80 per share. Given the current share price of US$706.41, the stock trades at a 32.1% discount to this valuation, suggesting significant undervaluation.

Complementing this analysis, the price-to-earnings (P/E) ratio provides another lens through which to assess Meta’s value. Currently, Meta trades at a P/E of 29.56x, above the industry average of 15.51x but slightly below the peer average of 31.30x. Simply Wall St’s fair P/E estimate for Meta is 41.27x, indicating that the stock’s current valuation is below this model-based perspective of fair value, further reinforcing the notion of underpricing.

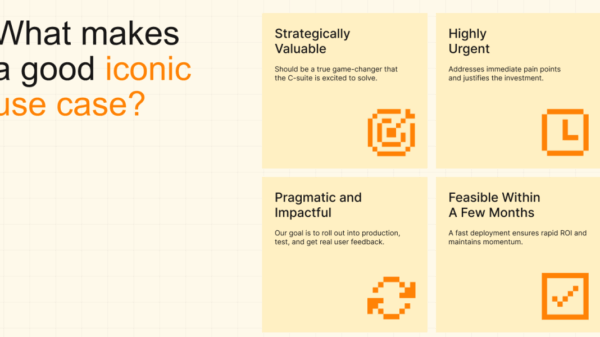

While the DCF and P/E assessments present a compelling case for Meta’s undervaluation, they also highlight the complexities of investor sentiment and market dynamics. The company’s valuation narratives allow investors to articulate their perspectives on fair value based on assumptions regarding future cash flows, margins, and growth potential. Such narratives evolve alongside new information, including earnings reports or significant market news, which keeps an investor’s analysis aligned with real-time data.

For instance, one investor may craft a narrative favoring a higher fair value based on confidence in Meta’s artificial intelligence initiatives and its metaverse strategy. Conversely, a more conservative investor might adopt a lower valuation perspective, prioritizing cautious forecasts for cash flows and profitability.

As Meta continues to navigate the ever-changing tech landscape, its current stock performance raises critical questions about future growth and profitability. Investors are left to decide whether the company’s ongoing investments will translate into tangible returns or if market skepticism will persist. The implications of these evaluations are significant, not just for Meta but for the broader tech sector, as it adapts to advancements in artificial intelligence and immersive technologies.

See also Aurora University Launches Comprehensive Certificate Program in AI Ethics for Future Leaders

Aurora University Launches Comprehensive Certificate Program in AI Ethics for Future Leaders Apple Acquires AI Startup Q.ai, Expands in India, and Shifts to Premium iPhones Amid Investor Optimism

Apple Acquires AI Startup Q.ai, Expands in India, and Shifts to Premium iPhones Amid Investor Optimism Runway Expands AI Festival to Include Design, Gaming, Fashion, and More Categories

Runway Expands AI Festival to Include Design, Gaming, Fashion, and More Categories New York Advances NY FAIR News Act to Mandate AI Disclosure and Safeguard Journalism Integrity

New York Advances NY FAIR News Act to Mandate AI Disclosure and Safeguard Journalism Integrity Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere