The stock market offers investors the opportunity to turn modest sums into significant wealth, especially in a landscape increasingly dominated by artificial intelligence (AI). With just $1,000 to invest—provided it is not earmarked for emergencies or short-term debts—investors may find promising prospects in three notable AI stocks. These companies not only exhibit robust growth but also boast substantial long-term potential, making them worthy considerations for those looking to expand their portfolios.

Palantir Technologies (PLTR +4.79%) has recently gained traction, buoyed by a solid earnings report. For its most recent quarter, Palantir reported a revenue of $1.41 billion, marking a 70% increase year-over-year. The company also posted a net income of $609 million, translating to an earnings per share of $0.24 and a profit margin of 43%. Known for its data mining and AI-powered software, Palantir is rapidly becoming essential for government agencies and commercial enterprises alike. In the last quarter alone, the company secured 180 contracts exceeding $1 million, culminating in a record total contract value of $4.26 billion—an increase of 138% from the previous year.

Today’s Change: (4.79%) $6.23 | Current Price: $136.24

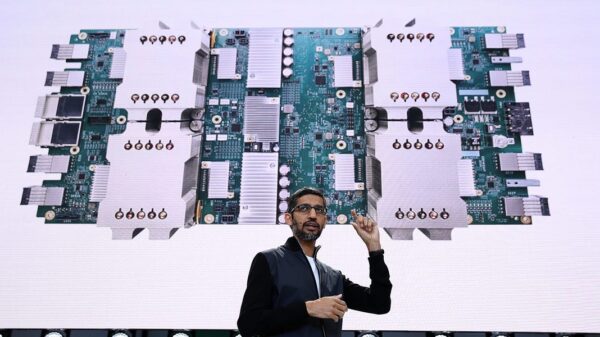

Next, Nvidia (NVDA +8.01%) stands out as a pivotal player in the AI stock boom of recent years. The company’s renowned graphics processing units (GPUs) are integral for high-performance computing tasks, including cryptocurrency mining, virtual reality applications, and AI platform development. Nvidia’s GPUs are in such high demand that the company has become the largest firm by market capitalization. Recent earnings announcements indicated that Nvidia’s cloud GPUs were sold out, even before the launch of its next-generation Rubin chips later this year.

Today’s Change: (8.01%) $13.77 | Current Price: $185.65

Today’s Change: (8.01%) $13.77 | Current Price: $185.65

Despite Nvidia’s strengths, Alphabet (GOOG 2.42%) (GOOGL 2.46%) may have an even more promising trajectory heading into 2026. The company’s Google Cloud computing division is a significant driver of its growth, benefiting from the increasing demand for AI solutions. In the third quarter, Google Cloud generated $15.15 billion in revenue, up 33% from the prior year. Alphabet’s dominant internet presence, bolstered by the widely-used Chrome browser and Google search engine, provides it with substantial leverage in the advertising sector, contributing $74.18 billion to its latest quarterly revenue.

Today’s Change: (-2.46%) $-8.16 | Current Price: $323.09

Today’s Change: (-2.46%) $-8.16 | Current Price: $323.09

Alphabet is also diversifying its offerings by marketing its Tensor Processing Units (TPUs), an in-house alternative to GPUs. A partnership with Anthropic aims to integrate up to 1 million TPUs into Google Cloud, and discussions with Meta Platforms could yield deals worth billions of dollars.

As the AI landscape evolves, the prospects for these companies appear bright. Their strategic positioning and robust financial performance suggest that they can continue to build wealth for investors, especially those willing to be patient and disciplined in their investment approach.

For more details on these companies, you can visit their respective official sites: Palantir Technologies, Nvidia, and Alphabet.

See also OpenAI Wins Legal Battle, Keeps Confidential Attorney Messages Private in Copyright Case

OpenAI Wins Legal Battle, Keeps Confidential Attorney Messages Private in Copyright Case AI Fuels Samsung and Micron’s Surge as They Eye Trillion-Dollar Valuations

AI Fuels Samsung and Micron’s Surge as They Eye Trillion-Dollar Valuations AI-Driven Revenue Deflation in Indian IT Stocks Likely Exceeds 3%, Warns Bhavin Shah

AI-Driven Revenue Deflation in Indian IT Stocks Likely Exceeds 3%, Warns Bhavin Shah Macron Announces 2026 Ban on Social Media for Under-15s Amid AI Mental Health Concerns

Macron Announces 2026 Ban on Social Media for Under-15s Amid AI Mental Health Concerns New York Governor Hochul Proposes Stricter AI Chatbot Regulations to Protect Children

New York Governor Hochul Proposes Stricter AI Chatbot Regulations to Protect Children