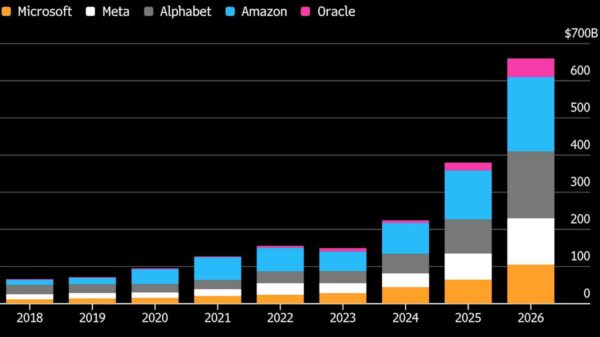

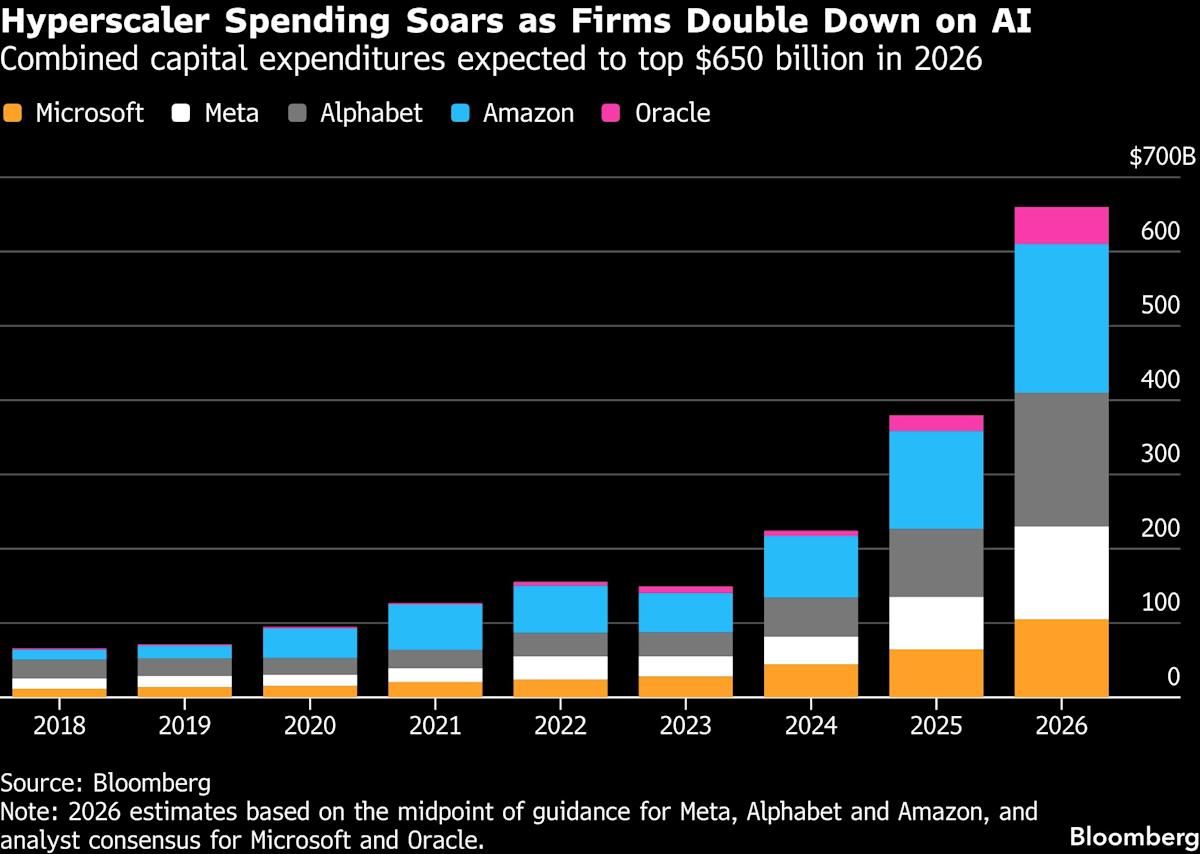

(Bloomberg) — The biggest tech companies are gearing up to spend even more on artificial intelligence than investors had anticipated, and money managers increasingly fear that whatever happens, credit markets will get hit. Microsoft Corp., Oracle Corp., and other “hyperscalers” are in an arms race to invest in AI, aiming to outpace competitors in a technology that could transform vast segments of the economy. Google parent Alphabet Inc. has announced that it is poised to spend as much as $185 billion on data centers this year, surpassing its total investments over the past three years combined. Amazon.com Inc. has promised an even larger outlay of $200 billion.

A significant portion of these investments is expected to originate from the high-grade corporate bond market, which could lead to more debt sales this year than investors initially anticipated. However, as tech companies continue to borrow, the potential pressure on bond valuations increases. Currently, these securities are trading at levels near their tightest spreads since the late 1990s. “The AI spending bonanza is finding buyers today but leaves little upside and even less room for error,” said Alexander Morris, chief executive officer and co-founder of F/m Investments. “There is no asset class that can’t and won’t spoil.”

Concerns surrounding tech companies’ debt were evident this week, as their notes weakened relative to Treasuries, including Oracle’s $25 billion debt sale on Monday. In the broader context, high-grade corporate bond yield spreads widened by about 0.02 percentage points. Beyond simple supply and demand, growing worries regarding AI’s disruptive potential have sparked tremors in the market. As companies like Anthropic PBC consistently release tools aimed at professional services ranging from finance to software development, investors are beginning to factor in the risks AI poses to entire business models.

Software firms have seen their leveraged loan prices decline roughly 4% this year, according to Bloomberg index data, as fears mount that AI will render many software products obsolete. Publicly traded lenders known as business development companies (BDCs) also have substantial exposure to software, which constitutes more than 20% of their portfolios on average, as noted in a report from Barclays. Consequently, a BDC equity index fell 4.6% this week.

While software companies are relatively underrepresented in the high-grade and high-yield bond markets—accounting for only about 3% of each, according to Barclays—their valuations remain high, which makes corporate bonds vulnerable to rising risks. As of Thursday’s close, the average US high-grade corporate bond spread stood at 0.75 percentage points. Barclays strategists Brad Rogoff and Dominique Toublan observed in a Friday note that “tight valuations make credit susceptible to potential disruption.”

In a forecast from November, JPMorgan Chase & Co. estimated that approximately $400 billion of high-grade US bond sales would be generated from the technology, media, and telecom sectors this year. However, that figure could increase as companies ramp up their spending plans. Despite concerns about an impending supply overload, current demand for investment-grade bonds appears to be outpacing supply. Fund flows into high-grade bonds totaled $6.44 billion in the week ending February 4, marking the largest inflow in over five years. This robust demand continues even as spreads remain near their tightest in decades.

However, as these tech giants escalate their spending and increase debt issuance for their AI initiatives, technical conditions in the market may weaken, according to Nathaniel Rosenbaum, head of US credit strategy at JPMorgan. New bond issues over the past 10 days have lagged behind the JPMorgan US Liquid Index by 4 basis points, marking the largest underperformance since October, even with dealer inventories remaining near all-time lows. Rosenbaum noted, “To the extent issuance picks back up again over the remainder of the month, as we believe it will, there is room for further technical weakness ahead.”

Investors might seize opportunities to purchase bonds as they become cheaper, potentially shifting from money market funds or mortgage bonds that have generated substantial gains, stated Andrzej Skiba, head of US fixed income at RBC Global Asset Management’s BlueBay Fixed Income, during a Bloomberg TV interview. Still, the combination of the tech sector’s borrowing spree, tight spreads, and rising credit risks related to AI presents a precarious environment for investors—one that could easily be prone to shocks. “It doesn’t take too many adverse events to create a selloff and for the prices to collapse,” cautioned Ali Meli, founder and CIO of Monachil Capital Partners. “While credit markets may appear very liquid when the markets are good, the buyers can quickly disappear.”

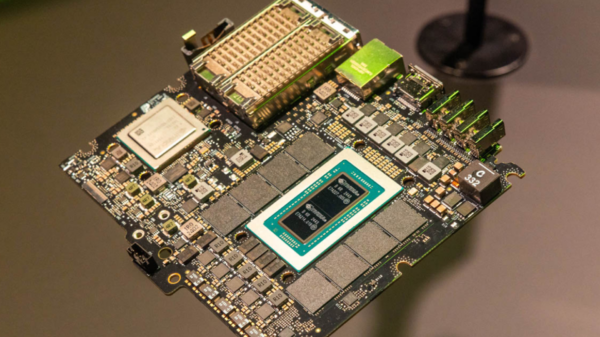

See also Nvidia Acquires $5B Stake in Intel, Boosting AI Compute Growth Potential

Nvidia Acquires $5B Stake in Intel, Boosting AI Compute Growth Potential Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse