As Africa prepares for its participation in COP30 in Brazil, the urgency for financial institutions across the continent to enhance their climate finance capabilities has never been more pressing. The challenges posed by climate change—especially in agriculture—demand a shift towards more resilient practices. With the intertwined issues of energy poverty and inclusive energy access, the integration of climate-smart technologies becomes essential in addressing these challenges.

Climate change is no longer an abstract concept for many in West Africa; it manifests in real challenges like food insecurity, poverty, and increasing migration. These issues fuel one another in a vicious cycle that threatens not just livelihoods, but the very fabric of societal stability. However, amidst these daunting challenges lie opportunities for creating a more inclusive and prosperous future through integrated climate resilience initiatives.

Financial institutions in Africa must develop strong climate finance capabilities to ensure they remain relevant to their environment, while also building robust climate-risk resilient portfolios.

To navigate this complex landscape, financial institutions must recognize the climate-related risks that impact their businesses, even if they are not directly involved in climate sectors. Transition risks, especially as the world moves toward climate-smart technologies, present potential long-term blind spots for banks and financial institutions. This is particularly relevant as investments could become stranded in a rapidly evolving market that increasingly values sustainability.

AI’s Role in Climate Risk Evaluation

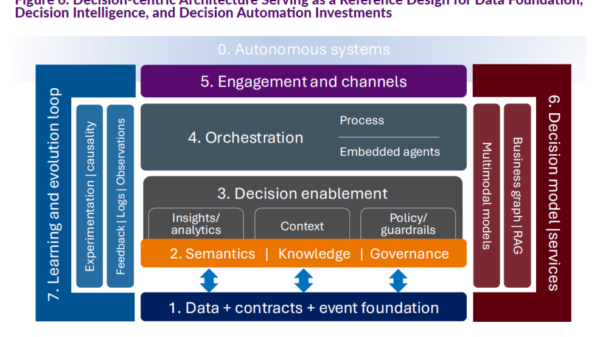

Artificial Intelligence (AI) is poised to play a transformative role in climate finance. To achieve effective climate risk evaluation and financing, financial institutions will need to leverage AI technologies capable of processing a multitude of structured and unstructured data. This encompasses everything from meteorological data and agricultural statistics to telecommunications and behavioral data. Such a comprehensive approach will enable real-time decision-making that supports sustainable financing initiatives.

How do we collaborate to ensure that critical ecosystem information is available for smart AI-aided climate financing decisions?

The challenges in Africa are compounded by a fragmented digital public infrastructure, which means that vital public good information often remains siloed and disconnected. Collaboration between diverse stakeholders is essential to overcome these barriers and enable more effective AI-driven climate financing solutions. A noted example of climate transition risk comes from a recent experience shared by a prominent African businessman who, while in Italy, learned that an electric taxi could travel 500 kilometers on a charge costing just €20. This serves as a stark reminder of the transition risks financial institutions face as they evaluate their investments in an evolving energy landscape.

Two Critical Cs: Collaboration and Capability

To fully harness AI’s potential in climate finance, two key components must be addressed: collaboration and capability. First, collaboration is essential for aggregating the diverse datasets necessary for informed decision-making. This requires breaking down the silos that currently inhibit data integration across sectors.

Second, the capability to utilize advanced AI technologies must be developed within financial institutions. The past decade has seen many banks struggle with digital transformation, often failing to realize the full benefits of their technological investments. Only those institutions that can overcome legacy technology challenges will be able to exploit AI’s full potential in climate financing.

Only smart banks with advanced technological capabilities will realize the full promise and potential of AI in climate financing.

As Africa navigates these complex challenges, the focus on building strong, climate-risk resilient portfolios through smart, AI-driven decision-making will not only enhance financial stability but also drive broader social impacts. Financial institutions must proactively engage in partnerships and collaborations to ensure they have access to dynamic feeds of critical ecosystem information, enabling them to better assess risks and opportunities.

In conclusion, the integration of AI in climate finance presents a significant opportunity for Africa’s financial institutions. By prioritizing collaboration and enhancing technological capabilities, these institutions can play a pivotal role in addressing the pressing climate challenges facing the continent.

See also Australian Executives Embrace AI’s Role in Finance, 91% Fear Delaying Adoption

Australian Executives Embrace AI’s Role in Finance, 91% Fear Delaying Adoption Nvidia Surpasses Q3 Earnings Estimates with $65B Revenue Forecast, Stock Jumps 5%

Nvidia Surpasses Q3 Earnings Estimates with $65B Revenue Forecast, Stock Jumps 5% McKinsey Reveals Agentic AI Could Boost Financial Crime Detection from 2% to New Heights

McKinsey Reveals Agentic AI Could Boost Financial Crime Detection from 2% to New Heights AI Data Center Expansion Drives DRAM Prices Up 60%, Impacting Consumer Electronics

AI Data Center Expansion Drives DRAM Prices Up 60%, Impacting Consumer Electronics Wall Street and FTSE Rise as US Jobs Report Shows 119,000 New Positions Despite 4.4% Unemployment

Wall Street and FTSE Rise as US Jobs Report Shows 119,000 New Positions Despite 4.4% Unemployment