Shares of semiconductor giant Broadcom (NASDAQ: AVGO) continued their downward trend as 2026 began, marking a 10% decline year-to-date as of February 5. Since the company last reported earnings on December 11, 2025, Broadcom’s stock has dropped 23%. However, the outlook from leading U.S. hyperscalers suggests that this decline may represent a buying opportunity for investors.

The capital expenditure (CapEx) guidance from these hyperscalers, particularly from Google and Meta, has significantly exceeded expectations, indicating a promising future for Broadcom. Hyperscaler CapEx serves as a critical indicator of Broadcom’s potential revenue, especially in the burgeoning field of artificial intelligence semiconductors.

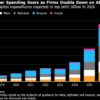

On February 4, Alphabet (NASDAQ: GOOG), the parent company of Google, reported its earnings and provided a bullish CapEx forecast for 2026. Alphabet anticipates spending between $175 billion and $185 billion, which represents nearly a 97% increase from its 2025 CapEx of $91.4 billion. This forecast far surpassed expectations of approximately $120 billion, which would have implied a mere 31% growth. Higher spending from Google, a key customer for Broadcom, is likely to positively impact Broadcom’s revenue projections.

In 2025, Google’s CapEx had already seen a 74% increase from $52.5 billion in 2024. The projected 97% growth for 2026 signals an accelerating investment in AI, a trend from which Broadcom stands to benefit significantly. Following the earnings report, Broadcom shares saw a modest uptick of about 1% on February 5, as investors recognized the implications of Google’s increased spending, although this gain is small compared to the recent decline in stock value.

Further supporting the bullish sentiment surrounding Broadcom is the CapEx guidance from Meta Platforms (NASDAQ: META). While their partnership with Broadcom has not been officially confirmed, it is believed that Broadcom is deeply involved in the development of Meta’s Meta Training and Inference Accelerator (MTIA). In its latest earnings report, Meta announced it expects to spend between $115 billion and $135 billion on CapEx in 2026, exceeding expectations of around $110 billion. This guidance reflects a growth rate of 73%, only slightly down from an 84% increase in 2025. Such figures suggest that Meta will likely increase its reliance on Broadcom for its chip requirements.

In the first quarter of 2026, Meta also indicated plans to expand its MTIA program to support its core ranking and recommendation training workloads alongside its existing inference workloads. This development implies that Broadcom’s MTIA offerings will play a more significant role in Meta’s operations, suggesting a stronger long-term partnership. Currently, Google is utilizing the seventh generation of its co-developed tensor processing units (TPUs), while Meta is still on the second generation of MTIA, indicating considerable growth potential for future collaborations.

These advancements in CapEx guidance bode well for Broadcom, especially as its shares are trading at a forward price-to-earnings (P/E) ratio near 30x, approximately 19% below its average ratio over the past year. Furthermore, analysts project a consensus price target of around $437 for Broadcom, indicating a potential upside of about 41%. Given these factors, investors may find Broadcom shares increasingly attractive at current levels.

The evolving landscape of AI and semiconductor demand, driven by significant investments from major players like Google and Meta, underscores the strategic importance of Broadcom’s technology. As hyperscaler spending continues to surge, the company appears well-positioned for future growth amidst its recent stock downturn.

For those considering investment opportunities in the tech sector, the developments surrounding Broadcom suggest a compelling case for future gains.

See also Meta’s Child Safety Lawsuit Advances Amid $10B AI Data Center Energy Crisis

Meta’s Child Safety Lawsuit Advances Amid $10B AI Data Center Energy Crisis Australia’s Economy Faces Inflation Risks Amid AI Investments and Geopolitical Tensions in 2026

Australia’s Economy Faces Inflation Risks Amid AI Investments and Geopolitical Tensions in 2026 Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT