In 2026, the global landscape is shifting dramatically as geopolitics becomes increasingly defined by coercion and economic sanctions, fiat currencies lose their credibility, and the race for advanced artificial intelligence (AI) encounters significant energy limitations. These intertwined trends are redefining notions of sovereignty and power on the world stage.

The ongoing geopolitical climate reflects a departure from traditional diplomacy, with major powers opting for assertive tactics that prioritize pressure over negotiation. Economic sanctions, technological restrictions, and selective tariffs have become primary tools in international relations. Recent events in the Western Hemisphere, including the detention of leaders connected to transnational networks, highlight a new norm where influence is imposed rather than negotiated. Control over critical supply chains and digital infrastructures now equates to a significant strategic advantage.

This shift is contributing to the fragmentation of the international system, where rival blocs are emerging, rendering sovereignty less about territory and more about the ability to manage vital resources. While this strategy might yield immediate benefits—such as enhanced control over trade routes—it risks straining relationships with traditional allies and may expedite the formation of alternative alliances. Moreover, the potential for accidental escalation remains a grave concern; a misinterpreted incident could lead to open conflict, with sovereignty increasingly measured by the resilience of critical infrastructures.

Simultaneously, the fiat monetary system is experiencing a gradual yet persistent erosion. Massive fiscal deficits and rampant inflation, compounded by frequent sanctions, are undermining the trust in government-issued currencies. In response, central banks worldwide are ramping up gold purchases, repatriating reserves and diversifying away from sovereign debt. As the price of gold reaches record highs, cryptocurrencies and digital assets are gaining traction as alternatives for those wary of traditional financial systems. This shift is cumulative; each new round of monetary expansion and crisis of confidence accelerates the search for stable assets, with real wealth dwindling for those dependent on conventional savings.

The stakes are high, as a potential systemic crisis—whether from a financial bubble tied to emerging technologies or a large-scale sovereign default—could spur a rapid transition to new monetary standards based on commodities, blockchain, or energy. Meanwhile, a steady erosion is already reshaping global investment and reserve strategies.

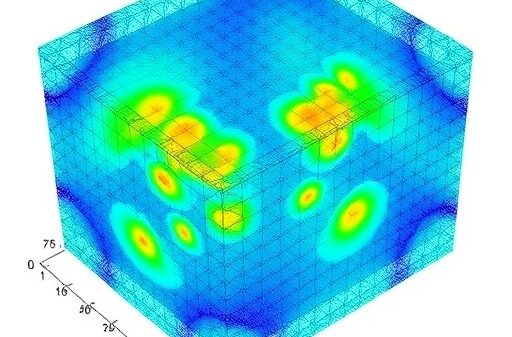

The pursuit of advanced AI compounds these issues, as countries and corporations invest heavily in developing powerful models. However, the primary constraint is not the chips or algorithms but the energy required to power data centers, which consume vast amounts of electricity—akin to the needs of entire cities in some regions. Projections suggest that energy demands for AI could double within a few years, straining already burdened power grids and necessitating significant investments in new energy generation sources.

Those with access to abundant and cost-effective energy stand to gain a critical advantage, while countries lacking such resources may face developmental delays in AI capabilities. This dynamic not only highlights the geopolitics of energy but also raises concerns about the potential for authoritarian surveillance and other risks associated with advanced technologies. The possibility of an unregulated entity achieving superhuman-level AI poses unpredictable and potentially irreversible consequences.

These three forces—geopolitical coercion, financial erosion, and AI energy demands—interact synergistically, amplifying each other’s impact. Coercive geopolitics accelerates financial sanctions, which in turn undermine fiat currencies and push capital toward alternative assets. The race for AI supremacy intensifies the pressure on energy resources, creating new vulnerabilities that can be exploited for political ends. Restrictions on chip exports or sanctions on essential minerals illustrate the intertwining nature of economic, technological, and military strategies.

The implications for the future are profound. If a single entity achieves uncontested dominance in AI without sufficient checks, the global balance of power could shift dramatically. Conversely, these technological advances could lead to extraordinary progress in various fields, including medicine and complex problem-solving. However, a stark division may also emerge between blocs that dominate energy, technology, and information, leading to a restrictive “digital and energy iron curtain.”

As 2026 unfolds, the confluence of these trends signals not just a chronological milestone but a pivotal moment in which foundational shifts in global governance and economic systems may become evident. The choices made by governments, businesses, and societies in navigating these forces will determine not just power dynamics but the very structure of global organization in the decades to come.

Sources consulted include Letras Libres, Reuters, The Guardian, and IEA reports. This article is for informational purposes only.

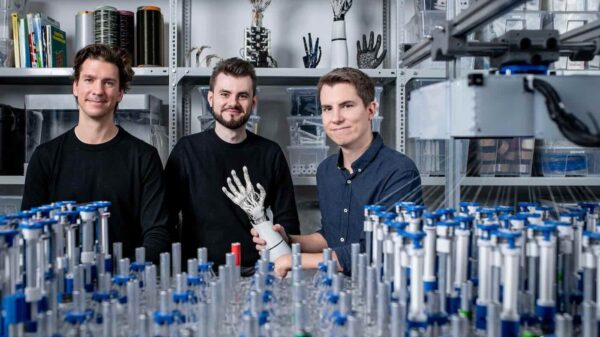

See also Allonic Secures $7.2M in Hungary’s Largest Pre-Seed Round for Robotic Bodies

Allonic Secures $7.2M in Hungary’s Largest Pre-Seed Round for Robotic Bodies Cisco Unveils $28B AI Infrastructure Strategy, Positioning to Dominate Enterprise Tech Future

Cisco Unveils $28B AI Infrastructure Strategy, Positioning to Dominate Enterprise Tech Future Alibaba Faces Overload Crisis Amid AI Shopping Surge and Robotics Breakthrough

Alibaba Faces Overload Crisis Amid AI Shopping Surge and Robotics Breakthrough Amazon Achieves FCC Approval for 4,500 Kuiper Satellites, Doubling Constellation Size to 7,700

Amazon Achieves FCC Approval for 4,500 Kuiper Satellites, Doubling Constellation Size to 7,700 India’s AI Impact Summit 2026 to Drive Global Collaboration on Equitable AI Access

India’s AI Impact Summit 2026 to Drive Global Collaboration on Equitable AI Access