The Alphabet Bond sale this week has garnered significant attention in global financial markets, as Google’s parent company raised nearly $32 billion in debt in less than 24 hours. This substantial bond issuance aims to fund Alphabet’s ambitious investment plans, especially in artificial intelligence and data infrastructure. The scale of this deal not only underscores Alphabet’s aggressive long-term strategy but also highlights the strong confidence from credit markets in the future of tech and AI-related investments.

Investors and companies across the stock market are closely monitoring the implications of Alphabet’s bond sale, which could reshape how tech giants finance their growth and support emerging technologies like machine learning and cloud computing. For those conducting stock research or tracking trends in AI stocks, the Alphabet Bond issuance serves as a pivotal development with potential ramifications for capital flows in technology sectors.

Alphabet’s bond issuance is among the largest corporate debt sales in recent history, with the company raising almost $32 billion in under a single day. This consisted of bonds denominated in U.S. dollars, British pounds, and Swiss francs. Following an earlier announcement that capital expenditures are expected to reach $185 billion in 2026, this fundraising reflects a significant increase in investment as Alphabet expands its AI, cloud, and data center infrastructure.

The inclusion of a rare 100-year bond is one of the standout features of this sale. Priced at about 1.2 percentage points above long-term UK government bonds, the century-long bond drew nearly 10 times the orders for what was initially offered, demonstrating a robust appetite from institutional investors such as pension funds and insurance companies. This is the first instance of a tech company issuing such long-dated debt since the late 1990s.

The dollar-denominated portion of the sale attracted over $100 billion in demand, far exceeding the amount available and underscoring the confidence lenders have in Alphabet’s financial strength. The currency-diverse strategy enables the company to access different segments of the global bond market, reduce refinancing risk, and align long-term financing with its planned capital deployment.

Alphabet chose to sell bonds as a means to raise funds for its growth initiatives, rather than issuing new equity or solely relying on internal reserves. This strategic choice is driven by several factors: interest rates on high-grade corporate debt remain attractive for companies with strong credit ratings like Alphabet, issuing bonds helps preserve shareholder equity and avoid dilution, and long-term bonds allow the company to secure financing at favorable rates while aligning debt maturities with expected returns on massive investments in AI infrastructure.

By leveraging debt markets instead of equity issuance, Alphabet signals confidence in its financial stability and projected cash flows. This strategy affords the company flexibility while pursuing its objectives in AI, cloud computing, and infrastructure expansion.

The record-breaking Alphabet Bond sale reflects strong investor confidence in tech companies and their aspirations in artificial intelligence. Demand from pension funds, insurers, hedge funds, and asset managers indicates that many large investors view Alphabet as a stable, long-term investment backed by a prominent brand, diverse business units, and ongoing revenue growth.

Analysts consider this strong backing in credit markets to be an endorsement of Alphabet’s capacity to manage its extensive investment plans judiciously. For the wider tech sector, Alphabet’s success in the bond market may motivate other major companies to contemplate similar funding routes. Industry peers like Oracle, Meta Platforms, and Microsoft have already initiated significant bond deals or expanded capital spending to support AI development, indicating a broader trend of high-tech borrowing to finance rapid growth in artificial intelligence and digital infrastructure.

However, the large-scale issuance of debt raises questions about capital allocation and risk. Some investors express concerns that heavy borrowing could pressure future earnings or divert focus from near-term profitability. Others argue that the significant investment required in AI to maintain global competitiveness justifies financing strategies that distribute costs over extended periods. These contrasting perspectives contribute to an ongoing debate on how technology firms should balance funding growth with financial prudence.

Alphabet’s bond strategy exemplifies how major tech and AI firms may finance growth in the future. As companies race to develop advanced AI systems, global spending on AI infrastructure is projected to remain high. Industry analyses suggest that AI and cloud capital expenditures could reach unprecedented levels by the decade’s end, with substantial investments in data centers, chips, and research initiatives.

The magnitude of Alphabet’s fundraising approach emphasizes the deep interconnection between capital markets and the advancement of cutting-edge technology. For investors focused on AI stocks and tech performance, Alphabet’s actions illustrate that financial strategy and long-term growth plans are increasingly reliant on innovative funding mechanisms.

While the bond sale highlights investor faith in Alphabet’s vision, it also brings to light the financial risks associated with extensive borrowing. Managing billions in long-term debt necessitates meticulous planning, stable cash flows, and disciplined execution of strategic initiatives. Companies that expand too rapidly could encounter challenges if market conditions or revenue forecasts shift unexpectedly.

Alphabet’s scenario showcases both the opportunities and challenges of financing swift technological transformation. As long as the company capitalizes on its investments in AI and infrastructure efficiently, the bond strategy may yield substantial returns over time. Conversely, if execution falters, the obligations tied to long-dated debt could impact the company’s financial performance and market sentiment.

The Alphabet Bond sale, which raised almost $32 billion in under 24 hours, represents a remarkable case of how tech giants are financing the next wave of innovation. The massive demand from credit markets reflects strong investor confidence in Alphabet’s financial strength and future growth potential as it expands its AI, cloud, and data center capabilities.

By opting to issue bonds rather than equity, Alphabet preserves shareholder value while securing long-term capital for strategic investments. This move may influence funding strategies across the tech sector, underscoring the vital role capital markets play in shaping the future of artificial intelligence and technology infrastructure.

For investors, the sale provides insights into the financial strategies that uphold long-term growth trajectories in modern tech firms, particularly those in the competitive AI landscape.

See also ServiceNow’s CEO Invests Big, Claims Path to $1 Trillion Valuation Amid AI Surge

ServiceNow’s CEO Invests Big, Claims Path to $1 Trillion Valuation Amid AI Surge OpenAI’s ChatGPT, Anthropic’s Claude, and Gemini: Which AI Excels in Your Field?

OpenAI’s ChatGPT, Anthropic’s Claude, and Gemini: Which AI Excels in Your Field? AI Ethics in Insurance Market Set for Major Transformation by 2033, Driven by Tech Giants

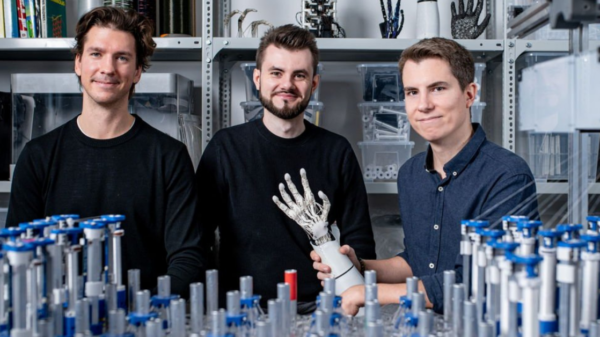

AI Ethics in Insurance Market Set for Major Transformation by 2033, Driven by Tech Giants Allonic Secures $7.2M Pre-Seed Investment to Transform Robotics Manufacturing

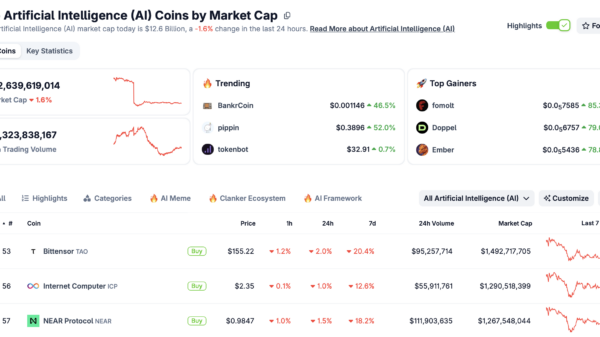

Allonic Secures $7.2M Pre-Seed Investment to Transform Robotics Manufacturing BankrCoin Surges 22%, Pippin Climbs 45% as AI Crypto Market Cap Stabilizes at $12.6B

BankrCoin Surges 22%, Pippin Climbs 45% as AI Crypto Market Cap Stabilizes at $12.6B