ServiceNow CEO Bill McDermott is optimistic about his company’s trajectory, declaring it a potential contender for the coveted trillion-dollar valuation. As the stock market has demonstrated significant growth over recent years, only 11 companies on U.S. exchanges have surpassed the $1 trillion threshold, with many of them closely linked to advancements in artificial intelligence (AI). Investors may want to consider smaller AI-focused stocks like ServiceNow, which, although currently valued at over $100 billion, is positioned to grow substantially amid the ongoing digital transformation.

Founded as an IT service management software provider, ServiceNow has broadened its offerings to encompass a wide array of enterprise solutions, including customer service, security, human resources, finance, sales, and legal solutions. The company boasts an impressive client base, counting 85% of the Fortune 500 among its customers. Recent acquisitions have further expanded its portfolio, including the purchase of cybersecurity firm Moveworks for $2.85 billion and an agreement to acquire Armis for $7.75 billion. While some investors express concern regarding the hefty price tags on these acquisitions, they strategically position ServiceNow to deliver comprehensive cybersecurity solutions, particularly as businesses increasingly adopt agentic AI technologies.

ServiceNow has rapidly integrated generative AI into its offerings, with its Now Assist AI solution suite reaching an annual contract value of $600 million by the end of 2025, a figure management expects to climb to $1 billion this year. The company has established an AI Control Tower, a core hub for managing AI agents, models, and workflows, and aims to capture a large share of the anticipated $1.3 trillion enterprise spending on AI-enabled applications by 2029, as projected by IDC. During the company’s fourth-quarter earnings call, McDermott expressed his unwavering belief in ServiceNow’s potential, stating, “This is a $1 trillion company in the making.”

In a show of confidence, McDermott not only reaffirmed his long-term commitment to ServiceNow but also underscored the attractiveness of its current stock valuation. In conjunction with the fourth-quarter earnings report, the company announced a $5 billion share repurchase plan, including a $2 billion accelerated share repurchase. ServiceNow’s fourth-quarter subscription revenue grew by 19.5%, surpassing both management’s guidance and analysts’ expectations. The adjusted operating margin also expanded to 31%, up from 29.5%.

While some investors might have reacted cautiously to management’s outlook for 2026, which projected a subscription revenue growth of 20.5% to 21%, excluding the effects of acquisitions and currency fluctuations, the numbers suggest even more modest growth. Concerns regarding increased spending on acquisitions persist, although management indicated that significant acquisitions will not be a primary focus moving forward. Amid a broader sell-off in Software as a Service (SaaS) stocks driven by fears of AI diminishing the profitability of software companies, ServiceNow remains well-positioned within the AI landscape, rapidly adopting the technology to enable businesses to leverage its platform alongside other AI solutions.

With its enterprise value now falling to less than 6.5 times revenue estimates for 2026, some analysts view ServiceNow’s stock as a compelling investment opportunity relative to its potential for growth. The question of whether it will reach a $1 trillion valuation remains unanswered, but given its strategic positioning and the broader market dynamics, ServiceNow appears to be worth considerably more than its current valuation of over $100 billion.

As the global technology landscape continues to evolve, with businesses increasingly integrating AI into their operations, ServiceNow’s role as a pivotal software provider may solidify its status in the market. McDermott’s confidence, coupled with the company’s ambitious plans, could lead to significant gains as it seeks to redefine enterprise solutions in an AI-driven future.

See also OpenAI’s ChatGPT, Anthropic’s Claude, and Gemini: Which AI Excels in Your Field?

OpenAI’s ChatGPT, Anthropic’s Claude, and Gemini: Which AI Excels in Your Field? AI Ethics in Insurance Market Set for Major Transformation by 2033, Driven by Tech Giants

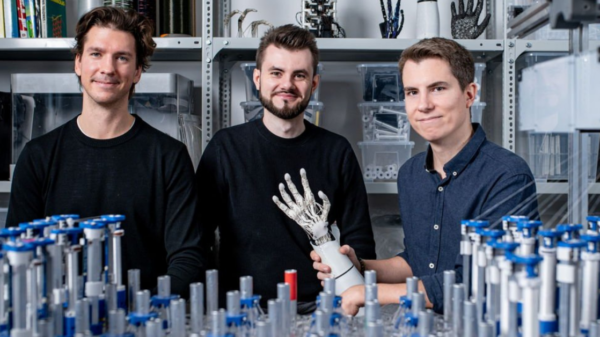

AI Ethics in Insurance Market Set for Major Transformation by 2033, Driven by Tech Giants Allonic Secures $7.2M Pre-Seed Investment to Transform Robotics Manufacturing

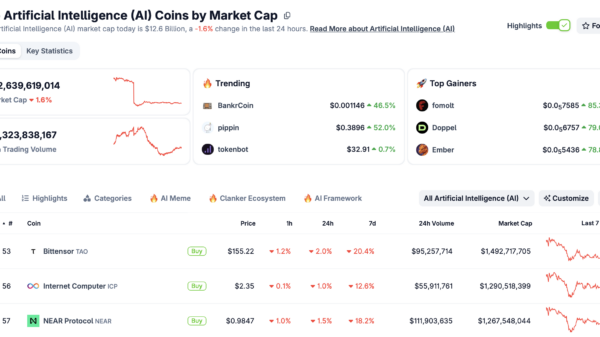

Allonic Secures $7.2M Pre-Seed Investment to Transform Robotics Manufacturing BankrCoin Surges 22%, Pippin Climbs 45% as AI Crypto Market Cap Stabilizes at $12.6B

BankrCoin Surges 22%, Pippin Climbs 45% as AI Crypto Market Cap Stabilizes at $12.6B Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere