Blueberry Markets, a forex and CFD broker established in 2016, has garnered attention for its diverse trading offerings. Based in Australia and regulated under the Australian Financial Services License (AFSL), Blueberry Markets provides access to more than 1,000 financial instruments across various asset classes including forex, commodities, indices, and cryptocurrencies. The broker aims to cater to different trading styles with a range of flexible account types and support for multiple trading platforms.

The review from Finance Magnates highlights Blueberry’s regulatory framework, which extends beyond its Australian roots, featuring authorizations and registrations in other jurisdictions. This regulatory oversight is critical for traders seeking a reliable and compliant trading environment. The broker supports several popular trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView, along with its proprietary platform, Blueberry.X.

Traders can access a wide array of instruments, including forex pairs, share CFDs, and crypto CFDs, with leverage options designed to accommodate various risk appetites. The review details how Blueberry structures its Standard and Raw accounts, providing insights into minimum and maximum trade sizes as well as potential leverage ratios. Traders may be particularly interested in the differences in spreads and commission structures that these accounts offer.

The analysis also covers crucial aspects such as swap rates, the availability of swap-free accounts, and the various funding and withdrawal methods supported by the broker. Processing times for these transactions and the overall customer support framework are explored, highlighting what new and experienced traders can expect when engaging with Blueberry Markets. Comprehensive customer support is essential in building trust and facilitating smoother trading experiences for users.

As the brokerage industry continues to evolve, platforms like Blueberry Markets are well-positioned to meet the demands of modern traders. With its robust regulatory environment and a diverse range of trading tools, traders are encouraged to assess whether Blueberry’s offerings align with their individual trading strategies and risk tolerance.

In conclusion, the review from Finance Magnates serves as a useful resource for anyone considering engaging with Blueberry Markets. It emphasizes the importance of understanding trading conditions, platforms, and regulatory compliance. As traders navigate the complexities of the financial markets, informed choices will be paramount to achieving their goals in this competitive landscape.

See also Fintech Xchange 2026: Industry Leaders Address AI, Ethics, and Consumer Empowerment

Fintech Xchange 2026: Industry Leaders Address AI, Ethics, and Consumer Empowerment India’s Debjani Ghosh Urges AI Adoption as Key for Tech Industry’s $850B Vision 2035

India’s Debjani Ghosh Urges AI Adoption as Key for Tech Industry’s $850B Vision 2035 GCM Corp Unveils Innovative AI Thermal Management Solution for Data Centres

GCM Corp Unveils Innovative AI Thermal Management Solution for Data Centres Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

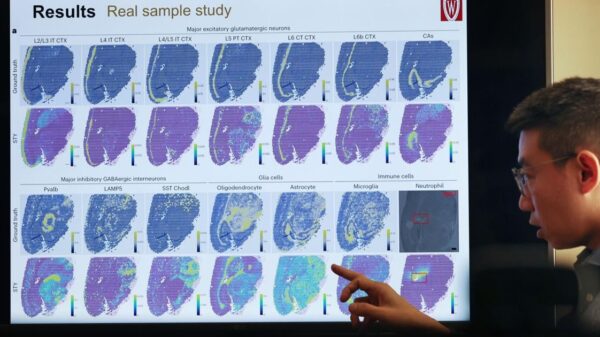

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT