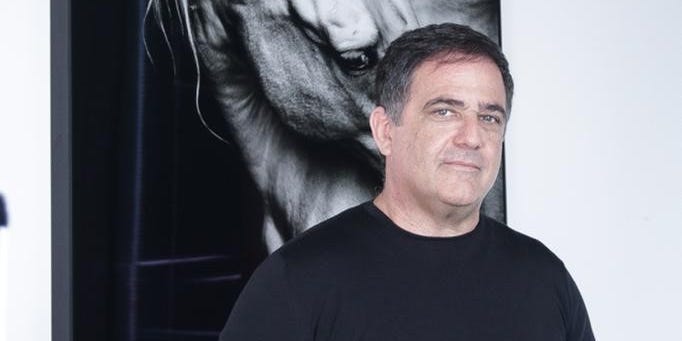

Shlomo Kramer, CEO of cybersecurity firm Cato Networks, expressed his belief that the industry is currently experiencing an AI bubble, yet he continues to invest in promising ventures. In an interview with Business Insider, Kramer noted that while the anticipated advancements in artificial intelligence are unfolding at a slower pace than many expected, he remains optimistic about its long-term potential for delivering results.

Kramer drew parallels between the current AI landscape and the dot-com boom of the late 1990s, which saw numerous companies falter and fail. “There was a lot of devastation,” he stated, emphasizing that despite the challenges, e-commerce emerged as an integral part of daily life—similar to what he envisions for AI in the future.

While he acknowledges that some AI startups may be overvalued, Kramer maintains that others are reasonably priced and plans to continue investing in those he deems promising. He highlighted the necessity for startups to demonstrate a “good combination of team, market, product” to attract his investment.

Kramer outlined three key criteria he uses when evaluating potential investments in AI products. First, he insists that a product must have a “hook”—a concept that is easily understandable and intuitive. “It feels right,” Kramer remarked, indicating the importance of immediate graspability in a product’s appeal.

The second criterion involves the product’s capacity to evolve into a platform or at least a “mini platform” that can expand its offerings over time. Lastly, he emphasizes that the founding team should possess a clear vision regarding the use cases that will ultimately lead to a monetizable business.

Investing Lessons

Kramer has made approximately 67 investments, according to PitchBook, including notable companies in the enterprise software space such as Palo Alto Networks, Gong, and Trusteer, which was acquired by IBM. However, he candidly acknowledged that not all investments have been successful, particularly those outside his primary focus of cybersecurity.

His intellectual curiosity has led him to explore AI applications in diverse sectors, including pharmaceuticals and marketing; however, he noted that many of these ventures have not yielded the desired returns. “It’s much easier to get excited about things you don’t understand,” Kramer said, underscoring the value of deep knowledge in making informed investment decisions.

Kramer highlighted the importance of understanding the customer perspective when developing a product, citing his experience with Check Point Software Technologies, the first startup he co-founded. He credited its success to the insights of Gil Shwed, Check Point’s former CEO, who, as a system administrator, had firsthand experience with customer challenges. “The secret sauce was that he understood the customer problem,” Kramer explained.

Today, Check Point boasts a market capitalization of approximately $18.9 billion, illustrating the potential for well-founded startups to thrive in competitive environments. As the AI sector continues to evolve, Kramer’s focus on foundational principles—team dynamics, market understanding, and product viability—serves as a reminder of the complexities inherent in navigating technological investment landscapes.

In reflecting on the future of AI, Kramer emphasizes the need for startups to remain adaptable and grounded in the realities of their chosen markets. As businesses increasingly embrace digital transformation, the lessons learned from both the successes and failures of the past will undoubtedly shape the next wave of innovation in the industry.

See also Anthropic’s Claims of AI-Driven Cyberattacks Raise Industry Skepticism

Anthropic’s Claims of AI-Driven Cyberattacks Raise Industry Skepticism Anthropic Reports AI-Driven Cyberattack Linked to Chinese Espionage

Anthropic Reports AI-Driven Cyberattack Linked to Chinese Espionage Quantum Computing Threatens Current Cryptography, Experts Seek Solutions

Quantum Computing Threatens Current Cryptography, Experts Seek Solutions Anthropic’s Claude AI exploited in significant cyber-espionage operation

Anthropic’s Claude AI exploited in significant cyber-espionage operation AI Poisoning Attacks Surge 40%: Businesses Face Growing Cybersecurity Risks

AI Poisoning Attacks Surge 40%: Businesses Face Growing Cybersecurity Risks