Capital One (COF) is drawing investor attention today following its announcement of a $5.15 billion acquisition of Brex, marking a significant move towards a tech-driven banking model focused on AI and agentic finance. The stock is trading near $207.37, up 0.48 (+0.23%) with a 52-week range of $143.22 to $259.64. Despite this uptick, COF is down 16.34% year to date, making the success of the integration and margin indicators crucial for its performance. For Indian investors, this development is particularly relevant, as it aligns with the growing demand for efficient B2B payments, spend control, and cross-border financial workflows within India’s rapidly digitizing enterprises.

Capital One’s acquisition of Brex enhances its offerings in corporate cards, spend management, and B2B payments, integrating these into its issuing framework. This strategic move is intended to improve CFO workflows from onboarding through to controls and reconciliation. For COF, the overarching narrative suggests that a unified operational stack can strengthen enterprise relationships, boost retention, and create valuable data feedback loops that refine underwriting processes over time. As the industry heads into a consolidation phase by 2026, the emphasis on scale and software capabilities will be paramount, as highlighted in recent analyses.

The shift towards Brex’s tools and the Discover network migration indicates a tighter control over economic factors affecting both issuing and network operations. Investors should monitor three key levers: interchange gains from higher-quality spending, software-like subscription services, and improved credit performance driven by richer data insights. These elements may help mitigate cyclical pressures on COF stock, provided that integration is executed cleanly and customer retention remains stable.

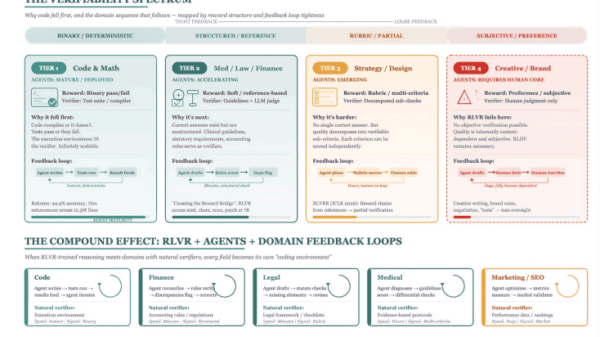

Moreover, the integration of AI-driven “agentic finance” systems could further enhance Capital One’s operational efficiency. This approach utilizes AI to set financial goals, plan necessary actions, and execute tasks while maintaining human oversight. Indian firms are increasingly moving towards such systems to amplify growth and efficiency, and this transition may yield quicker customer acquisitions and improved financial metrics for Capital One. AI technologies can potentially lower service costs, enhance approval accuracy, and reduce fraud losses, thus promoting enterprise adoption. However, the company must also navigate execution risks, including data integrity and privacy issues, as well as the possibility of model drift.

The current price of COF stands at $207.37, with a trading range between $202.24 and $208.74 for the day. Its 50-day moving average is $233.826, and the 200-day average is $216.5364, both indicating that the stock is currently below its longer-term trends. The Relative Strength Index (RSI) is at 33.65, while the Commodity Channel Index (CCI) is at -236.76, signaling that the stock may be oversold. Analysts currently rate COF with 19 “Buy” recommendations and 3 “Hold” ratings. The price-to-earnings ratio stands at 61.92, with earnings scheduled for April 21, 2026. Trading volume today is 5,245,698 shares compared to an average of 4,808,215.

Investors are advised to stay attuned to updates surrounding the Brex deal, enterprise customer retention rates, cross-selling metrics, and the progress of the Discover network migration. Key indicators to monitor include net interest margins, card charge-offs, and operational expenditures related to AI and integration. In this context, Capital One’s stock today appears poised to benefit from improved software revenue streams and stable credit conditions.

For Indian investors, the implications of this acquisition are significant, as there is a pressing demand for tighter spend control and efficient reconciliation processes. The technology-driven banking model adopted by Capital One aligns closely with the needs of mid-market businesses in India, from SaaS procurement to travel and expense management. Even though the stock is traded in the US, the Brex acquisition resonates with local enterprises’ aspirations for enhanced financial tools.

Indian investors utilizing international accounts are encouraged to consider gradual investment strategies, given the current volatility and the fact that COF is trading below its 200-day average. Currency fluctuations, particularly the USD/INR exchange rate, could further impact returns in rupee terms. It is advisable to synchronize buying decisions with earnings announcements and integration updates while maintaining realistic expectations regarding early contributions from AI initiatives.

In conclusion, Capital One’s acquisition of Brex underscores its commitment to a tech-centric banking model that leverages issuing capabilities, network economics, and AI-driven finance. The immediate focus for COF will be on effective execution, maintaining enterprise clientele, and proving the efficacy of software-based revenue models while managing credit costs. Technical indicators suggest the stock is currently oversold, with critical resistance levels near the 200-day and 50-day moving averages. A prudent strategy would involve staggered investments tied to key earnings dates and integration milestones, closely monitoring disclosures related to the AI implementation and operational discipline.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics