U.S. regulators have intensified their antitrust scrutiny of Microsoft, expanding an investigation into the tech giant’s cloud and artificial intelligence business practices. The Federal Trade Commission (FTC) has dispatched new information requests to Microsoft’s rivals, focusing on how the company bundles its AI, cloud, and security products. The investigation aims to determine whether these practices could place competitors at a disadvantage.

This scrutiny comes as Microsoft accelerates efforts to develop its own AI models and forge new global alliances emphasizing trusted and sovereign cloud solutions. The company’s share price is currently at $401.32, reflecting a mixed performance; it has seen a 12.7% decline over the past 30 days and a 15.1% drop year-to-date. However, its longer-term outlook remains strong, with returns of 58.8% and 73.2% over three and five years, respectively.

For investors, the expanded FTC probe coincides with significant changes in Microsoft’s approach to AI and cloud services. The adjustments in product bundles, contract terms, and partner programs in response to regulatory pressure could significantly influence customer adoption patterns and competitive positioning in the market. Overall sentiment around the company’s stock may also be affected as these developments unfold.

Analysts have indicated that Microsoft is trading approximately 33% below the consensus price target of $596, suggesting the stock may be undervalued. According to Simply Wall St, shares are estimated to be trading 11.9% below fair value. However, the recent trends signal weak short-term sentiment, which investors should monitor closely.

The FTC’s focus on how Microsoft integrates its AI, cloud, and security offerings could alter perceptions of future growth in its core businesses. Changes in pricing, contract terms, and the trajectory of partnerships could provide insight into how Microsoft intends to navigate these regulatory challenges. Additionally, progress in developing in-house AI models and establishing new trusted cloud alliances will be critical to understand how the management is adapting amidst scrutiny.

Regulatory pressure is not the only concern for Microsoft; recent insider selling has raised questions about governance and long-term oversight. Such factors could influence how investors perceive the company’s stability and strategic direction moving forward. While the current climate presents challenges, Microsoft’s robust historical performances and ongoing innovation efforts position it well for future growth, provided it can navigate the regulatory landscape effectively.

Investors interested in Microsoft’s developments are encouraged to stay updated by adding the company to their watchlist or portfolio. The community surrounding Microsoft also offers valuable perspectives on how the latest news may affect the company’s future narrative. As regulatory scrutiny intensifies, the landscape for Microsoft may shift, forming a critical point of analysis for analysts and investors alike.

This article by Simply Wall St is intended for informational purposes only and should not be construed as financial advice. It does not recommend buying or selling any stock and does not take individual financial circumstances into account. The analysis is based on historical data and analyst forecasts, delivered through an unbiased methodology.

For a more comprehensive understanding of Microsoft’s financial health and market standing, refer to the detailed company report available through Simply Wall St. Companies discussed in this article include MSFT.

For feedback or concerns regarding this article, please reach out directly at [email protected].

See also Wesfarmers Partners with Google Cloud to Revolutionize Retail with Agentic AI Deployment

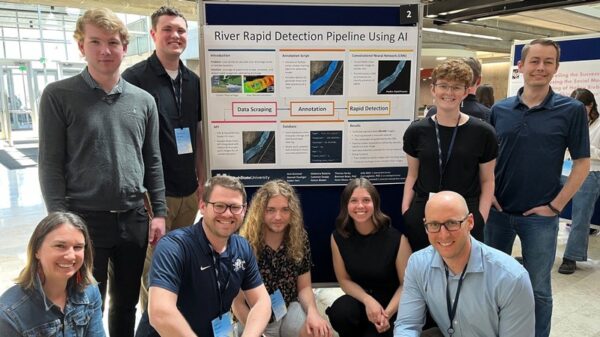

Wesfarmers Partners with Google Cloud to Revolutionize Retail with Agentic AI Deployment US, Canada, UK, and 7 Nations Unite at India AI Impact Summit 2026 to Drive AI Solutions in Travel and Sustainability

US, Canada, UK, and 7 Nations Unite at India AI Impact Summit 2026 to Drive AI Solutions in Travel and Sustainability India’s IT Secretary Urges Human-Centric AI at Global Summit to Drive Inclusive Growth

India’s IT Secretary Urges Human-Centric AI at Global Summit to Drive Inclusive Growth Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere