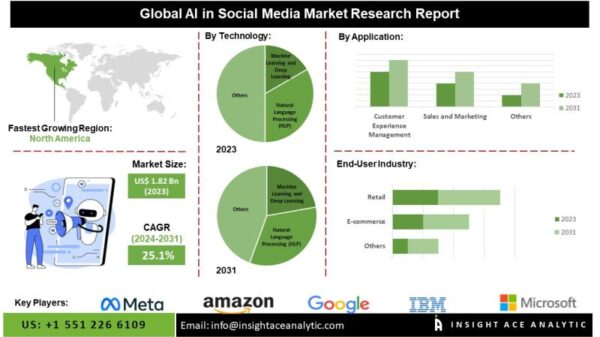

The artificial intelligence sector has captured significant attention and investment, yet concerns are surfacing about a potential bubble reminiscent of the dot-com era. Following a dramatic rise of over 50% from its April lows, the tech-heavy Nasdaq Composite index recently experienced a dip of nearly 5% this month, prompting investor anxiety regarding the timeline for substantial profits from the billions invested in AI technologies.

Veterans in the investment world are drawing parallels between current market enthusiasm and the dot-com boom that characterized the late 1990s. Optimists, however, assert that this time is different. Leading this current surge is Nvidia, the AI chipmaker that has become the world’s most valuable company amid the fervor surrounding AI advancements. Specializing in chips designed for AI model training, data centers, and robotics, Nvidia’s market performance has sparked considerable investor interest.

The company’s quarterly earnings report, released Wednesday, was highly anticipated by both AI proponents and skeptics. Nvidia exceeded analyst expectations in terms of profits and forecasted growth, resulting in a more than 4% rise in share price during after-hours trading. “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different,” stated Jensen Huang, Nvidia’s Chief Executive, during a conference call following the earnings release. He emphasized the expansive impact of AI across various industries, from social media to autonomous vehicles.

Despite Nvidia’s optimistic outlook, investor anxiety persists regarding whether the elevated stock prices of numerous AI-focused companies are justified. Historical precedents, such as the dot-com collapse, linger in investors’ minds, where many companies fell by the wayside, while a select few emerged as industry giants. The current tech landscape is further complicated by interdependencies, as companies invest heavily in mutual ventures, data centers, AI research, and competitive salary packages.

In September, Nvidia announced a substantial investment plan, potentially reaching up to $100 billion in OpenAI, the organization behind the widely-discussed ChatGPT. This funding aims to bolster OpenAI’s data center infrastructure—necessary for managing and processing the vast amounts of data essential for AI functionality. Analysts predict that OpenAI’s total capital expenditures could reach up to $130 billion by 2027, with Nvidia technology playing a crucial role in this buildout.

Even with a valuation nearing $500 billion, OpenAI is reportedly incurring significant financial losses as it continues to ramp up infrastructure and computing expenditures. “Whether we burn $500 million a year or $5 billion or $50 billion a year, I don’t care. I genuinely don’t,” Sam Altman, OpenAI’s CEO, remarked during a talk at Stanford last year, underscoring the company’s commitment to costly investments in AI development.

Amid such spending, concerns have escalated among investors. A survey from Bank of America indicated that approximately 45% of global fund managers perceive a risk of an “AI bubble,” which could adversely impact both the economy and the markets. However, some experts maintain that while certain AI investments may not yield returns, the overall trajectory of AI growth is solid. Samuel Hammond, Chief Economist at the Foundation for American Innovation, asserted that while inflated valuations for companies that fail to deliver are a risk, the backbone of the market’s growth is driven by established tech firms like Nvidia and Google.

Investment bank Goldman Sachs recently noted that, despite concerns over over-investment in technology, many firms are seeing profits and maintain robust balance sheets. “While the success of dominant technology companies is clear to see, this doesn’t necessarily mean that there is a bubble in the market that is in imminent danger of bursting,” they commented in an October report.

Despite such reassurances, voices of caution persist. Gary Smith, an economics professor at Pomona College, has raised flags regarding the potential fragility of OpenAI and the broader AI sector, suggesting that it may not withstand a bubble burst. He likened the current data center investment surge to the 1990s telecom boom, where excessive spending led to infrastructure that often sat idle.

As the AI landscape evolves, industry leaders like Google’s CEO Sundar Pichai have acknowledged the potential for overshooting in tech investments. Reflecting on the past, he remarked, “We can look back at the internet right now. There was clearly a lot of excess investment. But none of us would question whether the internet was profound.” As the AI market continues to develop, the debate about its sustainability and the implications of investment practices will likely remain a focal point for investors and industry stakeholders alike.

See also Grok Claims Elon Musk is ‘Fitter’ Than LeBron James, Igniting Controversy on X

Grok Claims Elon Musk is ‘Fitter’ Than LeBron James, Igniting Controversy on X IWF Calls for EU Ban on AI Child Sexual Abuse Imagery Amid Accelerating Crisis

IWF Calls for EU Ban on AI Child Sexual Abuse Imagery Amid Accelerating Crisis Demis Hassabis Warns AI Sector Shows Signs of Bubble Amid Growing Investment Concerns

Demis Hassabis Warns AI Sector Shows Signs of Bubble Amid Growing Investment Concerns Staffordshire Students Confront Lecturer Over AI-Generated Course Slides

Staffordshire Students Confront Lecturer Over AI-Generated Course Slides Amazon Invests $125B in AI, AWS Growth Surges Over 20% Amid Insider Sales

Amazon Invests $125B in AI, AWS Growth Surges Over 20% Amid Insider Sales