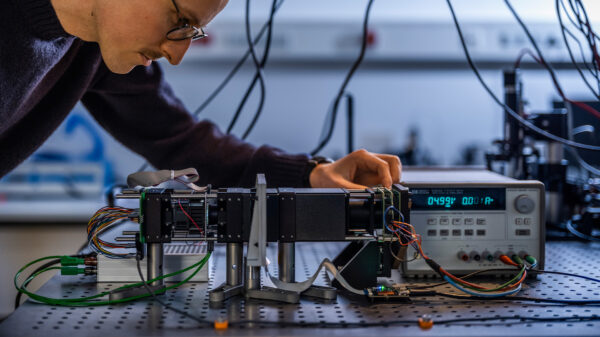

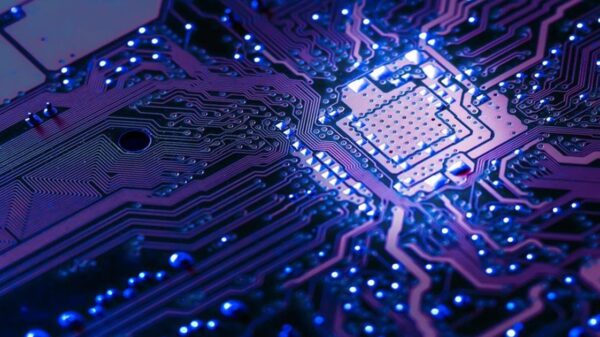

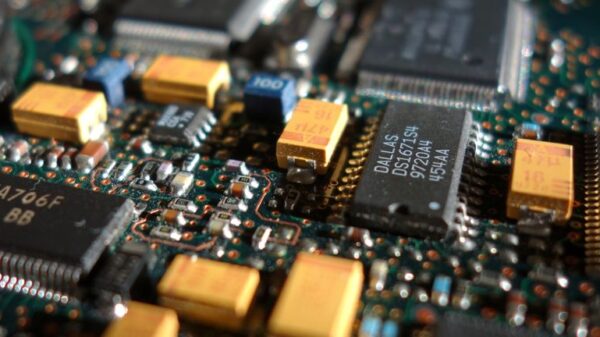

The rapid growth of AI data centers has sparked significant concerns across the technology sector, not just regarding potential overbuilding and environmental impacts, but also the rising costs of essential computer components. Recent reports indicate a sharp increase in the prices of dynamic random access memory (DRAM), exacerbating the challenges faced by both data center builders and everyday consumers.

As demand for AI capabilities surges, the competition for DRAM, which is critical for both consumer electronics and data centers, has intensified. While consumer devices typically utilize a type of DRAM known as double data rate memory (DDR), data centers favor high-bandwidth memory (HBM) due to its ability to handle larger data loads efficiently. Unfortunately, the memory suppliers are prioritizing HBM production in response to the higher margins associated with data center components, leading to a scarcity in the broader market for DRAM.

This shortage does not only affect personal computers; an array of devices, from smartphones to automotive systems and even medical equipment, could potentially face disruptions. According to Ryan Reith, group vice president at IDC, this trend is “not going to be good for consumers” as it drives up prices across the board, particularly affecting low-cost laptops and various embedded systems.

As companies like **Samsung**, **SK Hynix**, and **Micron** dominate the memory manufacturing landscape, their decisions significantly influence market dynamics. Reports indicate that Samsung has raised the prices of certain memory types by as much as **60%**, with **PCPartPicker** noting that prices for some memory sticks have escalated from approximately **$100** to over **$250**. Such increases reflect how the overwhelming demand for data center hardware is spilling over into the consumer market, resulting in inflated prices for everyday electronics.

“I think the general consensus is that in the last month … this has gotten a lot more attention, and not in a positive way,”

said Reith, emphasizing the potential long-term effects of this trend on consumer pricing in the tech market.

Amidst these rising costs, manufacturers are exploring strategies to mitigate the financial impact. Analysts, including **Bernstein’s** Stacy Rasgon, suggest that companies might look to reduce expenses by using less expensive and less powerful components elsewhere in their products or by negotiating with suppliers for better pricing. However, this approach may have limitations, especially for manufacturers of entry-level and mid-range systems, who have diminished flexibility in adjusting prices before eroding their profit margins.

The situation is reminiscent of previous cycles in the tech industry, where supply and demand dynamics create fluctuations in memory markets. As **Bob O’Donnell**, founder and chief analyst of **TECHnalysis Research**, points out, the market is inherently cyclical: “What happens is, there’s huge demand, and capacity gets built out, but it’s never smooth.” This cyclical nature indicates that while current conditions are challenging, the market will eventually stabilize as supply catches up with demand.

Yet, with numerous companies investing heavily in data center construction globally, predicting when the memory market will normalize remains a complex task. As data centers continue to proliferate, the demand for DRAM and HBM is unlikely to dissipate, and prices may remain elevated until market conditions shift sufficiently to balance supply with the burgeoning demand.

The ongoing memory shortage reflects broader themes in the AI landscape, emphasizing the interconnectedness of various technologies and the challenges they face as industries evolve rapidly. As the AI community navigates these growing pains, stakeholders must remain vigilant about the implications of rising costs and shift their strategies accordingly to remain competitive in an increasingly demanding market.

See also Wall Street and FTSE Rise as US Jobs Report Shows 119,000 New Positions Despite 4.4% Unemployment

Wall Street and FTSE Rise as US Jobs Report Shows 119,000 New Positions Despite 4.4% Unemployment AI Boom Fuels Nvidia’s $4.5 Trillion Valuation Amid Rising Market Risks

AI Boom Fuels Nvidia’s $4.5 Trillion Valuation Amid Rising Market Risks SMBC Launches Agentic AI Startup in Singapore to Cut Corporate Onboarding to 2 Days

SMBC Launches Agentic AI Startup in Singapore to Cut Corporate Onboarding to 2 Days Finance Committee Approves Wage Ordinance, Adding 3 Positions for 2026 Budget

Finance Committee Approves Wage Ordinance, Adding 3 Positions for 2026 Budget Fed’s Lisa Cook Warns AI Trading Risks Could Manipulate Markets, Impair Competition

Fed’s Lisa Cook Warns AI Trading Risks Could Manipulate Markets, Impair Competition