November 20, 2025 – The Technology and Semiconductor sectors are currently experiencing a complex and often contradictory landscape. Driven by the unquenchable demand for Artificial Intelligence (AI) technologies, which have led to substantial growth and unprecedented projections, the industry also faces economic uncertainties, geopolitical tensions, and fears of an emerging “AI Bubble.” This dual narrative of optimism and caution is shaping the market’s trajectory, necessitating a strategic approach from both investors and industry leaders.

Immediate repercussions indicate a sustained AI-driven growth engine, especially for foundational infrastructure providers. However, investor scrutiny around valuations and tangible profitability is intensifying. Market volatility is expected to persist, particularly for high-growth AI stocks, as macroeconomic pressures coexist with robust earnings reports. Companies are proactively adjusting through diverse supply chains and disciplined investments, with significant capital expenditures fueling expansion in advanced chip manufacturing and AI-specific research and development.

A Tumultuous Journey: Geopolitical Strife and the AI Ascent

The evolution of the Technology and Semiconductor sectors has been marked by pivotal events intertwining geopolitical tensions with the explosive rise of AI. Beginning in late 2022, the “chip war” escalated as the U.S. imposed strict export controls on advanced semiconductor technology targeting China. This included restrictions on Electronic Design Automation (EDA) tools. In retaliation, China enacted export limitations in July 2023 on critical minerals like gallium and germanium, essential for chip production, demonstrating the deepening trade divide. These tensions have continued into 2025, with advanced semiconductor export controls tightening despite a brief “Geneva agreement” on tariff reductions in May.

By 2024, the U.S. CHIPS and Science Act, implemented in August 2022, began to yield tangible results. This included a $6.6 billion commitment to Taiwan Semiconductor Manufacturing Co. (TSMC) for its Arizona expansion, which commenced 4nm wafer production in April 2024. Although these efforts aimed to strengthen domestic manufacturing, an “inventory glut” in Q1 2024 adversely affected many semiconductor firms, except AI leaders, prompting concerns about a market correction. Nevertheless, the AI boom quickly overshadowed these issues. By late 2024, Advanced Micro Devices (AMD) saw stock declines due to unmet AI chip sales expectations, while NVIDIA (NVDA) reached a forward P/E ratio of 50x, triggering valuation debates.

As of November 2025, fears of an AI bubble have intensified, with a Bank of America survey indicating that 45% of global fund managers view an AI stock bubble as the largest market risk. Initial market reactions included a slight downturn in U.S. tech stocks, with the tech-heavy Nasdaq closing below a key technical marker in early November. Major players such as Amazon (AMZN), Microsoft (MSFT), and NVIDIA (NVDA) experienced stock declines as investors reassessed speculative assets. However, NVIDIA’s optimistic revenue forecast of approximately $65 billion for the January quarter alleviated immediate bubble concerns, underscoring a robust demand for its AI accelerators. Additionally, Amazon solidified its AI commitment with a substantial $38 billion partnership with OpenAI.

Winners and Losers in a Volatile Market

The current market conditions, characterized by the AI gold rush alongside persistent economic anxieties, have created a distinct divide among companies in the Technology and Semiconductor sectors. Entities with strong, verifiable AI-driven revenue streams and diversified business models are positioned to thrive, while those reliant on traditional markets or speculative ventures face significant challenges.

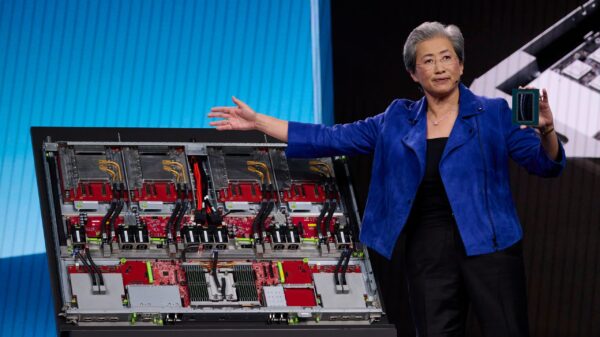

NVIDIA (NVDA) remains a frontrunner in the AI revolution, relying on its GPUs and CUDA software ecosystem, crucial for AI training and inference. The company projects continued revenue growth exceeding 50% annually through at least 2026, propelled by unprecedented data center demand. Despite its high valuation, NVIDIA’s stock performance often reflects the overall AI investment thesis. Another key player, TSMC (NYSE: TSM), has nearly doubled its stock price in 2024, spurred by robust demand for advanced technologies, with projected revenue growth in the mid-30% range for 2025.

Conversely, companies heavily reliant on speculative AI ventures face vulnerability. Many nascent AI firms, despite attracting significant investments, lack clear paths to profitability, making them susceptible to an “AI bubble” burst. Legacy companies, including Infineon (XTRA: IFX) and Texas Instruments (TXN), are struggling with oversupply and weak demand in their core segments, leading to anticipated revenue declines. Even Intel (INTC), despite efforts to rebound, faces intense competition and challenges in advanced manufacturing, limiting its performance compared to AI-pure plays.

Wider Significance: A New Era of Transformation and Trepidation

The ongoing market conditions in the Technology and Semiconductor sectors indicate not just a cyclical downturn but a profound transformation alongside heightened systemic risks. The prevailing concerns about an “AI Bubble” are shaping broader trends, influencing industry dynamics, and prompting significant regulatory considerations.

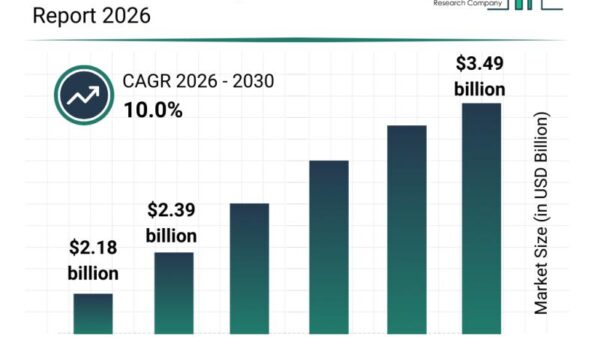

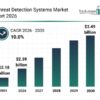

AI has transitioned from an emerging technology to a foundational shift, with generative AI rapidly moving from pilot projects to enterprise-level implementation. This has driven global AI spending to a projected compound annual growth rate of 29% from 2024 to 2028. However, this rapid growth has created memory bottlenecks, particularly for high-end DRAM, potentially leading to supply constraints for smaller firms. Major players like NVIDIA and TSMC are solidifying their dominance while traditional segments face challenges.

In summary, the Technology and Semiconductor sectors are positioned at a pivotal moment, shaped by the undeniable momentum of AI innovation, significant macroeconomic headwinds, and ongoing discourse surrounding the potential “AI Bubble.” The outlook remains largely positive, with continued demand for advanced chips and infrastructure as AI fundamentally reshapes the industry landscape.

This content is intended for informational purposes only and is not financial advice.

Abacus AI Launches Multi-Model Platform for $10, Reducing AI Costs by 60%

Abacus AI Launches Multi-Model Platform for $10, Reducing AI Costs by 60% Samsung Reveals Compression Tech to Run 30B-Parameter AI Models on Smartphones Under 3GB

Samsung Reveals Compression Tech to Run 30B-Parameter AI Models on Smartphones Under 3GB Trump’s Draft Order Aims to Block State AI Regulations, Sparking Bipartisan Concern

Trump’s Draft Order Aims to Block State AI Regulations, Sparking Bipartisan Concern Samsung Reveals 30B Parameter AI Model Running on Just 3GB Memory for Smartphones

Samsung Reveals 30B Parameter AI Model Running on Just 3GB Memory for Smartphones Wichita Police Deploy Axon AI for Real-Time Translation in Over 50 Languages

Wichita Police Deploy Axon AI for Real-Time Translation in Over 50 Languages