The FTSE 100 has seen a significant drop, hitting a one-month low as concerns surrounding a potential AI bubble resurface in financial markets. This decline follows negative sentiments from Wall Street, where the index fell by 104 points, or just over 1%, reaching 9423 points at the start of trading.

Leading the decline is the defense firm Babcock, which saw a decrease of 4.7%. This was closely followed by technology investor Polar Capital and precious metals producers Endeavour Mining and Fresnillo, which dropped by 4.1% and 4.5%, respectively.

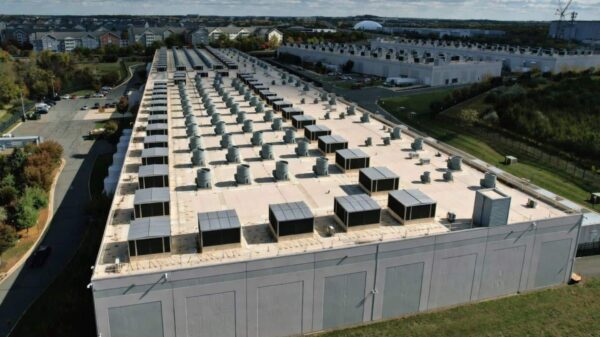

The downturn in the UK comes after a tumultuous trading session in the US. Initially, stocks rallied following impressive earnings reports from Nvidia, only to retract as investors absorbed a mixed US jobs report. Despite Nvidia’s earnings exceeding expectations, apprehensions linger about the financial commitments of firms investing in AI technologies. As Robert Pavlik, a senior portfolio manager at Dakota Wealth, stated, “The people who are selling the semiconductors to help power AI doesn’t alleviate the concerns that some of these hyper-scalers are spending way too much money on building the AI infrastructure.”

Jim Reid, a market strategist at Deutsche Bank, commented on the unpredictability of recent market movements: “It’s been a truly remarkable 24 hours… After the world’s largest company reported spectacular results, the stock was up around +5% by 3 PM London time. It closed down -3.15%.” Reid noted that the S&P 500 initially gained 1.93% before closing down 1.56% as doubts about AI valuations resurfaced, marking the largest intra-day swing since early April.

Despite the immediate market turbulence, analysts like Dan Coatsworth, head of markets at AJ Bell, suggest that this may reflect a shift in risk appetite. Coatsworth indicated that defensive-style companies, such as those in utilities and consumer healthcare, are gaining traction as investors grow cautious about the pace of AI’s transformative potential. He noted, “There is a lingering concern that the AI revolution might take longer than expected to truly transform the way companies do business.”

Coatsworth also pointed out that current market conditions differ significantly from the late 1990s dot-com bubble. He believes that while there is volatility, many of the leading companies in the AI space are in robust financial positions, which he characterized as “jam today rather than jam tomorrow.”

On another front, the UK economy is showing signs of slowing growth ahead of the upcoming budget, with a recent poll indicating that activity growth in the private sector has diminished, particularly among services companies. The S&P Global Composite PMI index fell to 50.5, down from 52.2 in October, indicating stagnation.

In the energy sector, the situation is also concerning. The UK energy price cap has been adjusted, with a slight increase expected, exacerbating financial pressures on households as winter approaches. Richard Neudegg, director of regulation at Uswitch.com, called the cap increase a “tedious disappointment,” highlighting the impact it may have on consumer spending as families brace for colder months.

As the economic landscape evolves, the interplay between AI investments, market confidence, and fiscal policy will be crucial in shaping both investor sentiment and the broader economic outlook. With substantial fluctuations observed recently, market participants will be closely watching how these dynamics unfold in the coming weeks.