Key Details

Brookfield Asset Management (BAM) stock recently experienced a surge of 1.5%, closing at $50.65 as of November 19. The stock’s performance is notable within the context of its 52-week high of $64. Analysts have set a price target for BAM stock at $63, indicating potential upside from current levels.

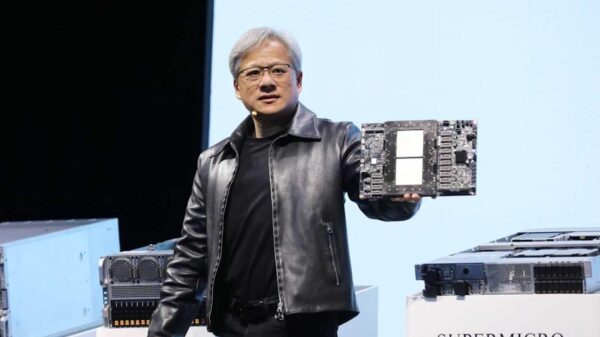

This upward momentum follows the announcement of a substantial $100 billion global AI infrastructure program in collaboration with NVIDIA and the Kuwait Investment Authority (KIA). Central to this initiative is the Brookfield Artificial Intelligence Infrastructure Fund, which aims to raise $10 billion in equity and has already attracted $5 billion in commitments from institutional partners, including Brookfield, NVIDIA, and KIA.

Industry Impact

The AI infrastructure program is poised to invest across the complete AI value chain, which encompasses critical components such as energy, land, data centers, and computing infrastructure. This strategic move aligns with Brookfield’s recent third-quarter earnings report, which highlighted record fundraising efforts of $30 billion in the quarter and over $100 billion in the past year.

Brookfield’s fee-related earnings rose 17% year-over-year, reaching $754 million, while fee-bearing capital has reached $581 billion. This financial strength positions the company to effectively capitalize on one of the largest infrastructure buildouts in history, which Sikander Rashid, Head of AI Infrastructure at Brookfield, estimates will require $7 trillion in capital over the next decade.

The collaboration with NVIDIA not only enhances Brookfield’s credibility but also underscores the broader industry trend where AI infrastructure is compared to the historical development of power grids and telecommunications networks. NVIDIA CEO Jensen Huang emphasized the transformative potential of AI, stating, “AI is transforming every industry, and like electricity, it will require every nation to build the infrastructure to power it.”

What Lies Ahead

Brookfield’s recent performance indicates strong demand for its investment strategies, with management anticipating an even more robust fundraising environment in 2026. Several flagship funds, including infrastructure, private equity, and the new AI infrastructure fund, are set to launch, potentially attracting significant capital.

The company has also reported a favorable transaction environment, with global M&A volumes increasing nearly 25% year-over-year. Over the past 12 months, Brookfield deployed nearly $70 billion while selling around $23 billion in real estate properties at attractive returns.

Looking ahead, Brookfield has outlined ambitious growth targets, aiming to double its business by 2030. This includes increasing fee-related earnings to $5.8 billion and fee-bearing capital to $1.2 trillion. The company’s focus on megatrends such as digitalization, decarbonization, and deglobalization positions it well to exploit growth opportunities across various sectors.

The announcement of the AI infrastructure fund is seen as a natural evolution of Brookfield’s strategic focus rather than a shift in direction. Having established expertise in renewable energy, data centers, and digital infrastructure, this new initiative consolidates those capabilities into a targeted solution for a rapidly growing segment of the global economy. Investors are encouraged to monitor Brookfield’s progress in deploying AI infrastructure and its fundraising activities leading into 2026.

With the execution of its growth strategies and exposure to structural tailwinds in infrastructure and real assets, BAM stock could experience significant upside from current levels.

See also Meta Seeks Dismissal of $359M Lawsuit Over Alleged Adult Film Downloads for AI Training

Meta Seeks Dismissal of $359M Lawsuit Over Alleged Adult Film Downloads for AI Training Fintech Revolution: Data, AI, and Regulation Drive New Era of Global Banking Innovation

Fintech Revolution: Data, AI, and Regulation Drive New Era of Global Banking Innovation France Investigates Elon Musk’s Grok AI for Promoting Holocaust Denial Claims

France Investigates Elon Musk’s Grok AI for Promoting Holocaust Denial Claims Perplexity Launches AI-Powered Comet Browser for Android with Voice Assistant Features

Perplexity Launches AI-Powered Comet Browser for Android with Voice Assistant Features