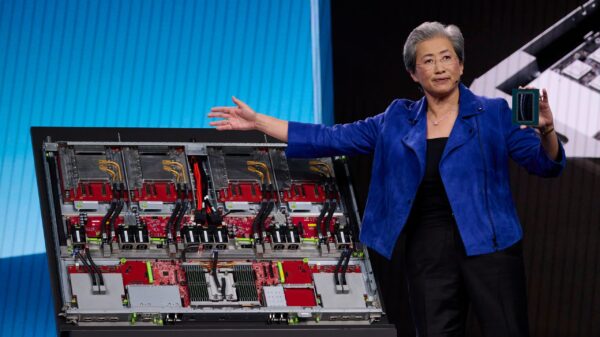

The artificial intelligence (AI) semiconductor landscape has witnessed significant developments, particularly with the emergence of Advanced Micro Devices (AMD). As industry giants like Nvidia and Broadcom continue to dominate, AMD is stepping into the spotlight, achieving impressive stock gains this year.

Nvidia, known for its leadership in the data center graphics processing unit (GPU) market, has seen its stock price soar by 39% in 2025. Broadcom, on the other hand, has experienced a remarkable 48% increase due to escalating demand for bespoke AI processors. However, these figures pale compared to the 99% rise in AMD’s stock, particularly since early October—a period that has marked a noticeable uplift in its standing in the AI chip market.

AMD’s Surge in the AI Chip Market

AMD has historically played a secondary role behind Nvidia and Intel in the data center sector, but it is now emerging from their shadows. The company’s server central processing units (CPUs) have seen a dramatic uptick in enterprise adoption. In just this year, AMD’s Fortune 100 CPU customer base has grown by over 60%, with the total number of new clients more than doubling in the first nine months of 2025.

AMD anticipates capturing a 40% market share in the server CPU space by 2025, with ambitions for over 50% in the long term. The company plans to achieve this with its next-generation server CPU, codenamed Venice, which is projected to be 1.7 times more powerful and efficient than current models, thereby enhancing demand for its Epyc server processors.

Moreover, AMD estimates that AI-driven demand for its data center CPUs could result in a $60 billion addressable market opportunity by 2030, more than doubling the $26 billion revenue expected in the current year. Capturing a 50% share of this market could push AMD’s data center CPU revenue to approximately $30 billion by the end of the decade, nearly quadrupling the projected revenue for 2024.

AMD’s data center GPU business is also expected to gain momentum, with substantial performance improvements anticipated from the MI450 series of accelerators, set to launch in 2026. It is worth noting that AMD’s next-generation GPUs have already been selected for deployment by major players, including OpenAI, Oracle, Meta Platforms, and the U.S. Department of Energy. Currently, seven of the top ten AI companies are utilizing AMD’s Instinct data center GPUs.

Financial Growth and Future Outlook

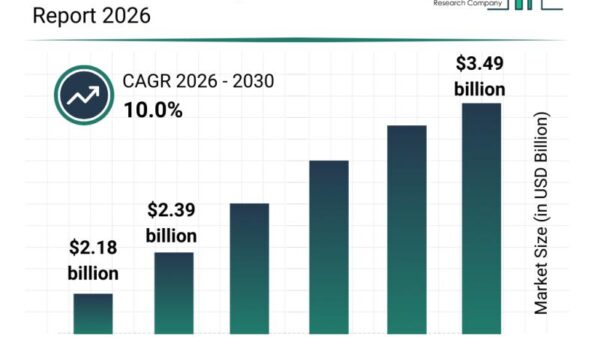

On the financial front, AMD’s management has indicated expectations of a 35% compound annual growth rate (CAGR) over the next three to five years. Furthermore, the company is aiming for its non-GAAP earnings to exceed $20 per share during this timeframe. For 2025, AMD anticipates earnings of $3.94 per share, suggesting a potential annual growth rate of over 38% to reach its ambitious target.

If AMD achieves this target sooner, say in three years, and trades at a valuation of 34 times earnings, comparable to the tech-heavy Nasdaq-100 index, its stock price could surge to approximately $680, representing a near 2.8x increase from its current price.

With robust growth projections in both CPU and GPU markets, AMD is positioned for continued success. As the AI semiconductor landscape evolves, the company presents a compelling opportunity for investors looking to capitalize on the burgeoning demand for AI-driven technology.

See also Yungblud Sparks Debate on AI’s Impact at Future of Music Event with THR and Frost School

Yungblud Sparks Debate on AI’s Impact at Future of Music Event with THR and Frost School Disney Partners with Animaj to Cut Animation Production Time by 80% Using AI Tools

Disney Partners with Animaj to Cut Animation Production Time by 80% Using AI Tools Stanley Druckenmiller Acquires Amazon, Meta, and Alphabet; Evaluates AI Growth Potential

Stanley Druckenmiller Acquires Amazon, Meta, and Alphabet; Evaluates AI Growth Potential AI Revolutionizes Milky Way Simulations, Mapping 100 Billion Stars in Days, Not Decades

AI Revolutionizes Milky Way Simulations, Mapping 100 Billion Stars in Days, Not Decades France Launches Investigation into Grok AI for Alleged Antisemitism and Holocaust Denial

France Launches Investigation into Grok AI for Alleged Antisemitism and Holocaust Denial