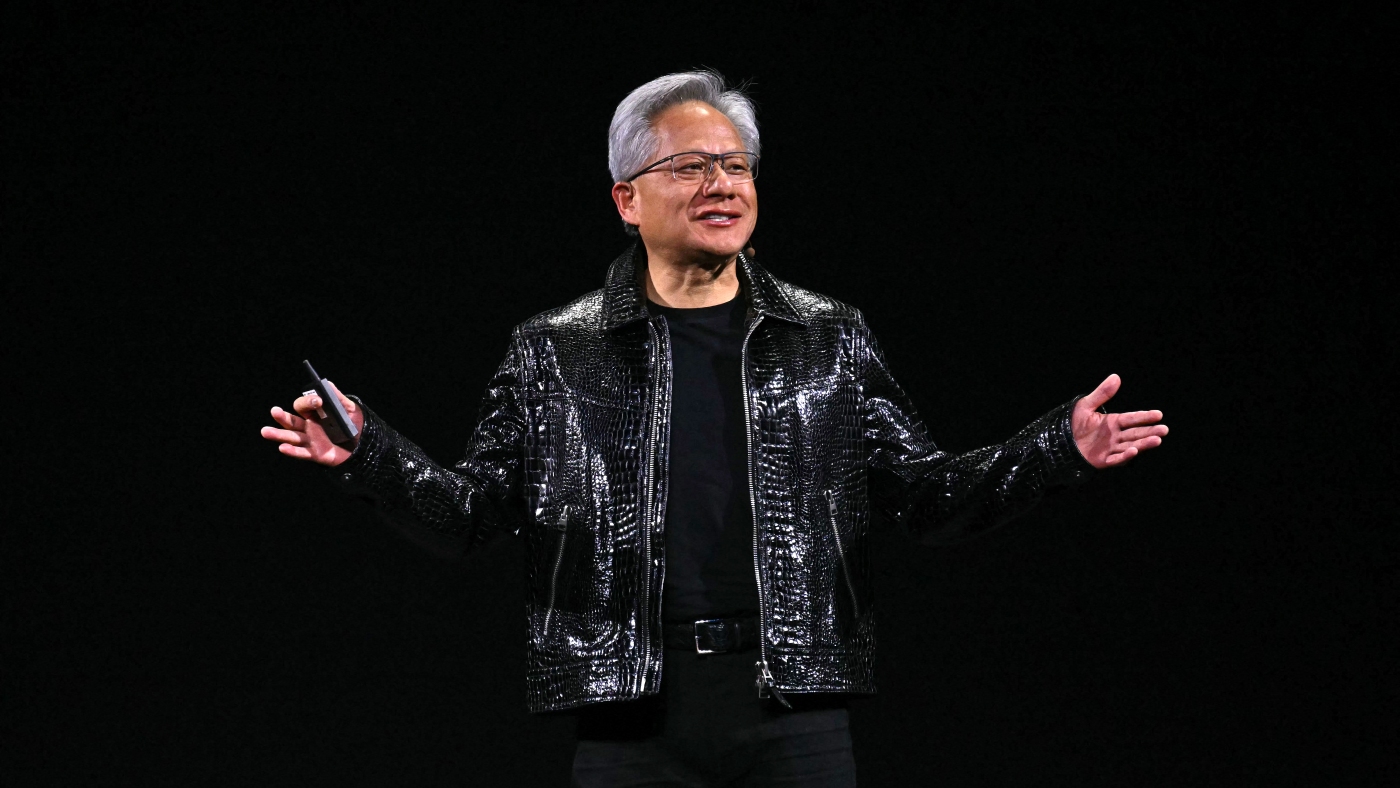

Nvidia’s CEO, Jensen Huang, has become a prominent figure in the current AI-driven market, with the company’s valuation soaring by approximately 300% over the past two years. During a recent earnings call, he aimed to alleviate concerns regarding a potential AI investment bubble, stating, “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.”

Investor Perspectives on AI’s Future

The dialogue surrounding the notion of an “AI bubble” has intensified, particularly from those benefiting most from continuous AI investments. Notable figures like David Sacks, a White House AI adviser, emphasized a positive outlook, asserting on his podcast, All-In, “I don’t think this is the beginning of a bust cycle. I think that we’re in a boom. We’re in an investment super-cycle.”

Similarly, prominent investor Ben Horowitz expressed skepticism about fears of a downturn, suggesting that the current demand and supply dynamics do not indicate a bubble. He stated, “If you look at demand and supply and what’s going on and multiples against growth, it doesn’t look like a bubble at all to me.” Meanwhile, Mary Callahan Erdoes, CEO of JPMorgan Chase, dismissed recent bubble claims as “a crazy concept,” asserting that the industry stands on the brink of a significant operational revolution.

Concerns About Speculation and Debt in AI

However, this optimism is not universally shared. Paul Kedrosky, a venture capitalist and research fellow at MIT’s Institute for the Digital Economy, cautioned against the substantial capital influx into a sector that remains largely speculative. He noted that while AI technology is indeed useful, its rate of advancement has plateaued, leading him to question the sustainability of the current growth trajectory.

Investment figures are staggering; for instance, OpenAI, the creator of ChatGPT, is now generating around $20 billion annually, with plans to invest a massive $1.4 trillion in data centers over the next eight years. Yet, a significant number of companies are reportedly not experiencing tangible benefits from AI technologies, with only 3% of users willing to pay for AI services.

Daron Acemoglu, a 2024 Nobel laureate in Economic Sciences, echoed this sentiment, arguing that current investment levels are excessive given the actual value generated by AI technologies. He stated, “I have no doubt that there will be AI technologies that will come out in the next ten years that will add real value and add to productivity, but much of what we hear from the industry now is exaggeration.”

Debt Financing and Its Risks

In 2023, major tech firms including Amazon, Google, Meta, and Microsoft are expected to invest roughly $400 billion in AI, primarily for building data centers. Analysts have noted that many of these companies are resorting to debt financing to fund their data center projects, with the debt load for hyperscaler companies increasing by over 300% compared to typical levels.

Some investment strategies, such as the use of “special purpose vehicles,” allow companies to mask debt on their balance sheets. For instance, a deal involving Meta and Blue Owl Capital has raised eyebrows; Blue Owl secured a $27 billion loan for a data center, backed by Meta’s lease payments. This structure means Meta benefits from increased computing capacity without reflecting the debt on its balance sheet.

As Gil Luria from D.A. Davidson highlighted, the current financing approaches echo past reckless practices that led to the collapse of firms like Enron. If these speculative investments do not yield the anticipated returns, Luria warns, the tech sector could face a crisis akin to the dot-com bubble burst, where overextension and mismanaged debt led to widespread financial failure.

With substantial investments flowing into AI, industry leaders show visible signs of concern. For instance, OpenAI’s CEO, Sam Altman, acknowledged the current investor excitement might be overstated, while Google CEO Sundar Pichai recognized “elements of irrationality” in the ongoing AI market.

As the landscape rapidly evolves, the balance between genuine AI advancements and speculative investments remains precarious, making it crucial for stakeholders to proceed cautiously in this high-stakes environment.

Tesla Stock Falls 3% Amid Robotaxi Progress and AI Bubble Concerns

Tesla Stock Falls 3% Amid Robotaxi Progress and AI Bubble Concerns Generative AI Can Cut Auto Finance Costs by Up to 8% According to McKinsey Report

Generative AI Can Cut Auto Finance Costs by Up to 8% According to McKinsey Report Surgent CPE Launches Agentic AI Certificate Series for Accountants with 10 CPE Credits

Surgent CPE Launches Agentic AI Certificate Series for Accountants with 10 CPE Credits Equiti Appoints New CISO and Compliance Head Amid Major AI and Finance Restructuring

Equiti Appoints New CISO and Compliance Head Amid Major AI and Finance Restructuring Embedded Finance Enhances AI Agents for Safer, Automated Financial Transactions

Embedded Finance Enhances AI Agents for Safer, Automated Financial Transactions