Nvidia is poised to make waves in the AI market with its upcoming earnings report, scheduled for November 19, 2025. As a key player in both the AI and semiconductor sectors, Nvidia’s financial performance is closely monitored by investors looking for indicators of market trends. Currently, Nvidia’s stock is priced at $184.13, reflecting a modest decline of 1.32%, suggesting a cautious sentiment among investors ahead of the earnings announcement. This report is critical not just for Nvidia’s stock valuation but also serves as a barometer for the overall health of the technology sector amid increasing competition in artificial intelligence.

The anticipated earnings report will provide essential insights into Nvidia’s impact on the AI marketplace. Investors are particularly eager to see if the company meets the high expectations set by analysts, who have assigned a consensus rating of ‘Buy.’ With a price-to-earnings ratio of 51.67, the pressure is on for Nvidia to deliver robust results. The implications of this report extend across various segments, including gaming and autonomous driving, where Nvidia has established itself as a leader.

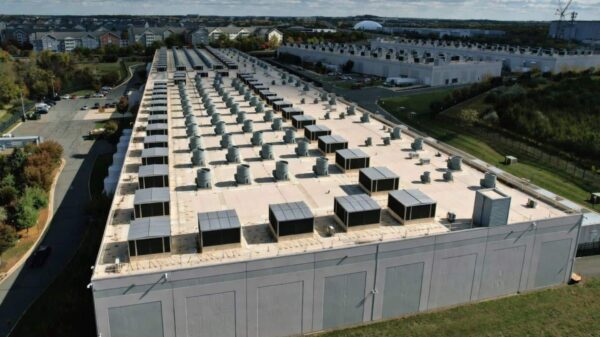

Amid the rapid advancements in AI technology and growing competition, investors will be keenly focused on key metrics such as revenue and earnings per share (EPS) growth. The data center segment, known for its significant contribution to Nvidia’s revenue, will be under particular scrutiny, given its crucial role in supporting AI applications. These performance indicators are vital for assessing Nvidia’s trajectory and its overall influence in the tech industry.

Market reactions to Nvidia’s stock today highlight the stakes involved. With a year-to-date increase of 43.91%, the market reflects strong growth confidence, although Nvidia’s share price recently hit a day low of $183.28, following an opening at $184.79. Analysts have set price targets ranging from $140 to $350, showcasing the market’s uncertainties about Nvidia’s future performance. Fluctuations in Nvidia’s stock are closely observed, as they can influence other technology stocks and signal broader trends in the AI market.

Investor sentiment on social media platforms, such as X and Reddit, mirrors this cautious optimism surrounding Nvidia’s expected performance. Discussions and analysis are rife as stakeholders await concrete earnings outcomes to refine their future predictions for the sector. Nvidia’s standing as a technology powerhouse amplifies the significance of its earnings, making the results a focal point for gauging market conditions.

The implications of Nvidia’s earnings report extend well beyond the company itself. As a benchmark for AI growth and innovation, its leadership in this space positions it strategically to influence industry trends. Collaborations with both established tech giants and emerging startups highlight Nvidia’s integral role in driving advancements within the AI sector. The financial outcomes will not only reflect Nvidia’s profitability from AI-driven products but will also signal health indicators for various sectors reliant on these technologies.

The anticipated financial metrics will serve as a crucial guide for investors, aiding them in making informed decisions regarding future investments in technology. Nvidia’s financial health significantly shapes perceptions of the AI market’s future, especially in a competitive semiconductor landscape. As the company continues to spearhead substantial advancements in AI, today’s earnings report will be pivotal in assessing both its financial stability and the broader implications for the technology sector.

Nvidia’s influence stretches across multiple sectors, further solidifying its role in shaping future technology investments. With industry analysts remaining predominantly bullish, stakeholders will focus on Nvidia’s performance and the broader market signals emerging from today’s report. This moment not only represents a crucial juncture for Nvidia but also highlights its potential to dictate trends within the dynamic landscape of artificial intelligence and semiconductors.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.

What is Nvidia’s current stock price? Nvidia’s current stock price is $184.13, reflecting a slight decrease of 1.32% today as investors await the earnings report impact on share performance.

How does Nvidia’s earnings report impact the AI market? Nvidia’s earnings reflect its role in AI and semiconductor markets, offering insights into technological advancements and competition dynamics critical for the AI market’s health.

What are analysts’ expectations for Nvidia’s earnings? Analysts have a consensus ‘Buy’ rating for Nvidia, with expectations for robust revenue from AI-driven segments critical to its financial performance.

See also Google DeepMind Launches New AI Research Lab in Singapore to Enhance Regional Collaboration

Google DeepMind Launches New AI Research Lab in Singapore to Enhance Regional Collaboration SAS Launches Data Maker in Microsoft Marketplace to Combat Data Scarcity and Enhance AI Models

SAS Launches Data Maker in Microsoft Marketplace to Combat Data Scarcity and Enhance AI Models Google Refutes Claims of Using Gmail for AI Training Amid Malwarebytes Controversy

Google Refutes Claims of Using Gmail for AI Training Amid Malwarebytes Controversy EU Approves Groundbreaking AI Act, Establishing Global Regulation Framework by 2025

EU Approves Groundbreaking AI Act, Establishing Global Regulation Framework by 2025 Alphabet Shares Surge 6% as Gemini 3 AI Outperforms Rivals, Nvidia Faces New Threat

Alphabet Shares Surge 6% as Gemini 3 AI Outperforms Rivals, Nvidia Faces New Threat