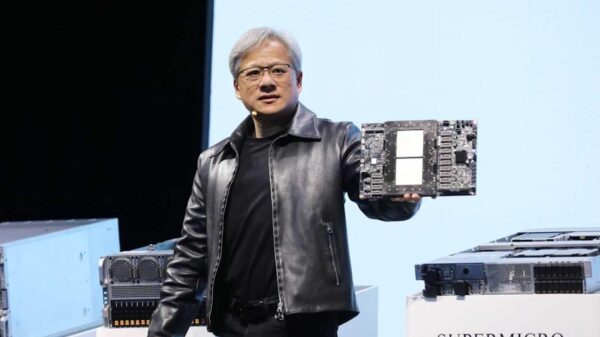

Nvidia (NVDA) stock rose 1.79% on Monday after President Donald Trump indicated he is considering allowing the company to sell its advanced artificial intelligence chips, specifically the H200 series, to China. This potential approval comes amid a backdrop of ongoing tensions between the U.S. and China regarding technology exports, highlighting the complex geopolitical landscape that continues to influence the tech sector.

The possibility of lifting restrictions on Nvidia’s H200 chips marks a significant shift, as both the Trump administration and the Chinese government have previously limited Nvidia’s access to the Chinese market for various reasons. President Trump noted he is consulting with several advisors on this matter, which has reignited investor optimism surrounding Nvidia’s future in the lucrative Chinese market. However, analysts caution that even if Trump moves forward with the approval, Nvidia may still face challenges. The Chinese government has been promoting local AI products, urging its citizens to prioritize domestic offerings over foreign imports, potentially complicating any resurgence of Nvidia’s sales in China.

Nvidia’s recent earnings report reflects a company experiencing rapid growth, reporting a 66% year-over-year increase in sales, totaling approximately $57 billion for the third fiscal quarter. Despite these impressive figures, the stock has not escaped the broader bearish trend affecting the tech market. Since November 10, NVDA shares have fallen from around $199 to $182, raising concerns about the sustainability of the AI sector’s explosive growth amid fears of a market correction.

In the context of U.S.-China trade relations, the potential sale of Nvidia’s advanced AI chips could signal a thawing in tensions that have characterized tech exports in recent years. Under the previous Biden administration, Nvidia faced stringent limitations on where its chips could be sold, stemming from fears of enhancing China’s technological capabilities to rival the U.S. If Trump authorizes the sale of the H200 chips, it would represent a significant policy reversal, opening doors for Nvidia to re-establish its presence in a market that is critical to its growth strategy.

Nvidia’s stock performance may experience substantial volatility depending on Trump’s decision. While a positive outcome could lead to a sharp uptick in stock value, analysts remain cautious given the unpredictable nature of U.S.-China relations and the current market sentiment surrounding AI companies. Commerce Secretary Howard Lutnick emphasized that the decision to permit sales of the H200 chips to China is currently awaiting Trump’s final approval, underscoring the impact of political decisions on corporate fortunes.

As Nvidia navigates these complex dynamics, the broader implications for the AI landscape remain uncertain. The company stands at a crossroads, balancing the need for expansion into new markets against the realities of international trade politics and competitive pressures from domestic Chinese enterprises. Investors and industry stakeholders alike will be closely monitoring developments as the situation unfolds, particularly as companies across the tech sector grapple with shifting regulatory environments and market demand.

See also Mitsotakis Signs AI Cooperation Agreement with Mistral AI to Boost Greek Tech Ecosystem

Mitsotakis Signs AI Cooperation Agreement with Mistral AI to Boost Greek Tech Ecosystem Penn State’s NaviSense App Empowers Visually Impaired with Real-Time Object Navigation

Penn State’s NaviSense App Empowers Visually Impaired with Real-Time Object Navigation Nvidia Accused of Misappropriating Avian AI Software Worth $1.5 Billion in Lawsuit

Nvidia Accused of Misappropriating Avian AI Software Worth $1.5 Billion in Lawsuit Trump Launches “Genesis Mission” to Accelerate Scientific Discovery with AI-Powered Supercomputing

Trump Launches “Genesis Mission” to Accelerate Scientific Discovery with AI-Powered Supercomputing Small Businesses Embrace Answer Engine Optimization to Thrive in AI Search Era

Small Businesses Embrace Answer Engine Optimization to Thrive in AI Search Era