Google parent Alphabet is experiencing a surge in investor confidence as its stock reaches record highs, largely attributed to Wall Street’s enthusiasm for the company’s custom AI chip strategy. This momentum coincides with the growing adoption of Google’s Tensor Processing Units (TPUs) beyond its own operations, with reports indicating that Meta is contemplating a significant shift to utilize Google’s AI hardware in its data centers.

This development signifies more than just a typical tech stock rally; it marks a fundamental reassessment of Google’s strategic position in the competitive landscape of AI infrastructure. Over the past seven months, Alphabet shares have doubled in value to reach $3.8 trillion as market confidence grows in the company’s ability to counter the challenges posed by OpenAI, the developer of ChatGPT.

The latest rally appears to be driven by Google’s aggressive initiative to commercialize its TPU technology. Multiple reports suggest that Meta may begin utilizing Google’s TPUs in 2027 and could start renting them from Google Cloud as early as next year, according to The Information. Such a move would mark a significant pivot from Meta’s current dependence on Nvidia hardware, representing an important validation of Google’s chip strategy.

Google’s newest TPU iteration, Ironwood, boasts impressive specifications, offering over 4X better performance per chip for both training and inference workloads compared to its predecessor, according to Google Cloud. This advancement positions Ironwood as particularly adept at meeting the industry’s growing need for high-volume, low-latency AI inference, especially as companies transition from training large models to executing them in real time.

The market’s reaction to Meta’s potential adoption of Google’s TPUs has been telling; Nvidia shares dipped as much as 7% before recovering slightly, while Alphabet’s stock climbed for a third consecutive day. This response suggests that investors view Google’s TPU initiative as a credible alternative to Nvidia’s established dominance in the AI hardware sector.

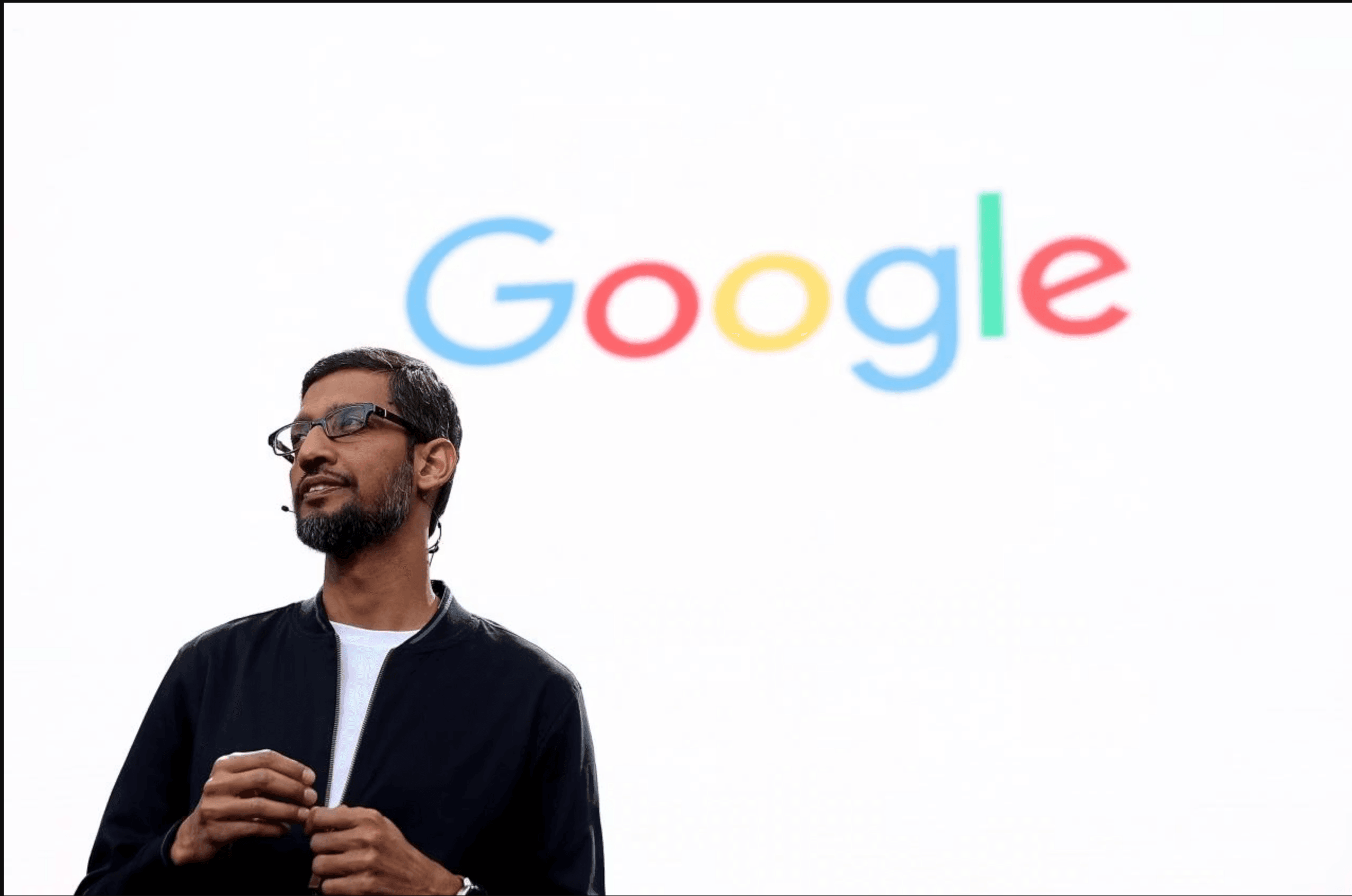

Google CEO Sundar Pichai has acknowledged the “elements of irrationality” in the current AI investment boom while asserting that the technological transformation underway is profound. In a recent interview with the BBC, Pichai remarked, “We can look back at the internet right now. There was clearly a lot of excess investment, but none of us would question whether the internet was profound. I expect AI to be the same.”

The TPU narrative underscores Google’s long-term commitment to domain-specific architecture. Unlike Nvidia’s GPUs, which were initially designed for graphics and later adapted for AI, TPUs are application-specific integrated circuits (ASICs) tailored specifically for neural networks. This design allows them to efficiently handle extensive calculations while minimizing the time required for data transfer within the chip.

Google’s TPU commercialization strategy seems to be gaining traction not only with Meta but also with other players in the market. Anthropic has announced plans to enhance its use of Google Cloud technologies, including access to up to one million TPUs, in a deal valued at tens of billions of dollars. Some Google Cloud executives estimate that the Meta collaboration could generate revenue equivalent to as much as 10% of Nvidia’s current annual data center business.

While this is not Google’s first attempt to challenge Nvidia’s reign, it might be its most credible strategy to date. The company introduced its first-generation TPU in 2018 for internal use within its cloud business, and since then, it has released increasingly advanced versions specifically designed for AI workloads, each showing significant performance enhancements.

The timing of Google’s TPU push aligns with broader industry trends as AI models grow more complex and demand for efficient alternatives to traditional GPU architectures increases. Google’s TPUs, with specialized features such as the matrix multiply unit (MXU) and proprietary interconnect topology, provide potential advantages for specific AI frameworks, particularly for large language models.

Nvidia has responded to this emerging challenge, defending its position via a post on X, stating, “We’re delighted by Google’s success – they’ve made great advances in AI, and we continue to supply to Google. NVIDIA is a generation ahead of the industry – it’s the only platform that runs every AI model and does it everywhere computing is done.”

For Google, the TPU strategy extends beyond a mere hardware initiative; it aims to establish a comprehensive AI ecosystem. The company’s full-stack approach encompasses not only the chips themselves but also the software infrastructure, featuring tools like the XLA compiler and JAX framework designed to integrate seamlessly with TPU architecture.

As the competition for AI infrastructure heats up, Google’s stock performance signals that investors believe the company’s long-term investments in custom silicon are starting to yield substantial returns. While the question of whether TPUs can genuinely rival Nvidia’s ecosystem remains open, Wall Street seems to recognize that Google is solidifying its presence in the AI hardware arena.

See also Over 1,000 Amazon Staff Warn AI Push Threatens Jobs, Democracy, and the Environment

Over 1,000 Amazon Staff Warn AI Push Threatens Jobs, Democracy, and the Environment Global Education Leaders to Tackle Learning Crisis at World Schools Summit in Abu Dhabi

Global Education Leaders to Tackle Learning Crisis at World Schools Summit in Abu Dhabi Moonshot AI and MiniMax Surpass OpenAI Models, Paving China’s Path to AI Leadership

Moonshot AI and MiniMax Surpass OpenAI Models, Paving China’s Path to AI Leadership Goldman Sachs and JPMorgan Reject AI Bubble Fears, Predict Sustainable Returns and Innovation

Goldman Sachs and JPMorgan Reject AI Bubble Fears, Predict Sustainable Returns and Innovation Harper Adams University Secures £500,000 to Advance AI and Engineering Education in Telford

Harper Adams University Secures £500,000 to Advance AI and Engineering Education in Telford