Artificial Intelligence dealmaking has surged in 2025, with projections suggesting a continuation into 2026 as investment activities reach unprecedented levels. Major technology firms such as Oracle, Meta, Amazon, Microsoft, Google, and Nvidia have collectively executed approximately $1 trillion in circular investments involving AI, large language models, and chatbot developers like OpenAI and Anthropic, alongside data center providers. These circular investments involve tech giants allocating billions to AI companies reliant on massive data centers and the procurement or lease of millions of graphic processing units (GPUs), essential for AI computations.

According to a recent study by McKinsey & Co., the deals closed in 2025 may merely represent the start of a much larger financial endeavor, with global data centers anticipated to require a staggering $6.7 trillion to meet burgeoning demand for computing power. This raises significant questions about the sustainability of such expansive spending and the potential risks involved for investors.

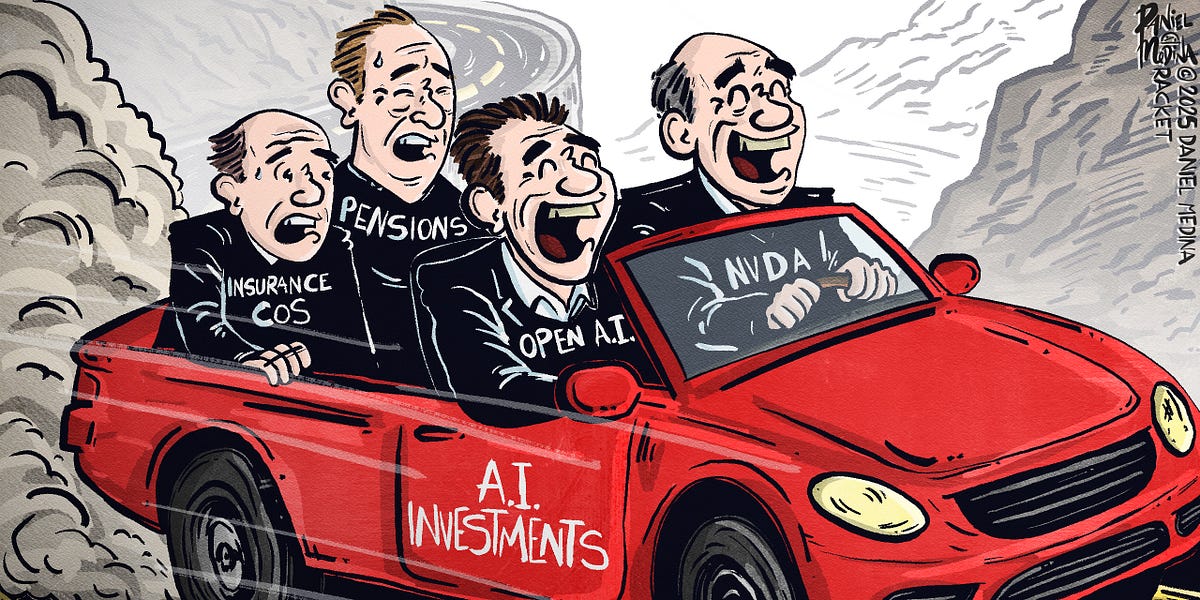

One pressing concern is the impact on hyperscaler stock investors. Companies providing substantial cloud computing services, including Microsoft, Oracle, Meta, Amazon, and Google, represent 26.1% of the S&P 500 as of late November 2025. Institutional investors—pension funds and insurance portfolios—hold significant stakes in these firms. The current high levels of capital expenditures (“CapEx”) could jeopardize their financial health, especially given dependencies on the profitability of leading chatbot developers. A recent report from investment bank HSBC expressed skepticism regarding OpenAI’s prospects for profitability, projecting that it may not achieve this milestone until 2030. By then, OpenAI’s user base may expand to 44% of the global adult population, necessitating an additional $207 billion in computing resources to support growth.

This intricate web of investments presents a systemic risk. A downturn or failure in one major player’s strategy could lead to cascading problems across the entire ecosystem. The interconnected nature of hyperscalers, AI developers, and chip manufacturers means that investors holding even diversified portfolios could face significant losses.

To fund the required AI infrastructure, hyperscalers may turn to private credit markets, borrowing extensively to support their ambitious projects. Reports indicate that Oracle, the only major hyperscaler with negative free cash flow, has seen its debt-to-equity ratio soar to 500%, a stark contrast to Amazon’s 50% and Microsoft’s 30%, according to JPMorgan. Historically, these firms would balance cash reserves with corporate bond market borrowing, but the scale of current funding needs has far outstripped this traditional approach, pushing them toward private credit.

Recent deals illustrate this shift in financing strategy. For instance, Meta is advancing a $30 billion data center project in Louisiana, structured to minimize on-balance-sheet impact. A special purpose vehicle, named Beignet, will manage the investment, allowing Meta to retain some equity while also securing substantial debt funding. Investment manager PIMCO will hold $18 billion of the investment-grade-rated notes, with repayment tied to Meta’s lease payments. The agreement permits Meta to exit the lease every four years, adding another layer of complexity and risk should the market for data centers shift.

Concerns about future demand for data centers are exacerbated by the growing trend of constructing facilities in remote locations, often described as being in the “middle of nowhere.” This raises questions about their viability if AI demand wanes or if technological advancements reduce reliance on traditional computing infrastructure. Microsoft has already warned investors of potential community pushback against data centers in populated areas, further complicating future projects.

Another notable transaction involves Elon Musk’s xAI, which is collaborating with Nvidia on its new Tennessee-based data center, dubbed Colossus. This $20 billion initiative includes a lease-to-own structure for approximately 300,000 GPUs, with financing arranged via a special purpose vehicle. The long-term value of these chips remains uncertain, raising concerns about residual value as technology evolves.

As Wall Street begins packaging lease agreements for GPU and data center financing into asset-backed securities (ABS), the complexities of these new financial products introduce additional risks. The evolving landscape of AI infrastructure investment is laden with uncertainty, as the historical data required for accurate risk assessment is scarce. Rating agencies face the challenge of evaluating these novel investment vehicles amidst a rapidly changing environment.

While these developments may offer opportunities for investors willing to take on risk, the implications for pension funds and insurance policies—often oblivious to the underlying investment risks—are profound. As the AI boom expands, the financial landscape may become increasingly precarious, reminding stakeholders of the potential for volatility when capital expenditures outpace revenue growth.

See also Flex Secures $60M to Scale AI-Driven Finance Platform for Mid-Market Businesses

Flex Secures $60M to Scale AI-Driven Finance Platform for Mid-Market Businesses AI Risk Management Tools Launch to Safeguard Africa’s Underbanked from Digital Threats

AI Risk Management Tools Launch to Safeguard Africa’s Underbanked from Digital Threats AI Companies Issue $120B in Debt, Raising Financial System Threat, Warns Zandi

AI Companies Issue $120B in Debt, Raising Financial System Threat, Warns Zandi Bloxley Raises $2.5M to Launch AI-Native Consumer Finance Platform in Q1 2026

Bloxley Raises $2.5M to Launch AI-Native Consumer Finance Platform in Q1 2026 CFOs Embrace Lean Financial Operations with AI to Enhance Agility and Cut Costs

CFOs Embrace Lean Financial Operations with AI to Enhance Agility and Cut Costs