As the year draws to a close, attention is increasingly focused on two pivotal themes shaping the medium-term economic landscape: geopolitics and investment in artificial intelligence (AI). With trade negotiations resulting in an average effective US tariff of 13.8%, the implications for global markets are profound. For Europe, the pressing issues of demography, energy transition, and competitiveness highlight geopolitics—encompassing concerns such as rare earths, economic security, and the ongoing conflict in Ukraine—as the primary short-term challenge, closely followed by the need to secure an advantageous position within the AI value chain.

In the geo-economic realm, recent easing of tensions in Gaza has shifted focus towards diplomatic efforts aimed at resolving the war in Ukraine. A potential ceasefire could lead to a temporary decline in energy commodity prices, contingent on the terms surrounding Russia’s market re-entry. However, the anticipated positive effects on the European economy may be muted; Russia’s crude oil exports have ceased since the conflict began, and natural gas imports have significantly dwindled. The EU’s goal is a complete decoupling from Russian energy sources by 2027. Therefore, a resolution could mitigate the adverse impact of US tariffs and bolster European growth, expected to hover around 1% to 1.5%. The reconstruction of Ukraine, estimated at around €500 billion by the World Bank, will play a crucial role, although funding remains unclear. The European Central Bank (ECB) is unlikely to alter its policy roadmap due to stable inflation expectations, which are firmly anchored at 2%.

While today’s geopolitical dynamics are crucial, the rapid advancement of AI investment is equally significant. Giuliano da Empoli, in his book “The Hour of the Predator,” posits that the primary dilemma of the 21st century revolves around determining the balance between human and machine intelligence. Over the past year, as political narratives have dominated headlines, an unprecedented surge in AI investment has emerged as a primary growth driver in the US. Total investments in technology—including software, hardware, data centers, and power generation—are projected to reach approximately $1.4 trillion this year, constituting nearly 5% of GDP. This figure far surpasses the historical average of 3.1% since the 1970s, with over 25% of this capital poured in by the five major hyperscalers.

The urgency of these developments compels Europe to expedite strategic initiatives, such as InvestIA or an Action Plan for AI, to enhance its standing in the value chain. Europe currently faces challenges in both hardware and computational capacities, necessitating a multi-faceted response that combines new investment initiatives, regulatory improvements, and a focus on skill development to close the gap with the US and reduce dependencies.

This current phase is more than a mere technological cycle or valuation bubble; it represents a significant mobilization of capital amid ongoing global conflicts. The rise of AI is being likened to a modern-day Manhattan Project, where computing resources replace uranium and energy infrastructures take the place of enrichment facilities. Despite the potential financial, ethical, and sustainability risks associated with this rapid development, an acceleration seems inevitable. The stakes extend beyond mere profits; they encompass hegemony and leadership in the global economy for the foreseeable future. This stands in stark contrast to the dot-com bubble of the late 1990s. The imperative now is clear: decisive action is required to differentiate between the structural transformations underway and speculative financial maneuvers.

As these elements converge, the interplay between geopolitical stability and technological advancement will determine the trajectory of both regional and global economies. With Europe facing the dual challenges of securing its energy future and capitalizing on the burgeoning AI sector, the coming months will be critical in shaping its competitive edge on the world stage.

See also India Surges to 3rd in Stanford’s 2025 Global AI Vibrancy Index, USA Leads with 78.6

India Surges to 3rd in Stanford’s 2025 Global AI Vibrancy Index, USA Leads with 78.6 Thales Partners with Cohere to Develop AI Solutions for Canada’s Navy

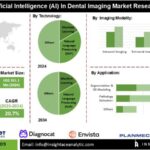

Thales Partners with Cohere to Develop AI Solutions for Canada’s Navy AI-Driven Dental Imaging Market to Surge from $351.1M to $2.3B by 2034, Transforming Diagnostics

AI-Driven Dental Imaging Market to Surge from $351.1M to $2.3B by 2034, Transforming Diagnostics Peloton’s Holiday Sale and AI Strategy: Key Insights on Valuation Risks and Opportunities

Peloton’s Holiday Sale and AI Strategy: Key Insights on Valuation Risks and Opportunities EU Opens Antitrust Investigation into Meta’s WhatsApp AI Restrictions for Businesses

EU Opens Antitrust Investigation into Meta’s WhatsApp AI Restrictions for Businesses