In a significant move within the artificial intelligence sector, Amazon is reportedly negotiating a potential investment exceeding $10 billion in OpenAI, a partnership that could redefine the competitive landscape of AI technologies. These discussions, still in their early stages, could see OpenAI valued at more than $500 billion, a remarkable increase reflecting the company’s rapid ascent since the launch of ChatGPT.

The timing of these negotiations is critical for OpenAI, which is actively seeking funding to support its ambitious research and infrastructure requirements. Amazon, already a key player in cloud computing through its AWS division, views this potential investment as a strategic opportunity to deepen its ties with a leading AI firm. Reports suggest that the partnership would not only involve substantial capital but also a commitment from OpenAI to utilize Amazon’s Trainium chips, which are specifically designed for training large language models. This arrangement could pose a challenge to Nvidia, the current dominant force in the AI hardware market.

Details of the negotiations were first disclosed by The Information, which cited sources familiar with the matter. The outlet highlighted that Amazon’s financial support could alleviate OpenAI’s substantial commitments related to server rentals and other resource expenses. Increasing costs linked to the demands for computational power have made it essential for OpenAI to seek integrated solutions, combining funding with cloud services and hardware.

Bloomberg has also reported on these developments, emphasizing how the deal could enable Amazon to broaden its influence in AI beyond its traditional e-commerce operations. The discussions are seen as a potential advantage for Amazon as it positions itself to compete more effectively with Nvidia. The integration of Trainium chips into OpenAI’s operations could help reduce its dependency on external hardware suppliers.

This is not Amazon’s first venture into AI investments. The company has historically directed significant resources toward its own AI projects, including the development of models for its Alexa voice assistant. However, a partnership with OpenAI could accelerate Amazon’s capabilities, particularly in generative AI applications relevant to retail and logistics. Analysts note that such reciprocal arrangements—where investments are linked to service usage—are increasingly common in the tech industry, akin to previous collaborations like that of Microsoft with various AI startups.

Reuters has further corroborated the reports, stating that the potential valuation of OpenAI indeed exceeds $500 billion. Their coverage highlighted that the negotiations build upon existing collaborations between the two companies, including OpenAI’s current use of AWS for certain operations. Integrating Trainium chips could significantly reduce operational costs for OpenAI, which is grappling with rising expenses associated with data center requirements and talent acquisition.

TechCrunch noted that this partnership could reflect a broader trend in the AI domain, with intertwined investments becoming a common strategy among tech firms. The discussions reportedly aim to secure OpenAI’s commitment to use Amazon’s AI chips, which would mark a pivotal shift away from Nvidia’s ecosystem. The urgency for alternatives to Nvidia’s GPUs has grown, given supply constraints and inflated prices.

Social media reactions reflect a mix of excitement and skepticism regarding the deal. Users on X, formerly known as Twitter, have highlighted Amazon’s aggressive AI spending, particularly with a projected $105 billion capital expenditure for 2025, driven largely by AI infrastructure. Some analysts speculate that Amazon’s commitment could help challenge Nvidia’s market dominance, while others remain cautious about massive AI investments, viewing them as indicative of market maturation.

Seeking Alpha provided financial context, reporting that OpenAI’s operations could require up to $100 billion in computing and talent costs over the next four years, making Amazon’s involvement strategically vital. This partnership could also deepen Amazon’s existing $38 billion cloud engagements with various AI entities.

The Economic Times elaborated on the competitive implications of adopting Trainium chips, suggesting that this could bolster Amazon’s position against Nvidia. OpenAI’s valuation surge, driven by innovations like GPT-4, exemplifies the escalating investment frenzy in AI, placing the company at the center of this dynamic environment.

CNBC confirmed the discussions regarding the investment and the chip agreement, highlighting Amazon’s intent to broaden its AI footprint. This collaboration could allow OpenAI to scale operations more rapidly while providing Amazon with a high-profile customer for its proprietary hardware. For OpenAI’s CEO, Sam Altman, securing such funding is critical amid increasing regulatory scrutiny and ethical discussions surrounding AI development.

As these negotiations unfold, the tech community is closely monitoring their potential impact. If finalized, the Amazon-OpenAI alliance will likely attract attention from regulatory bodies, raising concerns about market concentration given Amazon’s dominance in cloud services and OpenAI’s significant role in generative AI.

Looking forward, the potential partnership could accelerate advancements in AI applications across diverse sectors. Amazon’s e-commerce platform could leverage OpenAI’s technologies to enhance personalized shopping experiences, while OpenAI stands to gain access to vast datasets essential for model training. This mutual benefit illustrates the growing trend of collaboration among tech giants to address the monumental challenges associated with developing artificial general intelligence.

Ultimately, this prospective alliance embodies the relentless pursuit of AI supremacy. As valuations escalate and investments flood the sector, the partnership between Amazon and OpenAI could set a new standard for how technology companies collaborate to expand the boundaries of artificial intelligence.

See also NVIDIA Partners with DOE to Revolutionize U.S. AI Infrastructure and Scientific Discovery

NVIDIA Partners with DOE to Revolutionize U.S. AI Infrastructure and Scientific Discovery AMD Stock Rebounds 3.4% Amid AI Funding Concerns; Piper Sandler Maintains $280 Target

AMD Stock Rebounds 3.4% Amid AI Funding Concerns; Piper Sandler Maintains $280 Target Interconnects Doubles Audience to 40K in 2025 Amid Surge in Open Model Discussions

Interconnects Doubles Audience to 40K in 2025 Amid Surge in Open Model Discussions BTIG Boosts Amplitude (AMPL) Rating, Spotlights AI Potential Amid Investment Risks

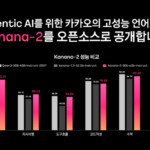

BTIG Boosts Amplitude (AMPL) Rating, Spotlights AI Potential Amid Investment Risks Kakao Unveils Kanana-2 Language Model on Hugging Face with Enhanced Tool Calling Features

Kakao Unveils Kanana-2 Language Model on Hugging Face with Enhanced Tool Calling Features