The federal government must intervene to prevent a fragmented landscape of state regulations from hindering the integration of generative artificial intelligence in the mortgage market, according to Leah Price of the Tinman AI Platform. As housing affordability becomes an increasingly pressing issue, the need for unified federal guidelines is paramount to facilitate innovation and prevent stagnation in the mortgage industry.

In December, federal regulators began addressing potential bottlenecks posed by state-level AI regulations. However, with some states poised to implement their own rules, it is crucial for the federal government to maintain a clear path for AI-driven advancements. Should individual states proceed with inconsistent regulations, it could lead to higher compliance costs and stifle experimentation among banks and mortgage lenders, echoing a pattern seen over the past decade where financial institutions have remained hesitant to innovate.

Having previously observed this dynamic during her tenure at the Federal Housing Finance Agency (FHFA), Price noted that the psychological impact of past regulatory frameworks, particularly the Dodd-Frank Act, has left an indelible mark on the industry. A climate of fear has permeated mortgage technology, where even as banks have embraced AI in other sectors, the mortgage stack has remained underfunded and resistant to change.

To encourage responsible innovation, the FHFA hosted a “Tech Sprint” in 2024, a rare initiative in the heavily regulated mortgage sector. This event aimed to explore how generative AI could be effectively utilized within housing finance. Surprisingly, several major banks opted not to participate, not due to a lack of seriousness, but rather out of concern regarding the optics of engaging with generative AI.

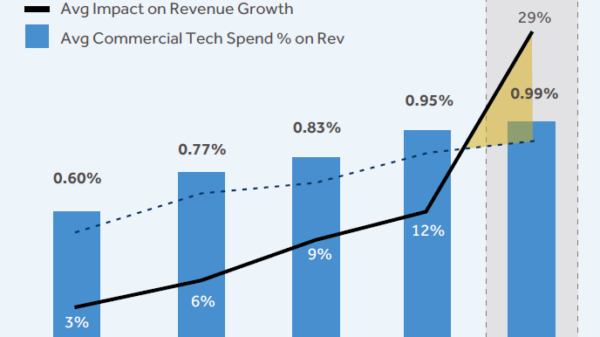

While many large financial institutions are investing heavily in AI, the regulatory intricacies of the mortgage market complicate their ability to position themselves as innovators. This has resulted in an uneven investment landscape that adversely affects the mortgage sector, limiting the potential for AI to enhance operational efficiency.

Price emphasized the significance of federal leadership in this context. The Trump administration has expressed a desire to accelerate AI integration across various industries, including financial services, and can achieve this by enforcing President Donald Trump’s executive order from December 11, 2025, aimed at establishing a national policy framework for artificial intelligence. The administration must prevent states like New York, California, and Colorado from introducing regulations that may further dampen innovation.

The stakes are high, with the cost of originating a mortgage skyrocketing to $11,800 in the second quarter of 2025, a substantial increase from less than $8,000 five years prior. This financial burden poses a significant challenge to the American dream of homeownership. Additionally, competition in the mortgage market remains limited as established players dominate distribution and workflow, leading to higher costs by default.

Fundamentally, mortgage lending relies heavily on data verification, involving the collection, validation, and documentation of borrower information. AI, when implemented with appropriate safeguards, has the potential to dramatically enhance productivity and mitigate reliance on slow, manual processes. By reducing operational inefficiencies, AI can shorten cycle times, lower defect rates, and ultimately decrease costs.

A recent survey by the National Association of Home Builders in 2025 revealed that 82% of Americans are concerned about housing affordability, driving the Trump administration to focus on this critical issue. Recent proposals from the administration include allowing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities, restricting institutional investors from acquiring single-family homes, and permitting homebuyers to tap into their 401(k)s for down payments. These discussions follow earlier ideas regarding a 50-year mortgage.

In this scenario, banks and mortgage lenders also have a vital role to play in making homeownership more accessible by leveraging AI to lower costs. Price argues that these cost savings should, in turn, be passed down to consumers.

Currently, the predominant obstacle is not technological but rather a pervasive fear—fear of regulatory repercussions, fear of negative media coverage, and fear of being perceived as overly progressive. Federal regulators have the power to alleviate these concerns by clarifying the regulatory framework, encouraging responsible experimentation, and preventing state-by-state fragmentation from masquerading as a de facto ban on AI innovation.

For a more efficient, competitive, and affordable housing finance system, it is imperative to stop viewing innovation as a threat. While AI is not a panacea, in an increasingly constrained market, it may represent one of the few remaining levers capable of shifting the dynamics in a favorable direction.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics