Gartner, Inc. has recently been recognized by Oakmark Funds as a leading player in global research, prompting the fund to purchase shares after the company’s stock faced pressure related to concerns over artificial intelligence (AI). At the same time, Gartner has outlined nine trends regarding the future of work, focusing on the implications of AI for employees and human resources, highlighting its dual role as both a consultant on and a subject of AI-driven transformations.

Investors are now evaluating whether the renewed confidence from fund managers in Gartner’s resilience to AI disruption can reshape the company’s investment narrative. Owning Gartner shares requires a belief in the sustainability of its subscription-based research and advisory model, especially as clients begin to explore more cost-effective AI tools. The recent buying activity by Oakmark on AI-related stock weaknesses indicates that while investors recognize AI disruption as a near-term risk, it does not significantly alter Gartner’s primary short-term catalyst: the company’s ability to engage clients and ensure contract renewals amidst potentially softer earnings and slower revenue growth.

Gartner’s recently published trends concerning the “future of work” directly connect to its ability to remain essential for senior decision-makers grappling with the adoption of AI. Insights from these trends may reinforce Gartner’s position as a crucial adviser for organizations navigating AI and workforce decisions, potentially allowing the company to maintain its pricing power and contract value, even as clients scrutinize costs and seek alternatives.

However, while many investors may view AI as an opportunity for growth, they must also consider the risk that cheaper AI tools could threaten Gartner’s core research subscriptions, reshaping expectations for the company’s long-term performance. Gartner’s narrative includes projections of $7.4 billion in revenue and $821.8 million in earnings by 2028, necessitating a yearly revenue growth of 4.7% and a significant decrease in earnings from $1.3 billion today.

As part of this narrative, Gartner has identified a fair value of $283.73 per share, indicating a potential upside of 19% from its current price. In contrast, diverse fair value estimates from the Simply Wall St community range from approximately $279.56 to $420.71 per share, reflecting a wide disparity in individual perspectives. Such differences underscore the necessity for investors to weigh the risks associated with generative AI and low-cost tools as they evaluate Gartner’s future.

For those who hold differing views on the existing narratives surrounding Gartner, a tool has been developed that allows investors to craft their own investment perspectives quickly. This innovation emphasizes that substantial investment returns often stem from independent thought rather than following prevailing market trends.

In the broader context of AI’s impact on various sectors, the healthcare industry is poised for significant transformations, with numerous companies actively developing solutions for early diagnostics and drug discovery, many of which are under a $10 billion market cap. This presents a timely opportunity for investors looking to enter these emerging markets.

As market conditions evolve rapidly, investors are urged to stay informed and seek opportunities before they become widely recognized. With the ongoing shifts in technology and investment landscapes, the ability to adapt will be crucial for both individual investors and firms like Gartner as they navigate the complex implications of AI.

See also South African Businesses Must Address Ethical AI to Mitigate Operational Risks, Warns Alkemi CEO

South African Businesses Must Address Ethical AI to Mitigate Operational Risks, Warns Alkemi CEO SAP.DE Stock Closes at €202.15 Amid AI Partnership; Upside Forecasts Signal Potential Growth

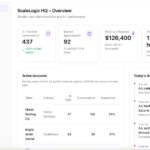

SAP.DE Stock Closes at €202.15 Amid AI Partnership; Upside Forecasts Signal Potential Growth ScaleLogix AI Launches Investor-Grade Platform to Democratize Access to High-Performance AI

ScaleLogix AI Launches Investor-Grade Platform to Democratize Access to High-Performance AI Czech Credo Ventures Invests $3.4M in Modeinspect to Disrupt $6B Design Software Market

Czech Credo Ventures Invests $3.4M in Modeinspect to Disrupt $6B Design Software Market Vertical AI Startups Face 99.5% Failure Rate in 2026—Market Shaping Offers Solution

Vertical AI Startups Face 99.5% Failure Rate in 2026—Market Shaping Offers Solution