Artificial intelligence (AI) is rapidly entering the finance sector, promising significant efficiencies through automated reconciliations, self-directed close cycles, and real-time insights. However, the implementation of AI is revealing deep-seated structural weaknesses within finance departments that have long been overlooked. As companies rush to adopt autonomous agents, many are finding that these technologies can expose foundational instabilities rather than simply streamline operations.

After extensive experience with ERP system overhauls and AI readiness initiatives in highly regulated finance environments, it has become evident that leaders are eager for the benefits of AI without addressing the underlying issues that impact its performance. The introduction of AI often leads to errors that appear to be technological failures, but are, in fact, indicators of systemic instability.

The first signs of trouble typically emerge within the chart of accounts, where inconsistencies accumulate over time. New business lines, regional variations, and ad hoc reporting create chaos that finance teams manage through manual fixes and informal rules. While human analysts can navigate these inconsistencies, AI lacks the adaptive intuition required. When AI is deployed at scale, it quickly highlights these misalignments, revealing the structural fragility that had been masked before.

Similarly, organizations often aim for AI to generate polished management commentary from ERP data. However, if definitions of key metrics such as revenue or margin differ across systems, the AI’s output may seem accurate on the surface, but will contain subtle inaccuracies that can mislead executives. The gloss of AI-generated reports can obscure deeper conflicts in data definitions.

While month-end closes are traditionally viewed as stable routines, they often rely heavily on undocumented tribal knowledge. Teams are familiar with exceptions and know which accounts typically finalize late. An AI agent, however, does not inherit this nuanced understanding; it requires consistent processes and clear endpoints. If the closing process varies due to personnel changes or system quirks, the AI may falter, leading to misconceptions that the technology itself is at fault, rather than revealing the underlying instability of the process.

This pattern continues in reconciliations and reporting, where human analysts routinely address upstream issues. Autonomous agents, lacking the ability to intuitively manage these inconsistencies, operate strictly according to programmed logic and thereby magnify existing structural problems.

The vulnerabilities of finance systems are further exposed through data lineage. While many finance teams believe they have robust data lineage because analysts can trace logic from memory, true lineage requires thorough documentation and clear ownership of definitions. When AI agents attempt to connect source data to outputs, discrepancies can cascade, leading to significant downstream issues. A single undocumented calculation can wreak havoc when scaled across business units, but again, the agent is not at fault; the organizational structure is.

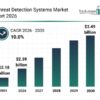

As AI adoption accelerates—Gartner reports that **58%** of finance functions utilized AI in **2024**, a marked increase from the previous year—the risks associated with these foundational weaknesses become more pronounced. Research from **IBM** underlines the dangers of poor data quality, indicating that inconsistent data can impede insights, slow decision-making, and heighten compliance risks. These challenges reflect the reality many executives face: the enthusiasm for AI is outpacing the foundational work needed to support it effectively.

Preparing for AI Integration

To harness the full potential of AI, finance leaders must first establish a stable operational environment. A four-part framework can guide teams in fortifying their systems before deploying AI solutions. First, reevaluate the chart of accounts and financial hierarchies with a focus on identifying conflicting definitions and outdated segments. If clarity requires unwritten knowledge, the structure is not adequately prepared for AI.

Next, document actual processes rather than idealized versions. Assess whether the processes would function without manual workarounds. If they would not, the introduction of AI may exacerbate existing instability rather than mitigate it. Third, strengthen data controls and lineage by ensuring there is centralized governance over naming conventions, reporting rules, and definitions. If data lineage is reliant on a few experts rather than well-documented systems, AI agents will inevitably expose gaps.

Finally, assess the overall environmental readiness. Many organizations operate across various platforms—cloud services, legacy systems, and point solutions. Identifying which systems deliver consistent outputs is crucial, as AI agents thrive in predictable environments. Fragmented ecosystems create challenges that autonomous agents struggle to overcome.

Preparing for AI adoption not only mitigates risks but also drives operational maturity. Organizations that invest in strengthening their structures, processes, and data governance will find it easier to scale and improve visibility. As finance teams create a stable environment, AI agents can enhance productivity and deliver the value they were designed to provide. The promise of AI remains intact; the imperative now is to fortify the foundations that will allow that promise to be realized.

See also Davis Finance Commission Recommends Targeted SRI Policy, Excludes Occupation Amendment

Davis Finance Commission Recommends Targeted SRI Policy, Excludes Occupation Amendment AI Bubble Risks: Five Strategies to Safeguard Your Investments from Market Collapse

AI Bubble Risks: Five Strategies to Safeguard Your Investments from Market Collapse Microsoft Launches Finance Launch AI to Automate Product Launch Processes and Enhance Efficiency

Microsoft Launches Finance Launch AI to Automate Product Launch Processes and Enhance Efficiency KB and Shinhan Intensify Rivalry as AI-Driven Strategies Reshape Financial Landscape

KB and Shinhan Intensify Rivalry as AI-Driven Strategies Reshape Financial Landscape Financial Services Scale AI Adoption with 79% Prioritizing Governance for Success

Financial Services Scale AI Adoption with 79% Prioritizing Governance for Success