AI Frenzy: The Rise and Risks in Today’s Financial Markets

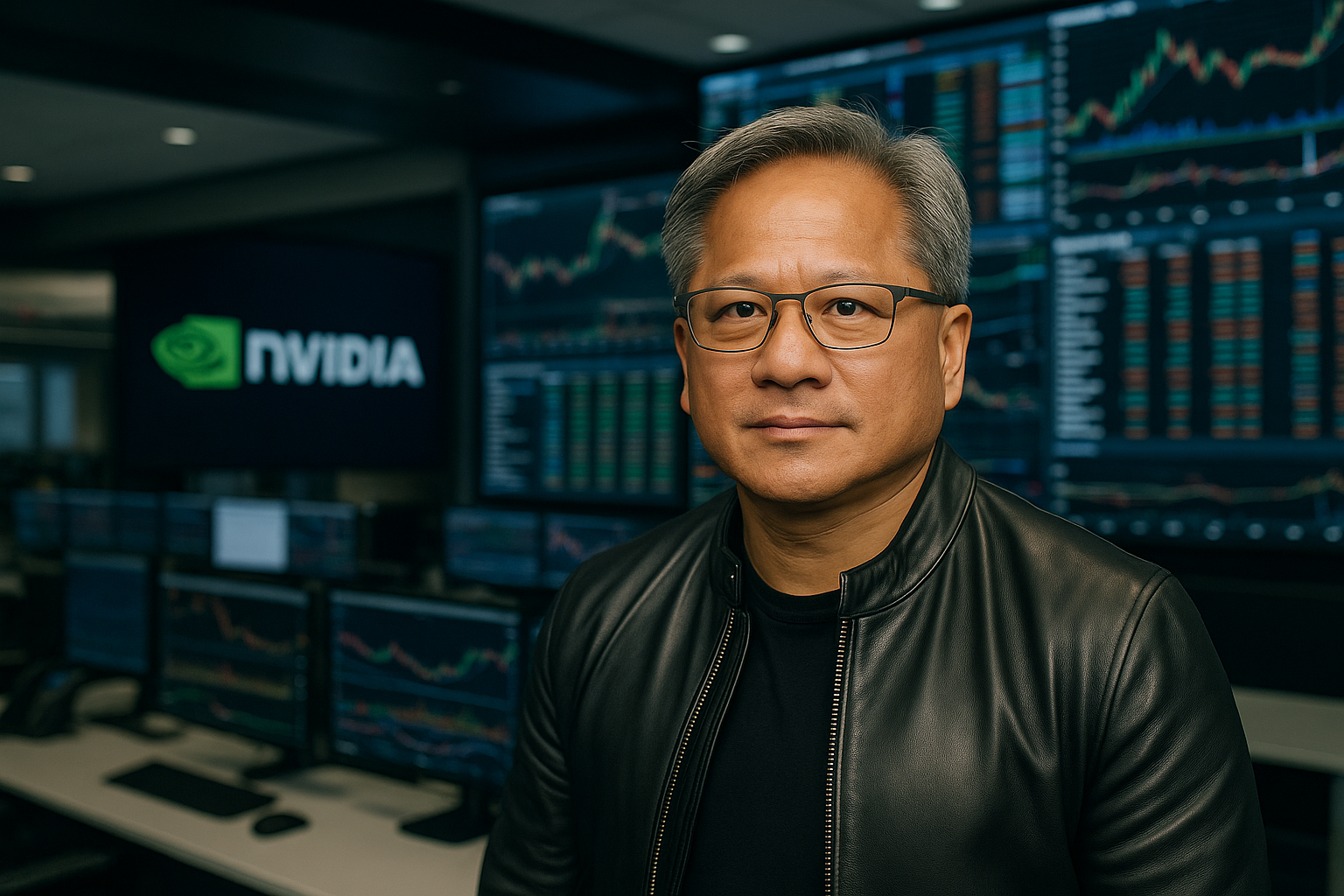

As the race for dominance in artificial intelligence (AI) intensifies, tech giants and investors are making substantial financial moves, causing stock prices and market risks to surge. The current climate has transformed AI into one of the most lucrative yet hazardous sectors within the U.S. financial landscape. Notably, Nvidia has reached an astounding valuation of $4.5 trillion, driven by record-breaking earnings and the relentless appetite for AI investments.

Understanding the Current Landscape

The recent influx of capital into AI has significantly inflated company valuations and placed additional stress on financial markets. According to Lazard, firms are increasingly acquiring exclusive datasets, leading to exorbitant prices based on future potential rather than immediate returns. The consultancy firm McKinsey estimates that the investment needed to expand AI data centers could reach a staggering $7 trillion by 2030—figures typically associated with colossal infrastructure projects. Nvidia’s impressive profit margins and skyrocketing stock price underscore the intense desire of investors to capitalize on AI advancements. However, warnings from firms such as Citadel highlight the precarious nature of this environment, suggesting an increased risk of market volatility.

The credit market is also showing signs of vulnerability, as some companies are accruing debt for assets that may depreciate in value faster than they can repay. The rise of riskier financial instruments, including zero-coupon convertible bonds, signals a shift toward more speculative investments. Compounding these challenges are illiquid assets like private credit, which could amplify the impact of sudden market changes.

The Implications for the Market

For market players, the escalating risks associated with AI investments cannot be overlooked. With tech companies doubling down on AI initiatives, market volatility is on the rise. Investors are gravitating towards riskier bonds and assets that may be difficult to offload in times of downturn. Citadel’s research indicates that market fluctuations are becoming both more intense and frequent, making it imperative for investors to closely monitor the factors influencing their returns.

On a broader scale, the financial strains of innovation in AI are reshaping industries and the financial system as a whole. While substantial investments could spurn long-term growth, current expectations appear to rest more on aspirations than solid profits. A downturn in the sector or the obsolescence of key technologies could have repercussions far beyond Silicon Valley, illustrating the extensive stakes involved in the AI revolution.

As the landscape evolves, the challenge lies in balancing the exhilarating opportunities presented by AI against the backdrop of rising risks and potential market instability. With the stakes higher than ever, stakeholders must navigate this complex ecosystem with caution and strategic foresight.

See also SMBC Launches Agentic AI Startup in Singapore to Cut Corporate Onboarding to 2 Days

SMBC Launches Agentic AI Startup in Singapore to Cut Corporate Onboarding to 2 Days Finance Committee Approves Wage Ordinance, Adding 3 Positions for 2026 Budget

Finance Committee Approves Wage Ordinance, Adding 3 Positions for 2026 Budget Fed’s Lisa Cook Warns AI Trading Risks Could Manipulate Markets, Impair Competition

Fed’s Lisa Cook Warns AI Trading Risks Could Manipulate Markets, Impair Competition AI Tools Mislead Users: Which? Study Reveals Accuracy Scores Below 70% for Finance Advice

AI Tools Mislead Users: Which? Study Reveals Accuracy Scores Below 70% for Finance Advice Principal Financial Upskills 20,000 Employees with New AI Literacy Program

Principal Financial Upskills 20,000 Employees with New AI Literacy Program