Artificial intelligence (AI) is rapidly transforming the accounting sector, serving as a key driver of efficiency and innovation. According to a recent study titled “Digitalization in Accounting 2025/2026” conducted by KPMG, over half of the companies surveyed, specifically 53 percent, have either implemented AI solutions in their accounting processes or are currently in the implementation phase.

This shift highlights a growing awareness of AI’s strategic importance within finance. The KPMG report reveals that 61 percent of respondents view AI as a critical success factor for both current and future financial operations. The study emphasizes that AI is not a new player in finance; rather, it has been integrated into the sector for some time and is fundamentally altering work processes.

AI algorithms are increasingly recognized for their ability to enhance efficiency, particularly in standardized tasks like document processing and entry bookings. Many organizations are leveraging AI to not just speed up their workflows but also improve the quality of their operations. The report indicates that among companies utilizing AI in accounting, a significant majority report notable improvements, especially in transactional processes such as payment processing.

Specifically, 37 percent of respondents noted significant time savings immediately following implementation, while approximately 70 percent indicated enhanced process quality in the short to medium term. Financial impacts are also becoming evident, with 15 percent of companies experiencing immediate cost savings and an additional 54 percent reporting positive results over time.

Furthermore, the KPMG study reveals that two-thirds (66 percent) of companies find that their expectations regarding AI-based accounting solutions have been met. In contrast, 17 percent of respondents expressed that their expectations remain unfulfilled. This slight dip in overall satisfaction compared to the previous year suggests a trend towards more realistic perceptions based on practical experience with the technology.

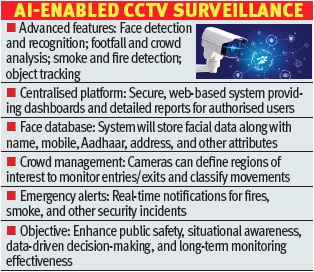

However, the transition to AI is not without its challenges. Data protection and security are significant concerns for 65 percent of respondents, with 59 percent highlighting the need for traceability and transparency of AI algorithms. Other obstacles include the lack of standardization (46 percent) and the legal classification of AI systems (40 percent).

Alongside the adoption of AI, companies are also advancing their overall digital infrastructure in accounting. The report indicates that nearly all organizations have expanded their digital capabilities in recent years, with an increasing focus on achieving paperless accounting and standardizing workflows. Currently, 26 percent of companies operate entirely paperless, while another 46 percent have adopted paperless practices in specific areas. Workflow standardization is similarly progressing, with 13 percent reporting completion and 45 percent in the implementation phase.

The KPMG study also highlights that emerging technologies like machine learning are becoming more integral to accounting processes. Approximately 28 percent of respondents have fully integrated machine learning into their workflows, nearly doubling the figure from 2023. Additionally, 59 percent of companies are utilizing cloud systems, while 32 percent are employing robotic process automation (RPA).

In conclusion, the integration of AI in accounting is not just a trend but a fundamental shift reshaping the landscape of financial operations. With ongoing advancements in digitalization and emerging technologies, businesses are poised to realize significant benefits while navigating the inherent challenges of this transformative era.

See also Finance Committee Approves $82K Police Overtime Transfer Amid Staffing Shortages

Finance Committee Approves $82K Police Overtime Transfer Amid Staffing Shortages Cohere CEO Predicts AI Will Transform Finance, Valued at $7 Billion After Latest Funding

Cohere CEO Predicts AI Will Transform Finance, Valued at $7 Billion After Latest Funding CFP Board Reveals Key Strategies for Integrating AI in Financial Planning Profession

CFP Board Reveals Key Strategies for Integrating AI in Financial Planning Profession AI Transforms Climate Finance in Africa: Strategies for Resilience and Growth

AI Transforms Climate Finance in Africa: Strategies for Resilience and Growth Australian Executives Embrace AI’s Role in Finance, 91% Fear Delaying Adoption

Australian Executives Embrace AI’s Role in Finance, 91% Fear Delaying Adoption