Tesla (TSLA) stock faced a downturn late last week, closing lower on Friday as optimism surrounding its upcoming robotaxi services struggled against prevailing fears of an AI bubble. The company’s stock experienced a decline of over 2% on Thursday, followed by an additional drop of around 1% on Friday. This negative trend followed a significant sell-off in prominent tech stocks, including Tesla and others in the “Magnificent Seven,” despite a strong earnings report from Nvidia (NVDA) on Wednesday evening.

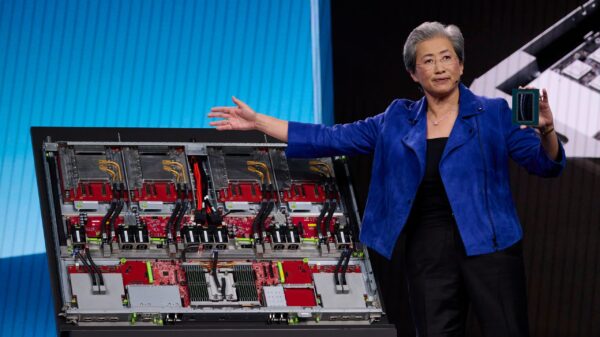

The current skepticism regarding AI investments stems from concerns about major players like Nvidia committing over $1 trillion to build out data centers without demonstrating positive cash flow. This financial backdrop has raised questions about the sustainability of such investments, adding pressure to stocks like Tesla, which has increasingly positioned itself as an AI robotics company rather than solely an automotive manufacturer.

Interestingly, despite the stock’s performance, Tesla has made notable progress in its autonomous vehicle initiatives. According to a report from Business Insider, Tesla has successfully completed the self-certification process to operate robotaxis in Nevada, as confirmed by a source from the Nevada Department of Motor Vehicles (DMV). While this certification allows Tesla to deploy its robotaxis on public roads, it still requires approval from the Nevada Transportation Authority before operating commercially.

A representative from the Nevada DMV stated that Tesla has obtained an “Operations Certificate of Compliance,” enabling the company to “deploy [robotaxis] and operate its autonomous vehicles on public roads in Nevada.” Alongside these developments, the Arizona Department of Transportation (ADOT) also announced this week that Tesla has finalized the necessary steps to initiate a robotaxi service in the state. However, similar to its existing services in Austin, Texas, and the San Francisco Bay Area, these robotaxis will still involve a safety driver during operations.

The login screen of Tesla’s Robotaxi app on September 4, 2025. (Andrej Sokolow/picture alliance via Getty Images)

As Tesla expands its robotaxi services in Austin and the Bay Area, it faces competition from companies like Waymo. While Waymo operates in multiple regions without safety drivers, Tesla has yet to achieve level 4 autonomy, which would allow for fully self-driving capabilities in specific areas.

Despite these hurdles, enthusiasm for Tesla’s robotaxi potential has led Wall Street analysts to revise their price targets favorably. Recently, Stephen Gengaro from Stifel raised his price target for Tesla from $483 to $508, maintaining a Buy rating. He cited the strength of Tesla’s Full Self-Driving (FSD) technology and its anticipated robotaxi service as key drivers behind this optimistic outlook.

As Tesla navigates an increasingly complex landscape characterized by AI skepticism and robust competition, its ability to deliver on robotaxi promises could significantly impact its market positioning and stock performance in the coming months.

See also Generative AI Can Cut Auto Finance Costs by Up to 8% According to McKinsey Report

Generative AI Can Cut Auto Finance Costs by Up to 8% According to McKinsey Report Surgent CPE Launches Agentic AI Certificate Series for Accountants with 10 CPE Credits

Surgent CPE Launches Agentic AI Certificate Series for Accountants with 10 CPE Credits Equiti Appoints New CISO and Compliance Head Amid Major AI and Finance Restructuring

Equiti Appoints New CISO and Compliance Head Amid Major AI and Finance Restructuring Embedded Finance Enhances AI Agents for Safer, Automated Financial Transactions

Embedded Finance Enhances AI Agents for Safer, Automated Financial Transactions AI Enhances Financial Planning Efficiency, Reveals Comerica’s 2025 Tool Insights

AI Enhances Financial Planning Efficiency, Reveals Comerica’s 2025 Tool Insights