PALO ALTO, Calif., Jan. 15, 2026 /PRNewswire/ — Zeni, the leading AI-powered bookkeeping platform for startups and growing businesses, today announced the launch of Zeni Treasury, a new cash management solution designed to help businesses manage idle capital while maintaining liquidity and operational flexibility.

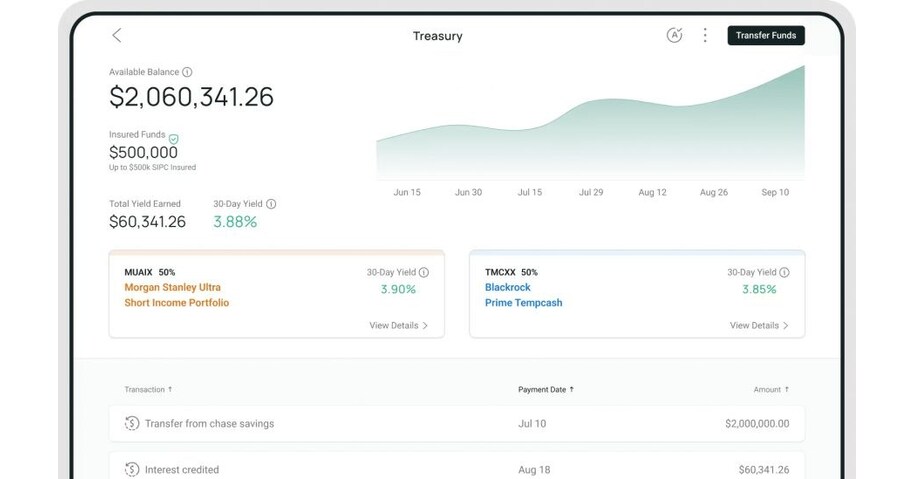

Zeni Treasury allows businesses to earn competitive, market-leading yields on cash reserves, significantly outperforming traditional business checking and savings accounts. The offering features zero minimums, no lockup periods, and instant access to funds. This product integrates seamlessly with Zeni’s AI-powered bookkeeping and finance management platform, providing businesses with a unified view of all financial operations.

“Every dollar sitting idle in a checking account represents a missed opportunity,” said Snehal Shinde, CPO and Cofounder at Zeni. “Zeni Treasury was built to solve a fundamental problem for modern businesses: how to maximize returns without sacrificing liquidity or adding complexity. With Treasury, companies can put their cash to work immediately while maintaining the flexibility they need to operate and grow.”

Businesses using Zeni Treasury can expect several key features and benefits. The product offers competitive high yields, enabling faster capital growth compared to traditional banking products. There are no barriers to entry, such as minimum balance requirements, hidden fees, or high-balance thresholds. Companies also benefit from complete liquidity, with instant access to funds and no penalties for withdrawals.

Furthermore, the funds are invested in diversified money market funds managed by SEC-registered partner Atomic Invest LLC, which typically allocates to low-risk instruments including U.S. Treasuries and high-quality commercial paper. The integration of Treasury accounts with Zeni’s AI finance platform allows businesses to track all financial activities, including checking, credit cards, bookkeeping, and cash management, through a single dashboard. Zeni’s AI finance team also automates transaction tracking for effortless reporting and tax preparation.

Unlike traditional business banking products that offer minimal returns or impose restrictive terms, Zeni Treasury combines institutional-grade yields with the accessibility and ease-of-use demanded by modern businesses. Existing Zeni customers can access Treasury through their current dashboard, while new customers can open accounts in minutes without needing to complete any paperwork.

The introduction of Zeni Treasury reflects the company’s commitment to providing comprehensive, AI-driven financial solutions that enable businesses to optimize every aspect of their financial operations. By integrating high-yield cash management directly into its platform, Zeni reduces the need for businesses to maintain separate relationships with multiple financial service providers.

About Zeni – Zeni is an AI bookkeeping software backed by a dedicated finance team. With a comprehensive suite of financial tools and services, businesses can leverage automation to save up to 70 hours per month and enhance the accuracy of their financial operations.

For more information, contact:

VP of Marketing

Garit Boothe

Zeni

[email protected]

McHenry County Finance Committee Approves $500K Reclassification for Court Interpreter Reimbursements

McHenry County Finance Committee Approves $500K Reclassification for Court Interpreter Reimbursements AI-Powered Automation Reshapes U.S. Finance Roles, Reducing Errors and Fraud by 30%

AI-Powered Automation Reshapes U.S. Finance Roles, Reducing Errors and Fraud by 30% UK Millennials Turn to AICC’s AI for Autonomous Finance Amid Rising Economic Pressures

UK Millennials Turn to AICC’s AI for Autonomous Finance Amid Rising Economic Pressures Financial Executives Prioritize AI and Tech Investments, Revealing 2026 Growth Strategies

Financial Executives Prioritize AI and Tech Investments, Revealing 2026 Growth Strategies