Earlier this week, Charter Communications revealed a significant partnership with Amazon Web Services (AWS) to enhance its software and operational efficiency through the integration of advanced generative AI. This collaboration aims to standardize essential development processes and deploy AI-powered tools such as GitLab Duo alongside Amazon Q Developer throughout its operations. This move underscores Charter’s dedication to digital transformation, targeting automation in software development to amplify both efficiency and customer experiences across its Spectrum services.

This partnership signifies a formidable shift in Charter’s business strategy, focusing on generative AI adoption that could reshape its future investment narrative. By automating key operational processes, Charter is positioning itself not only to enhance internal efficiencies but also to improve customer satisfaction—a critical factor in today’s competitive telecommunications market.

Investment Implications of the AWS Partnership

For investors contemplating Charter Communications, the primary investment thesis revolves around the company’s capability to foster growth via its broadband, mobile, and bundled services, all while facing fierce competition and striving to retain its customer base. The recent AWS generative AI partnership highlights Charter’s ambition to enhance operational efficiencies and customer experiences. However, it does not immediately alter the dynamics of mobile subscriber growth or mitigate the risks associated with broadband market share erosion.

Among the notable announcements is the expansion of 4K content availability on the Spectrum TV App. This initiative reflects Charter’s ongoing efforts to enhance its value proposition for subscribers, which is critical for reducing customer churn and defending market share against rivals who are increasingly emphasizing fiber and wireless alternatives.

Despite Charter’s investments in technology, it’s essential for investors to remain vigilant regarding the escalating competition from new fiber and mobile providers. These emerging competitors could significantly pressure broadband growth and impact Charter’s overall market position.

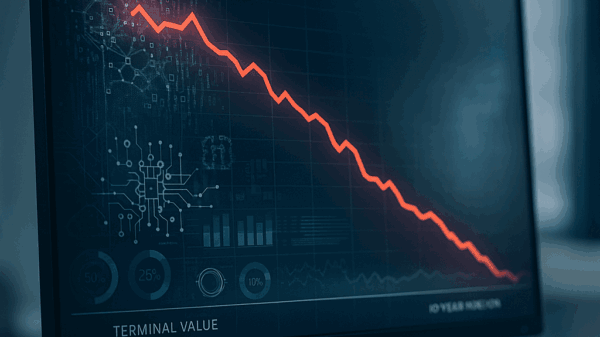

Looking ahead, Charter Communications is projected to generate $56.8 billion in revenue and $6.0 billion in earnings by 2028. This projection assumes a slight annual revenue decline of 0.9%, paired with a modest earnings increase of $0.7 billion from its current earnings of $5.3 billion.

Analysts have determined that Charter Communications possesses a fair value estimate of $314.94, indicating a potential upside of 55% compared to its current stock price. This valuation reflects the company’s potential to leverage its new generative AI capabilities to capture more market share and enhance profitability.

Community Perspectives on Charter’s Valuation

Fair value estimates from the Simply Wall St community exhibit a broad range, with projections stretching from US$223 to US$759. This variation highlights the differing opinions among analysts regarding Charter’s future potential, emphasizing how market conditions and competitive pressures could influence outcomes. Investors may want to weigh these diverse perspectives against the context of intensifying broadband competition, which could significantly impact future growth trajectories.

For those who believe alternative narratives may apply, there’s an opportunity to craft a personalized investment strategy regarding Charter Communications in under three minutes—an invitation for investors to explore unique perspectives rather than conforming to prevailing views.

In a rapidly evolving telecommunications landscape, Charter’s commitment to integrating generative AI with AWS could serve as a cornerstone for its future growth strategy, enabling the company to not only streamline operations but also to enhance customer engagement and satisfaction.

As the market continues to shift, those interested in the telecommunications sector should keep a close watch on how this partnership unfolds, particularly regarding its implications for Charter’s market position and the broader competitive landscape.

This article is designed to provide insights based on factual data and analyst forecasts, and it does not constitute a recommendation to buy or sell any stock. For more detailed analysis, including nuanced perspectives, visit Simply Wall St.

See also GAP-Diff Framework Enhances JPEG Image Protection Against Diffusion-Based Customization

GAP-Diff Framework Enhances JPEG Image Protection Against Diffusion-Based Customization Brendan Greene Advocates Against Generative AI in Gaming, Citing Community Opposition

Brendan Greene Advocates Against Generative AI in Gaming, Citing Community Opposition Insurers AIG and WR Berkley Seek Exclusions for Corporate AI Risk Coverage

Insurers AIG and WR Berkley Seek Exclusions for Corporate AI Risk Coverage IAB Australia Launches LLM Prompting Guide to Enhance Marketing AI Strategies

IAB Australia Launches LLM Prompting Guide to Enhance Marketing AI Strategies Amy Redford Criticizes AI-Generated Tributes, Urges Transparency in Mourning Practices

Amy Redford Criticizes AI-Generated Tributes, Urges Transparency in Mourning Practices