In a recent interview with the BBC, Alphabet CEO Sundar Pichai expressed concerns about the overwhelming influx of investments into the artificial intelligence (AI) sector, pointing out signs of irrational behavior among investors. This period, he noted, is marked by substantial capital and soaring valuations for AI companies, drawing parallels to the dotcom bubble of the late 1990s.

Pichai’s remarks come at a crucial time when AI companies are attracting unprecedented levels of investment. He emphasized the necessity for caution, stating that current investor enthusiasm may not align with the actual economic underpinnings of the technology.

The Market Landscape

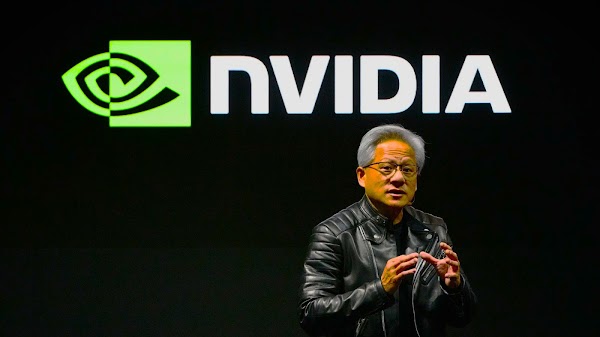

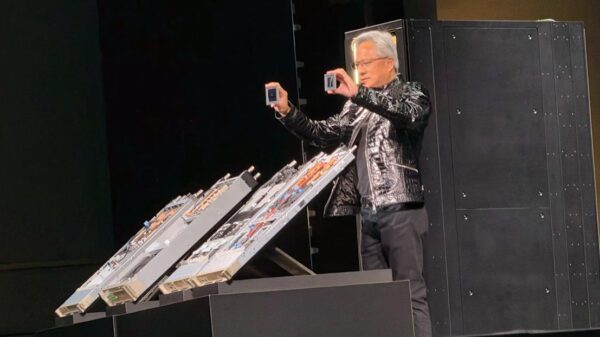

Recent data underscores Pichai’s concerns. Notably, Alphabet’s market value has doubled to $3.5 trillion in just seven months. Similarly, Nvidia has reached a staggering $5 trillion valuation, while OpenAI has become the focus of approximately $1.4 trillion in investment despite generating only a fraction of that in annual revenue. Pichai warned that should the market experience a downturn, companies—including Alphabet—may face significant exposure to losses.

He acknowledged that while Google maintains control over its technology pipeline—including chips, data, models, and scientific research—this does not shield the company from market risks or a potential investor confidence correction.

Challenges in Energy Demand and Infrastructure

Another critical point raised by Pichai is the growing demand for energy driven by AI technologies. Currently, AI systems account for roughly 1.5% of global electricity consumption. Pichai highlighted that this increasing energy requirement is already hindering Alphabet’s progress toward its 2030 net-zero targets, urging both public and private sectors to enhance energy capacity to support continued growth in technology.

Google is actively working to address these challenges by investing in energy-efficient solutions and advocating for robust infrastructure development that can sustain the energy demands of AI technologies.

AI Development Initiatives in the UK

In an effort to bolster its AI initiatives, Alphabet announced a commitment of £5 billion over the next two years to expand AI development in the UK. This investment will include research at DeepMind’s London headquarters and will facilitate the training of AI models within the country. This move aligns with the UK government’s ambition to establish the nation as a premier global center for AI innovation.

Impact on Employment and Skill Development

Pichai described AI as one of the most transformative technologies developed to date, asserting that it will significantly alter job dynamics across various sectors. While traditional roles in fields such as education and healthcare will persist, he emphasized that individuals who embrace AI tools are likely to be more successful in their careers. He urged the workforce to focus on learning how to collaborate with AI technologies rather than resisting their influence.

The potential reshaping of jobs and the requisite shift in skills underscores the urgent need for educational systems and corporate training programs to adapt to the evolving landscape fueled by AI advancements.

Why It Matters: The rapid growth of AI investment presents both opportunities and risks. Pichai’s insights resonate with the broader tech community, signaling the need for cautious optimism amidst a dynamic and sometimes unpredictable market. Balancing ambition with a realistic understanding of current conditions is essential for sustainable growth in the AI sector.

For a deeper dive into Pichai’s insights, you can read the full interview on the BBC.

Nvidia’s Earnings Report Set to Impact AI Market Stability Amid 2.81% Stock Decline

Nvidia’s Earnings Report Set to Impact AI Market Stability Amid 2.81% Stock Decline AppsFlyer Launches Eight New Products in Next-Gen Marketing Cloud for Data and AI Growth

AppsFlyer Launches Eight New Products in Next-Gen Marketing Cloud for Data and AI Growth Top Investors Sell Nvidia Shares Amid $5.8B SoftBank Exit and AI Market Concerns

Top Investors Sell Nvidia Shares Amid $5.8B SoftBank Exit and AI Market Concerns Adobe Acquires Semrush for $1.9B to Enhance AI Marketing Tools and SEO Capabilities

Adobe Acquires Semrush for $1.9B to Enhance AI Marketing Tools and SEO Capabilities AI Integration in Marketing Boosts Customer Engagement by 30% Through Automation

AI Integration in Marketing Boosts Customer Engagement by 30% Through Automation