U.S. Congress is contemplating a proposal to preempt state-level regulations on artificial intelligence (AI) as part of the National Defense Authorization Act (NDAA). This initiative aims to establish a unified federal framework to prevent regulatory inconsistencies across states that could hinder AI adoption and deployment. Proponents argue that this step is crucial not only for boosting productivity and GDP growth but also for ensuring the United States maintains its competitive edge against China in the AI sector. A significant fiscal benefit projected from this preemption is estimated to save the federal government approximately $600 billion between 2026 and 2035.

The forecasted savings stem from two main areas: $39 billion in lower procurement costs for the federal government due to enhanced productivity among federal contractors, and $561 billion in increased federal tax revenues resulting from an AI-driven GDP surge. These estimates highlight the potential economic impact of a streamlined regulatory approach to AI.

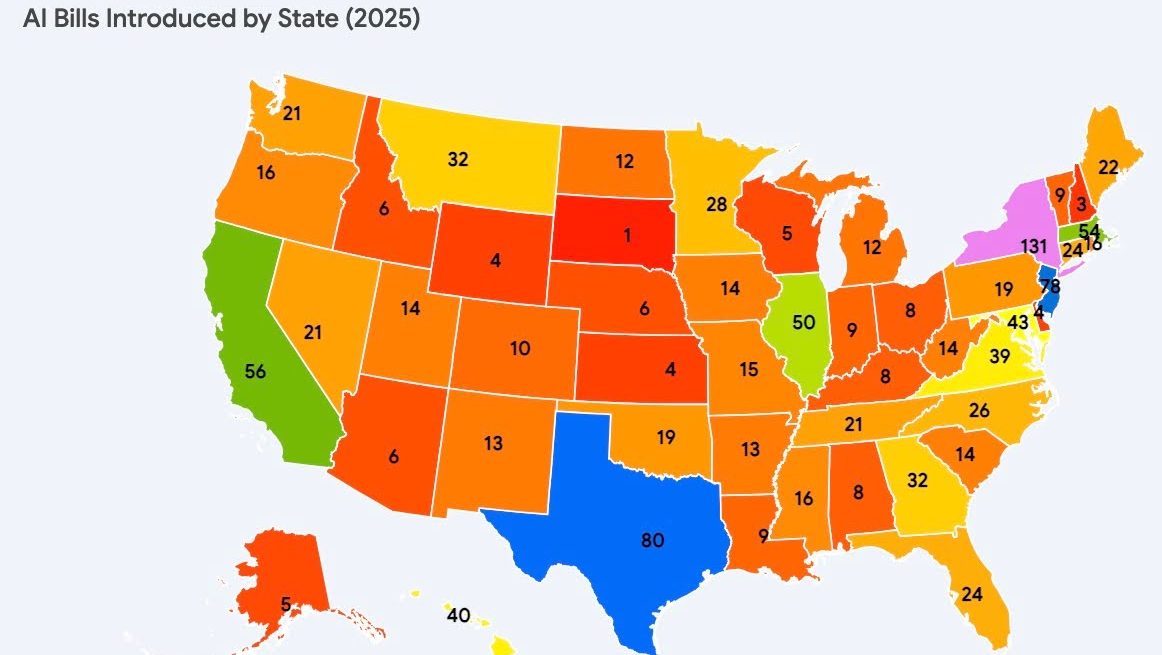

In 2025 alone, state legislatures introduced 1,134 bills related to AI regulation, with 131 of those becoming law. Notably, all U.S. states introduced at least one AI-related bill, and 40 states enacted regulations. As regulatory frameworks diverge, developers of AI tools face the daunting task of complying with conflicting state laws, which may lead to significant legal liabilities when services cross state lines. Without federal preemption, future state-level legislation could result in an average of 2 to 3 new AI laws being enacted annually, exacerbating regulatory fragmentation and impeding innovation.

According to estimates, a potential $1.3 trillion opportunity space exists for the federal government from professional services contracts. In fiscal year (FY) 2023, federal obligations totaled approximately $759 billion, of which $478 billion was for services, predominantly involving professional contractors. Over the next decade, the federal government is projected to spend around $1.3 trillion on professional services. However, regulatory fragmentation could exacerbate compliance costs and reduce the incentive for firms to adopt AI-enhanced services.

For instance, without a cohesive federal standard, contractors might have to develop separate compliance protocols for different states, which could complicate operations and deter companies from offering services in jurisdictions with high compliance burdens. This situation is particularly acute if state regulations conflict, potentially forcing AI developers to choose between states or avoid certain markets altogether. The overall effect could be a scaled-back market for AI tools, diminishing the potential for economies of scale and increasing costs for taxpayers.

The estimated $39 billion savings in federal procurement costs is driven by an anticipated productivity boost of 15% among U.S. workers using AI tools. Should a nationwide harmonization of regulations increase AI deployment by just 20% in professional services, it could yield a 3% productivity improvement over a decade, translating into substantial savings. These gains are viewed as achievable due to competitive bidding pressures that would compel vendors to lower prices as their costs decrease.

On a broader economic scale, AI is poised to significantly influence the U.S. economy. Projections suggest that AI could enhance labor productivity growth by up to 0.6% annually through 2040. Recent estimates from leading financial institutions indicate that AI might contribute between $2.9 trillion and $5.3 trillion to GDP by 2035, with even the most conservative projections suggesting a boost of around $660 billion.

Federal revenues, generally averaging about 17.3% of GDP, would benefit from this GDP growth. Applying this percentage to conservative GDP estimates results in an additional $561 billion in federal tax receipts from 2026 to 2035—a critical factor in justifying the case for federal preemption of state AI regulations.

Regulatory compliance costs are expected to be passed on to taxpayers, manifesting as higher prices and reduced AI adoption. The current regulatory landscape necessitates vendors to divert resources toward compliance, delaying the rollout of innovative offerings. The fragmented market can diminish investment incentives for AI tool developers, potentially leading to a less competitive environment with fewer options available to consumers.

In summary, the projected fiscal benefits of federal preemption—amounting to $600 billion over the next decade—underscore the importance of a streamlined regulatory environment for AI. This savings could enable significant investments in public services or tax relief initiatives. As the U.S. government grapples with fiscal sustainability, the need for coherent AI regulation becomes increasingly urgent, promising not only cost savings but also a catalyst for enhanced economic growth and innovation.

See also Global Tech Giants OpenAI, Google, and Microsoft Form AI Safety Alliance to Set Standards

Global Tech Giants OpenAI, Google, and Microsoft Form AI Safety Alliance to Set Standards Parliament to Tackle AI Governance, Digital Regulation, and Trade Disruptions in December Session

Parliament to Tackle AI Governance, Digital Regulation, and Trade Disruptions in December Session Lawttorney.ai Launches as India’s Premier Legal AI, Reducing Research Time by 80%

Lawttorney.ai Launches as India’s Premier Legal AI, Reducing Research Time by 80% Congress Tackles AI Regulations, China Export Limits, and Youth Safety in December

Congress Tackles AI Regulations, China Export Limits, and Youth Safety in December New York Mandates Algorithmic Pricing Disclosure for Companies Using Personal Data

New York Mandates Algorithmic Pricing Disclosure for Companies Using Personal Data