New York, Feb 6, 2026, 18:12 EST — After-hours trading saw shares of Lam Research soar nearly 8%, closing at $231.01, following a day of volatility where the stock fluctuated between $214.23 and $232.41. Beginning the session at $220.95, the chip equipment manufacturer demonstrated a significant rebound from its Thursday close of $213.31.

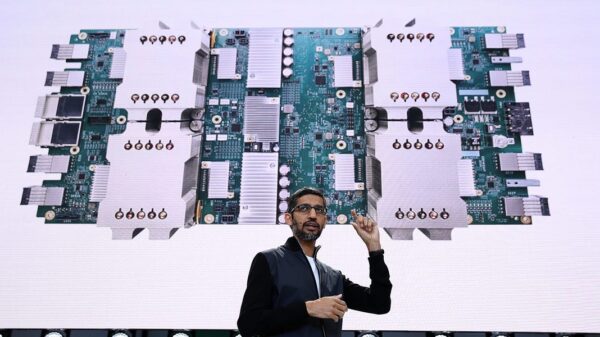

The surge in Lam’s stock reflects a broader optimism among investors, particularly as chip-linked stocks rallied amid increasing expenditures from major cloud companies on artificial intelligence infrastructure. Notably, Amazon announced plans to boost its capital spending by over 50%, primarily focusing on data centers and related equipment, while Alphabet made a similar commitment earlier in the week. These developments contributed to a 5.7% gain in the PHLX semiconductor index, reinforcing the sentiment that demand for AI products is escalating. “There’s enough evidence that there’s real demand for AI products,” remarked Ross Mayfield, an investment strategy analyst at Baird.

Lam Research’s core operations involve etch and deposition tools—essential machinery for the semiconductor industry that carves and coats silicon. Investors closely monitor Lam, along with peers such as Applied Materials and KLA, for early indicators of capacity expansions among chipmakers catering to AI workloads.

Friday’s trading also coincided with some stabilization in the macroeconomic landscape, as the University of Michigan’s latest survey revealed U.S. consumer sentiment at 57.3, a level not observed in six months. However, the survey also highlighted rising concerns regarding job security and the potential inflationary impact of tariffs. “We may have seen the trough in consumer sentiment,” noted Oren Klachkin at Nationwide.

Adding to the company’s positive news, Lam Research disclosed on Thursday a quarterly dividend of $0.26 per share, slated for payment on April 8 to shareholders registered by March 4. The announcement indicated that future dividends will be subject to board review and approval.

In a separate filing, Lam Research announced the appointment of Anirudh Devgan, CEO of Cadence Design Systems, to its board. The company also confirmed that Sesha Varadarajan will assume the role of chief operating officer on March 6, succeeding Patrick Lord, who plans to retire.

Chief Executive Tim Archer recently reported settling an equity award in a Form 4 filing, bringing his total direct shareholdings to 1,203,939 shares as of February 4. At the end of last week, Lam projected its third-quarter revenue to reach $5.7 billion, plus or minus $300 million, exceeding analyst expectations and reflecting strong demand for its chipmaking equipment. “Entering 2026, our expanding product and services portfolio is enabling the market’s transition,” Archer stated.

However, the cyclical nature of the tech sector means that the current enthusiasm could be tempered by future challenges. Cloud companies may reduce their spending once the current wave of AI infrastructure development subsides. Moreover, potential export restrictions, tariffs, or ongoing supply-chain disruptions could adversely affect demand for semiconductor equipment. Historically, high-multiple chip stocks respond swiftly to such downturns, often experiencing sharp price corrections.

As the markets gear up for the new week, Lam Research investors will be closely watching two upcoming events: the March 4 dividend record date and the March 6 transition of COO duties. These key dates could influence investor sentiment and stock performance in the days ahead.

See also AI Study Reveals Generated Faces Indistinguishable from Real Photos, Erodes Trust in Visual Media

AI Study Reveals Generated Faces Indistinguishable from Real Photos, Erodes Trust in Visual Media Gen AI Revolutionizes Market Research, Transforming $140B Industry Dynamics

Gen AI Revolutionizes Market Research, Transforming $140B Industry Dynamics Researchers Unlock Light-Based AI Operations for Significant Energy Efficiency Gains

Researchers Unlock Light-Based AI Operations for Significant Energy Efficiency Gains Tempus AI Reports $334M Earnings Surge, Unveils Lymphoma Research Partnership

Tempus AI Reports $334M Earnings Surge, Unveils Lymphoma Research Partnership Iaroslav Argunov Reveals Big Data Methodology Boosting Construction Profits by Billions

Iaroslav Argunov Reveals Big Data Methodology Boosting Construction Profits by Billions