Advanced Micro Devices (AMD) is facing downward pressure on its stock, despite reporting strong fourth-quarter earnings that exceeded analyst expectations. The company’s revenue guidance also surpassed forecasts, signaling robust demand amid a competitive semiconductor landscape. Cody Acre, managing director and senior semiconductor research analyst at Benchmark Company, addressed this dynamic during a recent discussion, offering insights into AMD’s positioning against rivals such as Nvidia (NVDA) and Broadcom (AVGO).

In its latest earnings report, AMD not only topped the consensus estimates but also provided an optimistic outlook for the upcoming quarter. The company’s performance reflects its ability to capitalize on increasing demand for high-performance computing and gaming solutions. However, the stock’s decline raises questions about investor sentiment and market reactions to broader economic conditions, which have been volatile in recent months.

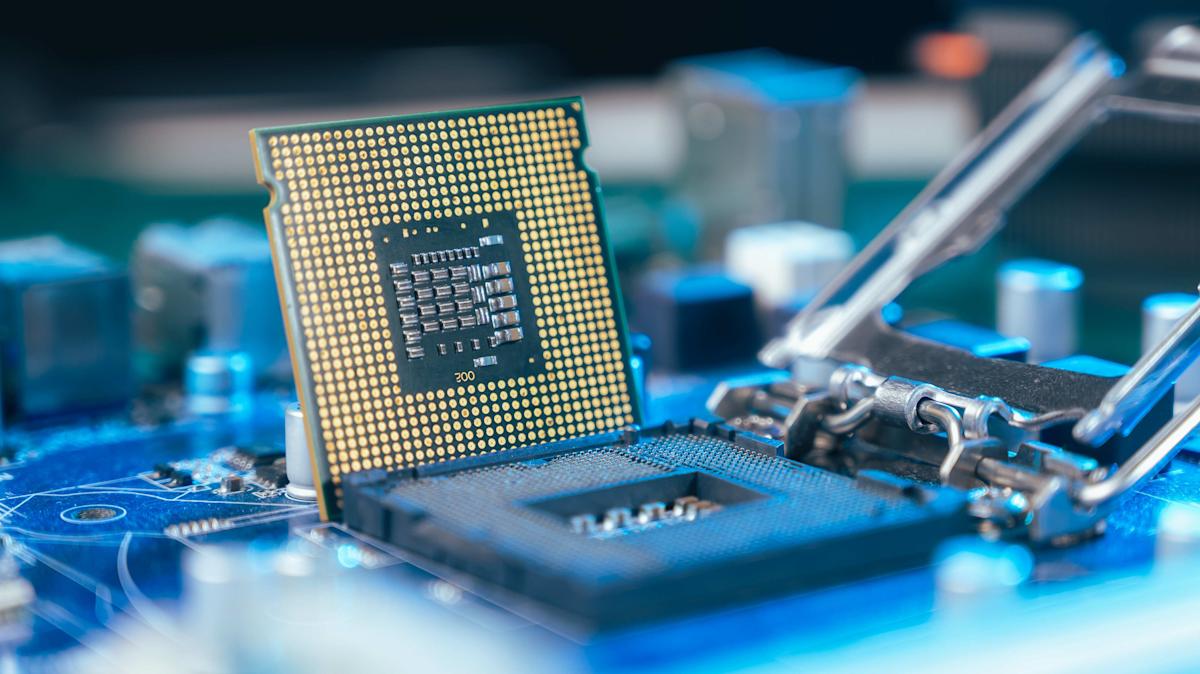

Acre emphasized that while AMD is experiencing challenges in the market, it remains well-equipped to compete effectively against industry giants like Nvidia and Broadcom. AMD’s recent advancements in chip technology and product offerings position it as a formidable player in the semiconductor arena. The company’s focus on next-generation processors and graphics cards could provide it with a competitive edge, particularly in sectors such as artificial intelligence and cloud computing, which continue to gain traction.

The semiconductor sector has witnessed intense competition, driven by rapid technological advancements and evolving consumer demands. Nvidia, for instance, has solidified its dominance in the GPU market with its cutting-edge architectures, while Broadcom continues to expand its footprint in networking and broadband technologies. Acre noted that AMD’s strategy to innovate and diversify its product range is crucial for maintaining market relevance and fostering growth.

A key aspect of AMD’s competitive strategy involves enhancing its product capabilities through research and development. The company has invested heavily in developing its Zen architecture, which has been well-received in the market for its performance efficiency. As AI applications proliferate, AMD’s focus on integrated solutions could position it favorably, especially as enterprises seek powerful and efficient computing resources.

Despite these advancements, the stock market reaction highlights a broader trend where investor expectations may not align with corporate performance. Analysts are closely monitoring macroeconomic indicators, including inflation and supply chain disruptions, which can significantly impact technology stocks. While AMD’s fundamentals appear strong, the external economic environment remains a critical factor influencing market sentiment.

As AMD navigates this challenging landscape, the company is expected to ramp up its marketing efforts to communicate the value of its product innovations effectively. Acre pointed out that investor education is essential; understanding AMD’s long-term vision and strategic initiatives can enhance confidence among stakeholders. The semiconductor industry as a whole is poised for growth, and companies that can articulate their value propositions clearly are likely to gain favor in the eyes of investors.

In conclusion, while AMD has achieved significant milestones in enhancing its product lineup and delivering impressive earnings, the current market dynamics present both challenges and opportunities. The company’s ability to adapt to competitive pressures from Nvidia and Broadcom, coupled with a clear communication strategy, will be vital in shaping its future trajectory. As the demand for advanced computing solutions intensifies, AMD’s ongoing innovations could play a pivotal role in determining its success in the semiconductor market.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech