Shares of Advanced Micro Devices (AMD) surged approximately 8.5% on Wednesday ahead of the company’s upcoming earnings report, driven by a resurgence of confidence in its server CPU demand. The stock’s rally signals renewed optimism among investors that AMD’s core data-center business could deliver better-than-expected results when it reports its fiscal fourth-quarter and full-year 2025 results on February 3, followed by a conference call later that evening.

The recent price increase reflects a belief that AMD’s involvement in AI-driven infrastructure spending—particularly through its server CPUs—could yield positive surprises in revenue and guidance. Investors are keenly focused on whether AMD can maintain its momentum amid ongoing waves of investment in cloud computing and artificial intelligence.

This rebound follows a period of significant selling pressure that had left AMD vulnerable to a relief rally as sentiment shifted. Analysts, including KeyBanc’s John Vinh, have expressed optimism about the company’s near-term outlook, predicting that AMD will exceed consensus revenue estimates largely due to robust demand for its server CPU lineup. Vinh noted that AMD is nearing full capacity for its latest-generation Turin data-center processors, suggesting that hyperscale customers may be willing to accept price increases of 10% to 15% to secure reliable supply.

Vinh previously projected that AMD’s server CPU segment could grow by at least 50% in 2026, highlighting the critical role of CPUs in AI data centers even as graphics processing units (GPUs) capture the headlines. AMD occupies a unique position within the semiconductor landscape, contributing essential CPUs that are foundational to AI server infrastructure. As the demand for balanced computing systems grows, the company’s data-center CPU business—which is typically less volatile and driven by longer procurement cycles—could see sustained benefits.

However, while the recent stock movement has been promising, some analysts caution that it represents a technical bounce rather than a definitive trend reversal. AMD has reclaimed its 50-day moving average, which now acts as short-term support. Despite this, the stock remains significantly below recent highs, and key resistance levels have yet to be convincingly breached.

AMD’s recent performance at the Consumer Electronics Show (CES) also raised concerns rather than alleviating them. Analysts were left underwhelmed by AMD’s messaging regarding AI acceleration, which seemed to fall short of market expectations. Following CES, AMD shares declined over 3%, extending a broader pullback that saw the stock fall nearly 15% in the preceding week. This event highlighted the disparity between market expectations and AMD’s current capabilities in the rapidly evolving AI landscape.

In contrast, Nvidia demonstrated a commanding position in the market, showcasing its next-generation Vera Rubin platform and highlighting its production capabilities. Nvidia’s offerings feature fully integrated systems supported by an established software ecosystem, contrasting sharply with AMD’s more limited announcements centered around MI455 processors and MI440X accelerators. While AMD positions its products as competitive alternatives, the disparity in ecosystem depth and deployment scale remains a concern for investors.

Despite posting strong financial results in the past, where revenue rose 36% year over year to $9.25 billion and non-GAAP EPS reached $1.20, AMD’s stock has not enjoyed a lasting rally. Investors are increasingly demanding clear leadership in AI platforms and sustainable margins, criteria that AMD is perceived to be falling short of. The company’s valuation had previously accounted for sustained AI momentum, but as sentiment has cooled, the market has reacted by repricing AMD’s stock.

Geopolitical factors also complicate AMD’s outlook. The company confirmed it can ship certain MI308 chips to China under a licensing framework that involves a 15% payment to the U.S. government, impacting margins directly. While maintaining access to the Chinese market is beneficial, this arrangement poses limited upside and exposes AMD to potential future policy changes.

Furthermore, enthusiasm around AMD’s partnership with OpenAI has diminished. Initially seen as a catalyst for large-scale accelerator adoption, the partnership now raises concerns about uncertain volumes and revenue visibility. As hyperscalers increasingly develop custom silicon, AMD’s competitive edge appears to be waning in the face of Nvidia’s expanding ecosystem.

In conclusion, while AMD’s recent stock surge reflects renewed confidence in server CPU demand and anticipation of a solid earnings report, it exists alongside unresolved issues regarding AI leadership and competitive positioning. As AMD approaches its earnings release, investors will be closely monitoring execution, guidance, and margin stability. The company may have found temporary relief, but broader questions about its role in the AI market and its competitive viability remain unresolved.

See also UC Riverside Reveals Test-Time Matching Method Boosting AI Reasoning by 89.4%

UC Riverside Reveals Test-Time Matching Method Boosting AI Reasoning by 89.4% US House Panel Advances AI Overwatch Act to Control AI Chip Exports to China

US House Panel Advances AI Overwatch Act to Control AI Chip Exports to China Microsoft’s Satya Nadella Embraces AI Competition, Predicts Tech’s GDP Share Growth

Microsoft’s Satya Nadella Embraces AI Competition, Predicts Tech’s GDP Share Growth FlashLabs Launches Chroma 1.0, First Open-Source Real-Time Voice AI with 135ms Latency

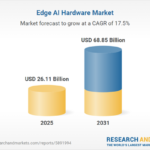

FlashLabs Launches Chroma 1.0, First Open-Source Real-Time Voice AI with 135ms Latency Edge AI Hardware Market to Reach $68.85 Billion by 2031, Driven by IoT Growth and AI Demand

Edge AI Hardware Market to Reach $68.85 Billion by 2031, Driven by IoT Growth and AI Demand